OPEC surplus forecast, U.S. stockpiles push oil lower

MG News | November 13, 2025 at 01:06 PM GMT+05:00

November 13, 2025 (MLN): Oil prices extended their decline for a second consecutive day on Thursday as rising U.S. crude stockpiles and forecasts of global supply exceeding demand heightened concerns over an oversupplied market.

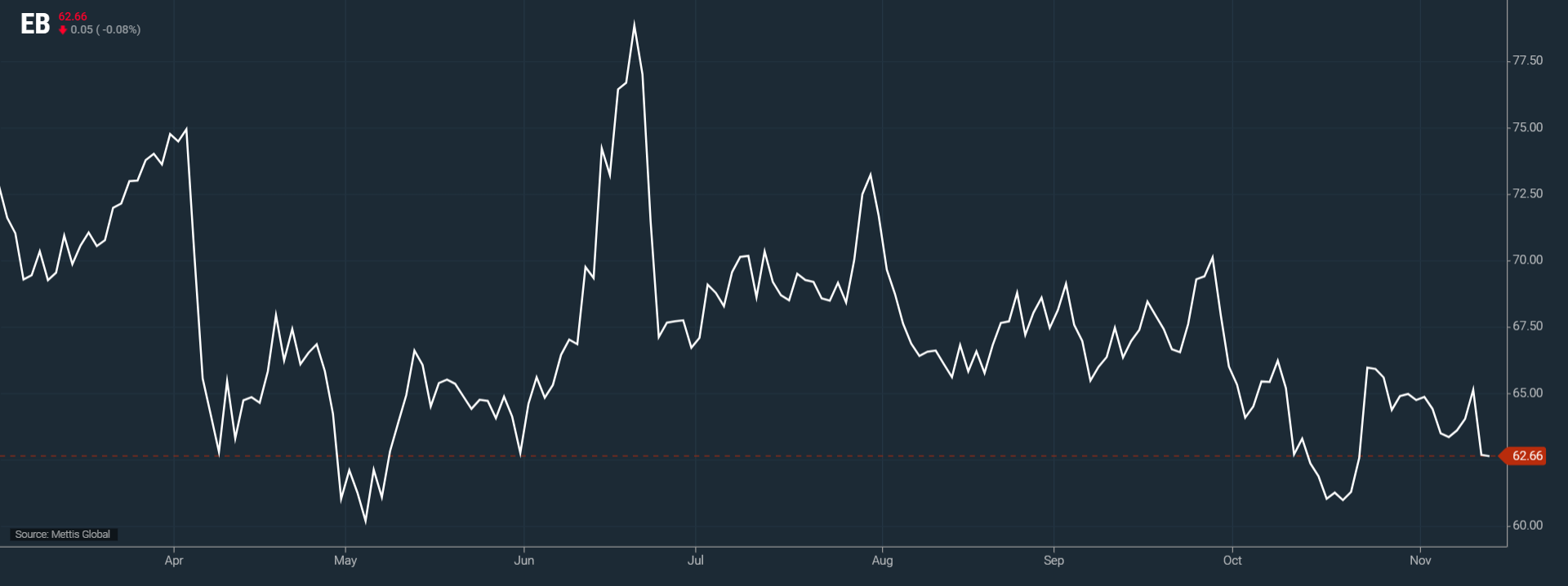

Brent crude futures went down by $0.05, or 0.08%, to $62.66

per barrel.

West Texas Intermediate (WTI) crude futures decreased by $0.05,

or 0.03, to $58.46 per barrel by [1:05 pm] PST.

Industry sources citing American Petroleum Institute (API)

data reported that U.S. crude inventories increased by 1.3 million barrels for

the week ending Nov. 7, while gasoline and distillate stocks fell.

The build in crude supplies comes amid broader worries about

ample global fuel availability. These trends have reinforced bearish sentiment

in the oil market, according to CNBC.

Oil prices had already dropped more than $2 per barrel on

Wednesday after OPEC’s latest monthly report projected that global oil supply

would slightly surpass demand in 2026.

This marks a shift from the group’s previous expectations of

a supply deficit. “OPEC’s signal of a supply surplus, combined with rising U.S.

inventories, triggered selling pressure, pushing oil prices lower on Thursday

morning,” said Yang An, analyst at Haitong Securities.

OPEC’s forecast of a supply surplus next year is attributed

to production increases by OPEC+, the coalition of OPEC members and allied

producers, including Russia.

Market participants are now awaiting the U.S. Energy

Information Administration (EIA) inventory report, scheduled for later

Thursday.

Additional reports from the EIA have added to the bearish

outlook. The agency’s Short-Term Energy Outlook indicated that U.S. oil

production is on track to reach a record high this year, exceeding prior

forecasts.

Global inventories are also expected to rise through 2026 as

production growth continues to outpace demand, putting further pressure on

prices.

The market structure also showed the oversupply concerns,

with West Texas Intermediate (WTI) crude entering a contango situation on

Wednesday.

In a contango market, the spot price of oil falls below the

futures price for later delivery, signaling lower immediate demand or

expectations of surplus supply. On Thursday, the front-month WTI contract

traded at an 18-cent discount to the six-month futures contract.

The combined impact of rising U.S. crude inventories and

OPEC’s supply forecasts continues to weigh on global oil markets, raising

questions about near-term price stability as production outpaces consumption.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes