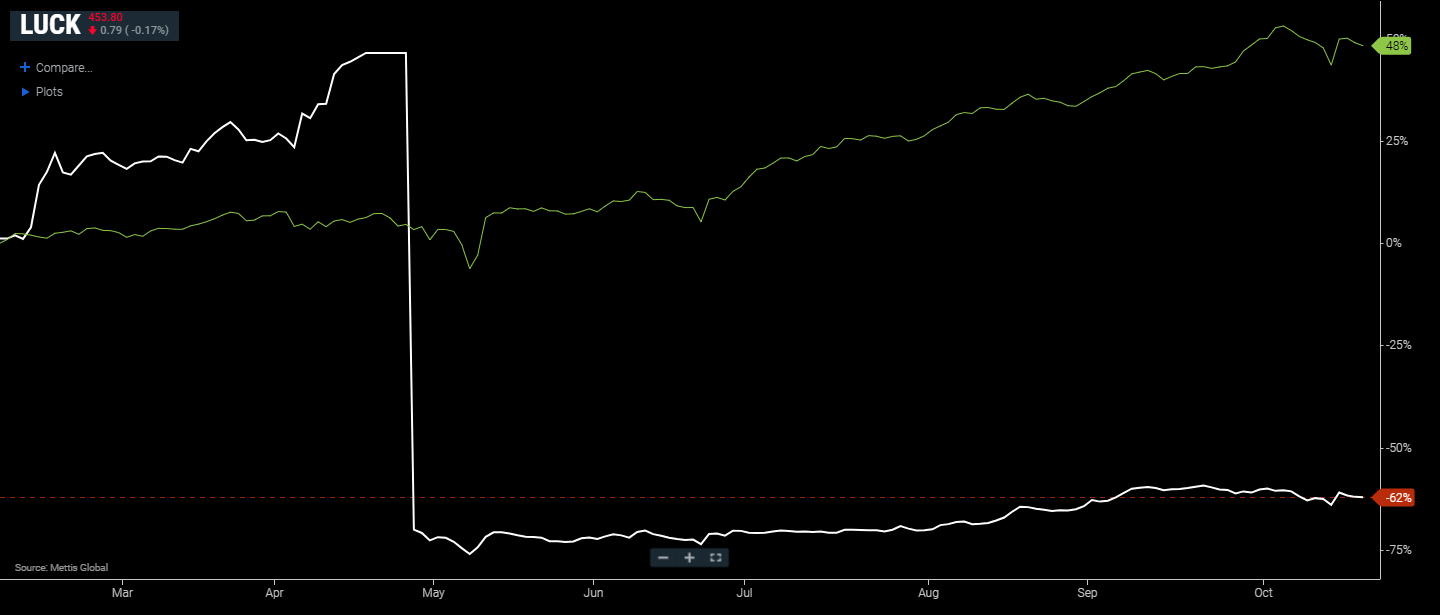

Lucky Cement’s share price seen rising to Rs602

.png?width=950&height=450&format=Webp)

MG News | October 17, 2025 at 12:55 PM GMT+05:00

October 17, 2025 (MLN): Lucky Cement Limited (PSX: LUCK) is

projected to reach a target price of Rs602 per share by June 2026, an upside

potential of 24% from its current market level of Rs486, according to a report

by ABA Ali Habib Securities.

The brokerage has assigned a ‘Buy’ rating to the stock along with a 1% dividend yield.

The report highlights Lucky Cement’s strong earnings

potential through diversification, supported by its presence in multiple

sectors including cement, power, automobiles, and chemicals. The company is

expected to post consolidated earnings per share (EPS) of Rs64 and dividends

per share (DPS) of Rs6 in FY26, representing a 22% growth compared to FY25 EPS

of Rs52.5.

“We have incorporated the latest financial results in our

model, coupled with changing company dynamics such as increased utilization and

improved cost efficiencies,” the report noted.

The outlook is underpinned by the revival of the

construction sector, strong contribution from Lucky Electric Power Company

(LEPCL), and recovery in the auto and soda ash segments. Furthermore, the

firm’s international operations and portfolio diversification are expected to

enhance earnings stability in the medium term.

Cement Sector Outlook

The brokerage observed that Pakistan’s cement sector

experienced a slowdown in FY25, with total cement dispatches declining 4% YoY to

36.4 million tons due to high interest rates and inflation. However, economic

stability, easing inflation, and government spending under the Rs4 trillion

PSDP for FY26 are expected to fuel a rebound in construction activity.

The report cautioned that the key risks to Lucky Cement’s

valuation include:

- Demand trailing behind projections

- A sudden increase in international commodity

prices

- Lower income or sales from Lucky Motor Company

(LMC).

Despite these risks, the brokerage believes Lucky Cement

remains well-positioned to deliver robust earnings growth, backed by its

diversified portfolio and strong operational base.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes