NBP crosses $1.5bn market cap, secures 2nd largest rank

MG News | September 29, 2025 at 04:03 PM GMT+05:00

September 29, 2025 (MLN): The National Bank of Pakistan (NBP) has achieved a significant milestone, with its market capitalization soaring past the $1.5 billion mark.

As of the close of business on September 30, 2025, NBP’s market capitalization stood at USD 1,515,725,602, solidifying its position as the second-largest bank in the country by market value.

This performance highlights NBP's robust financial health and its appeal to domestic and international investors.

The bank’s paid-up shares of over 2.127 billion, trading for 200.46 (PKR), propelled it ahead in the competitive banking landscape.

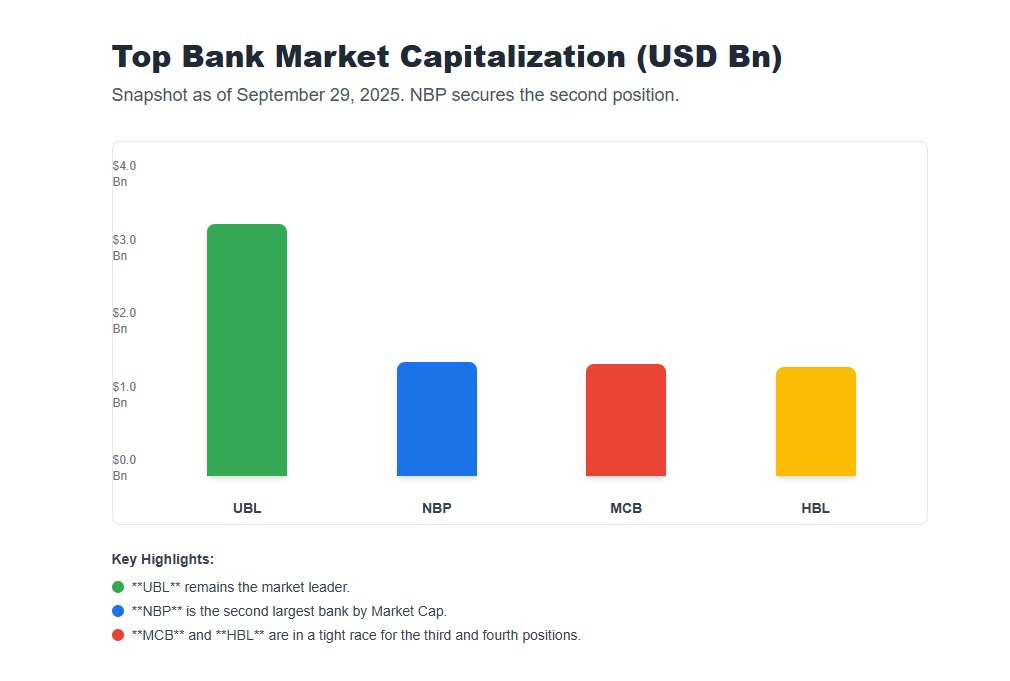

NBP's ascent places it immediately behind the market leader, UBL, which commands a total market capitalization of approximately $3.34bn.

The race for the second spot remains highly competitive, with MCB and HBL following closely:

MCB: $1.486bn

HBL: $1.450bn

In a major development for shareholders, NBP management revealed during a recent Analysts' Meet & Greet session that the bank will likely significantly boost dividend payouts. The primary strategic aim is to prevent overcapitalization and maintain optimal Return on Equity (ROE) levels, a move designed to maximize shareholder value.

The bank is expected to move toward a traditionally generous dividend policy, targeting sustainable payout ratios of 70–80%. This target aligns with NBP’s strong track record, where dividend payout ratios were consistently maintained at approximately 80% between 2011 and 2017.

Key Payout Details:

2024 Performance: NBP's commitment to shareholder returns was recently demonstrated by the declaration of Rs 8/- per share, representing an 80% payout ratio.

Future Outlook: While current street expectations for the next announcement stand around a 50% payout, this figure is likely to increase significantly following the incorporation of the latest strong financial results and the management's announced strategic shift.

Regulatory Note: As per the NBP Act, dividends can only be declared with year-end results, with the final decision resting with the Board of Directors.

NBP's strategic alignment of market growth with shareholder returns is expected to be viewed positively by investors, positioning the bank for continued strong performance.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,893.09 355.32M | 2.59% 4266.79 |

| ALLSHR | 100,888.78 687.85M | 1.91% 1889.56 |

| KSE30 | 51,723.30 154.72M | 2.74% 1380.77 |

| KMI30 | 236,793.15 125.14M | 3.40% 7778.72 |

| KMIALLSHR | 64,642.45 317.23M | 2.51% 1584.54 |

| BKTi | 49,503.80 58.63M | 0.97% 475.26 |

| OGTi | 32,753.55 16.04M | 2.00% 643.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile