Weekly Market Roundup

MG News | October 19, 2025 at 10:03 AM GMT+05:00

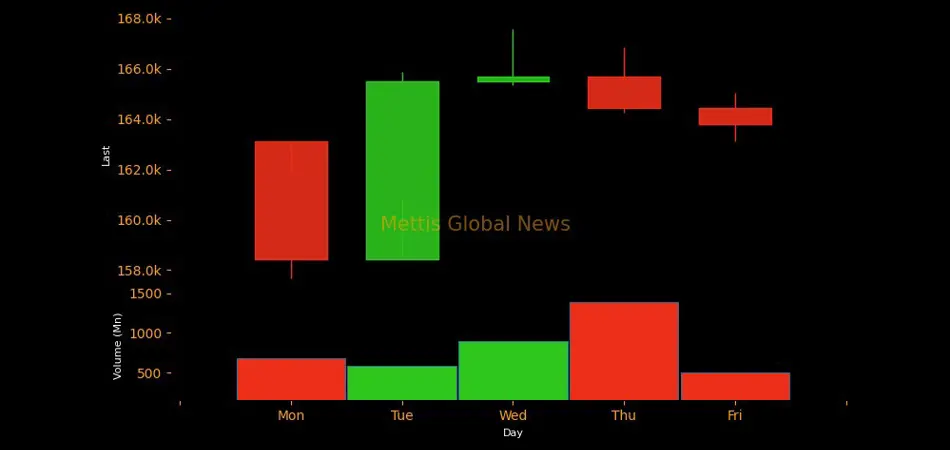

October 19, 2025 (MLN): The Pakistan Stock Exchange (PSX) experienced a volatile yet

ultimately positive week as the KSE-100 Index closed at 163,806 points, gaining

708 points or 0.4% week-on-week.

The week opened with prevailing caution, as investors

engaged in profit-taking amid heightened geopolitical unease triggered by

renewed border clashes between Pakistan and Afghanistan, including the closure

of major crossings after artillery exchanges, along with the large-scale

protest movement of Tehreek‑e‑Labbaik Pakistan (TLP) in Punjab.

Mid-week, however, the market regained composure as the

border clashes eased following a cease-fire and the government’s firm stance

toward the TLP helped restore sentiment._20251019045153815_c0e481.jpeg)

The rebound was largely fueled by Pakistan’s successful

conclusion of a Staff-Level Agreement (SLA) with the International Monetary

Fund (IMF) for the second review of the $7 billion Extended Fund Facility (EFF)

and the first review of the $1.3bn Resilience and Sustainability Facility

(RSF).

The agreement, subject to approval by the IMF Executive

Board, is expected to unlock $1bn under the EFF and an additional $200 million

under the RSF. This development significantly lifted investor confidence,

especially as the market entered the corporate results season.

Market Cap:

In terms of valuation, the market capitalization remained stable at around Rs4.86 trillion, showing resilience despite early volatility.

In dollar terms, it recorded a mild uptick from $17.2bn to $17.3bn, reflecting

both local investor confidence and a steady PKR/USD exchange rate._20251019045045800_5ae407.jpeg)

The market’s USD-based return turned positive this week,

recording a gain of 0.45% compared to a sharp 3.45% decline last week._20251019044932516_4ccbd1.jpeg)

On the macroeconomic front, the Pakistan Bureau of

Statistics (PBS) reported a revised number of a widening trade deficit $3.4bn in

September 2025.

The government’s proactive participation in

debt markets continued to attract attention.

Meanwhile, the State Bank of Pakistan’s (SBP) foreignexchange reserves inched up to $14.44bn, marking a modest weekly increase of $20.7m,

while the Pakistani Rupee remained largely stable, closing at 281.10 against

the USD.

In the credit market, an encouraging sign emerged as

automobile financing rose by 3.64% month-on-month to Rs304.77bn in September

2025, compared to Rs294.08bn in August 2025.

Industrial output also provided a glimmer of optimism, with

the Large-Scale Manufacturing Index (LSMI) registering a 4.44% year-on-year

growth during July–August FY26, standing at 113.62 compared to 108.79 last

year.

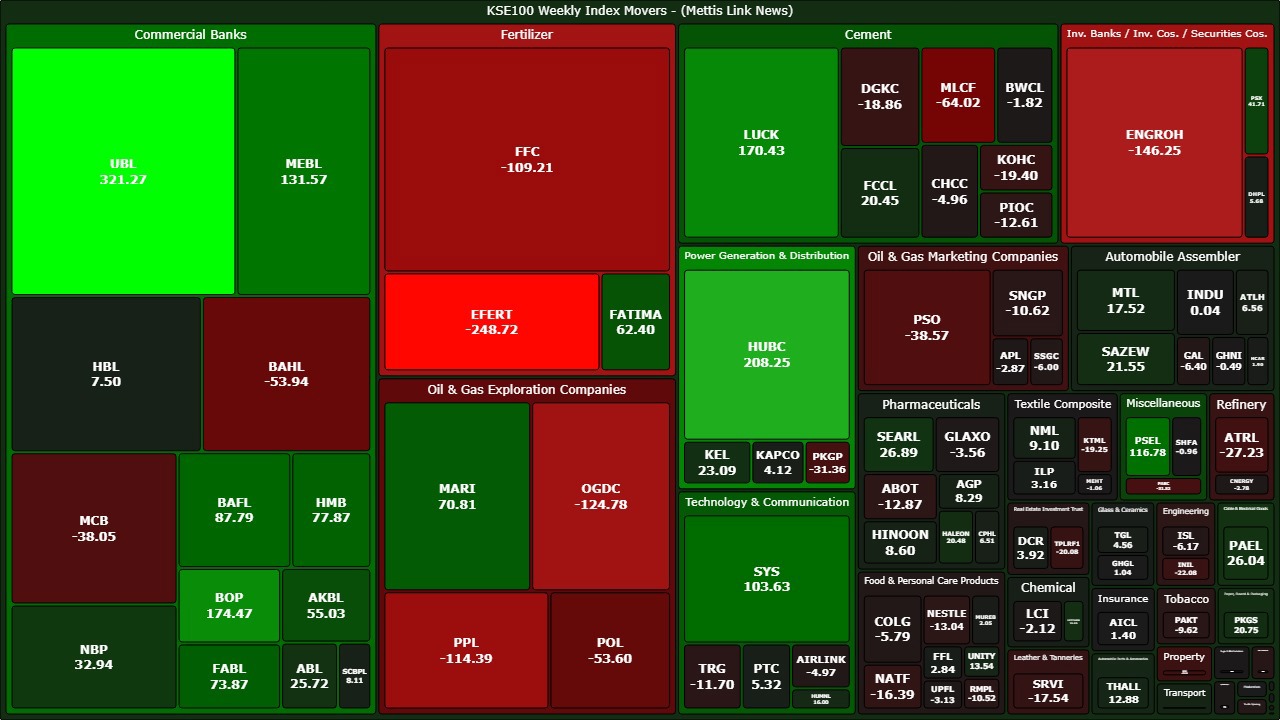

Index Movers:

Sector-wise performance showed a mixed trend, with

heavyweights like Commercial Banks (+904 points), Power Generation &

Distribution (+204 points), and Technology & Communication (+108 points)

leading the rally. Cement (+69 points), Pharmaceuticals (+54 points), and

Automobile Assemblers (+41 points) also contributed positively.

Conversely, Fertilizers (-296 points), Oil & Gas

Exploration Companies (-222 points), and Investment Banks & Securities (-99

points) dragged the index down. The oil and gas sector, in particular, saw

pressure due to profit-taking following earlier gains._20251019045101430_b70c84.jpeg)

Among individual stocks, United Bank Limited (UBL) emerged

as the top performer, adding 321 points to the index, followed by Hub Power

Company (HUBC) with 208 points and Bank of Punjab (BOP) with 174 points. Lucky

Cement (LUCK), Meezan Bank (MEBL), and Systems Limited (SYS) also provided

significant support.

On the flip side,

Engro Fertilizers (EFERT), Engro Corporation (ENGROH), and Oil and Gas

Development Company (OGDC) were among the major laggards, collectively eroding

over 480 points from the benchmark

FIPI/LIPI:

Foreign investors remained net sellers, offloading $13m worth

of equities, primarily from the banking and fertilizer sectors.

In contrast, local institutions provided strong buying

support, with companies leading the charge with net purchases worth $30.3m.

Banks and DFIs

followed with net buying of $15.7m, while individuals added another $6.2m to

their portfolios.

Mutual funds and insurance companies, however, opted for

profit-taking, collectively selling over $36.5 million worth of shares._20251019050338194_186d08.jpeg)

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 151,973.00 479.70M | -9.57% -16089.17 |

| ALLSHR | 91,178.86 800.22M | -9.20% -9239.97 |

| KSE30 | 46,326.47 200.60M | -9.73% -4995.92 |

| KMI30 | 212,170.17 176.87M | -9.84% -23154.95 |

| KMIALLSHR | 58,382.38 455.91M | -9.19% -5909.79 |

| BKTi | 44,306.03 79.95M | -9.79% -4809.39 |

| OGTi | 29,106.80 28.46M | -9.93% -3209.99 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance