IMF Board meets today to review Pakistan’s $1.2bn disbursement

Nilam Bano | December 08, 2025 at 10:06 AM GMT+05:00

December 08, 2025 (MLN): The International Monetary Fund (IMF) Executive Board is set to meet today (December 8) to assess Pakistan’s performance under its ongoing loan programs.

This is a crucial step toward unlocking around $1.2 billion in fresh financing.

The Board will review Pakistan’s progress under two key programmes, the second review of the 37-month Extended Fund Facility (EFF) and the first review of the Resilience and Sustainability Facility (RSF).

If approved, Pakistan will receive $1 billion under the EFF and $200 million under the RSF.

This combined disbursement will strengthen the country’s foreign exchange reserves, which have been recovering gradually following the staff-level agreement reached in October 2025.

The meeting was scheduled after Pakistan completed key prior actions, most notably the publication of the Governance and Corruption Diagnostic Assessment (GCDA) last month.

The report highlighted structural vulnerabilities and corruption risks across state institutions and was a mandatory condition by the IMF aimed at ensuring stronger governance and transparency reforms.

The outcome of today’s review will be critical for Pakistan’s external financing needs and economic stabilisation trajectory.

At present, the foreign exchange reserves held by the State Bank of Pakistan (SBP) stood at $14.57 billion.

Investor sentiment remained upbeat as markets perceived the upcoming IMF Executive Board meeting positively.

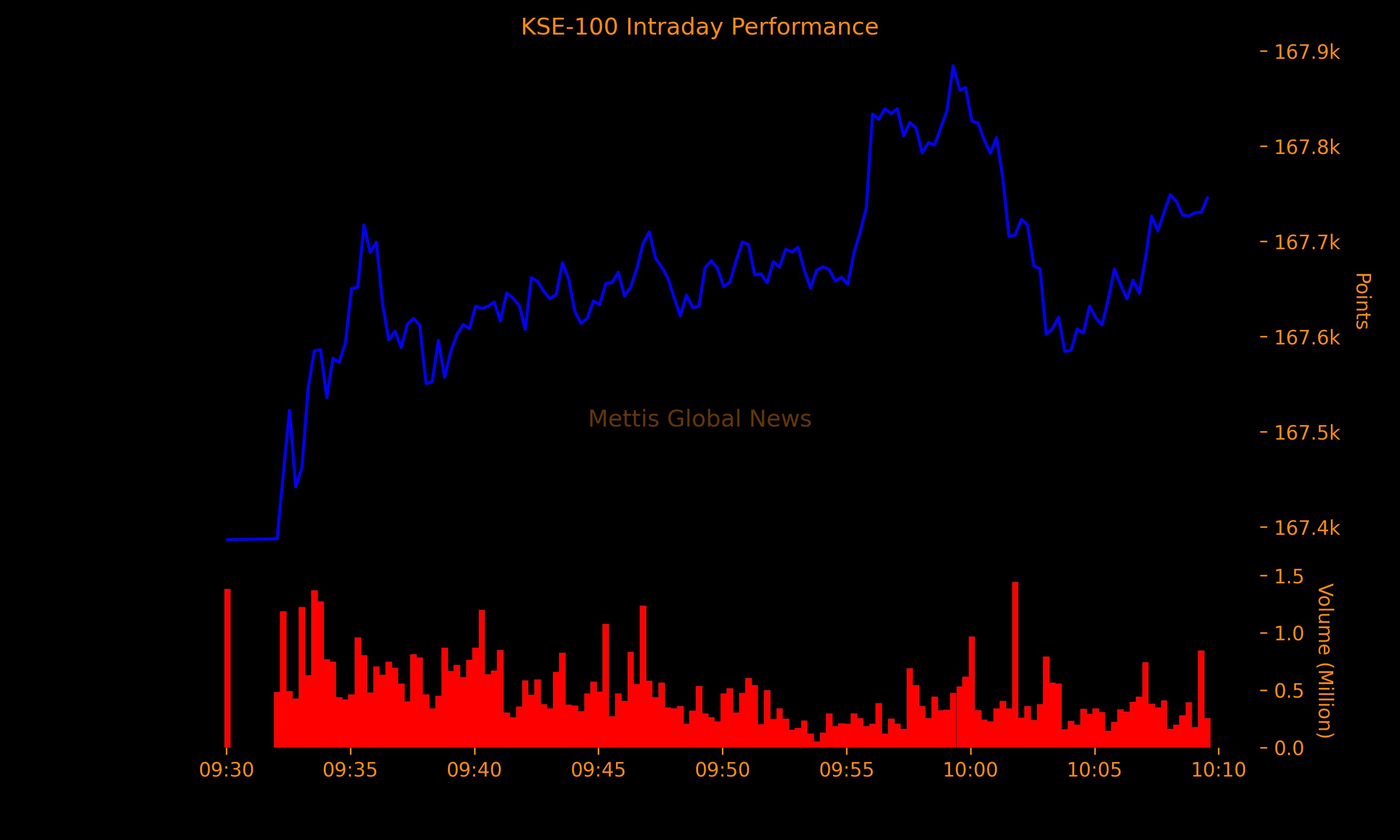

The benchmark KSE-100 Index maintained a strong positive trend on Monday morning, rising to 167,790.16 at 10:12 am, up 704.58 points, or 0.42%.

The index traded firmly in the green, marking an intraday high of 167,884.60 (+799.02).

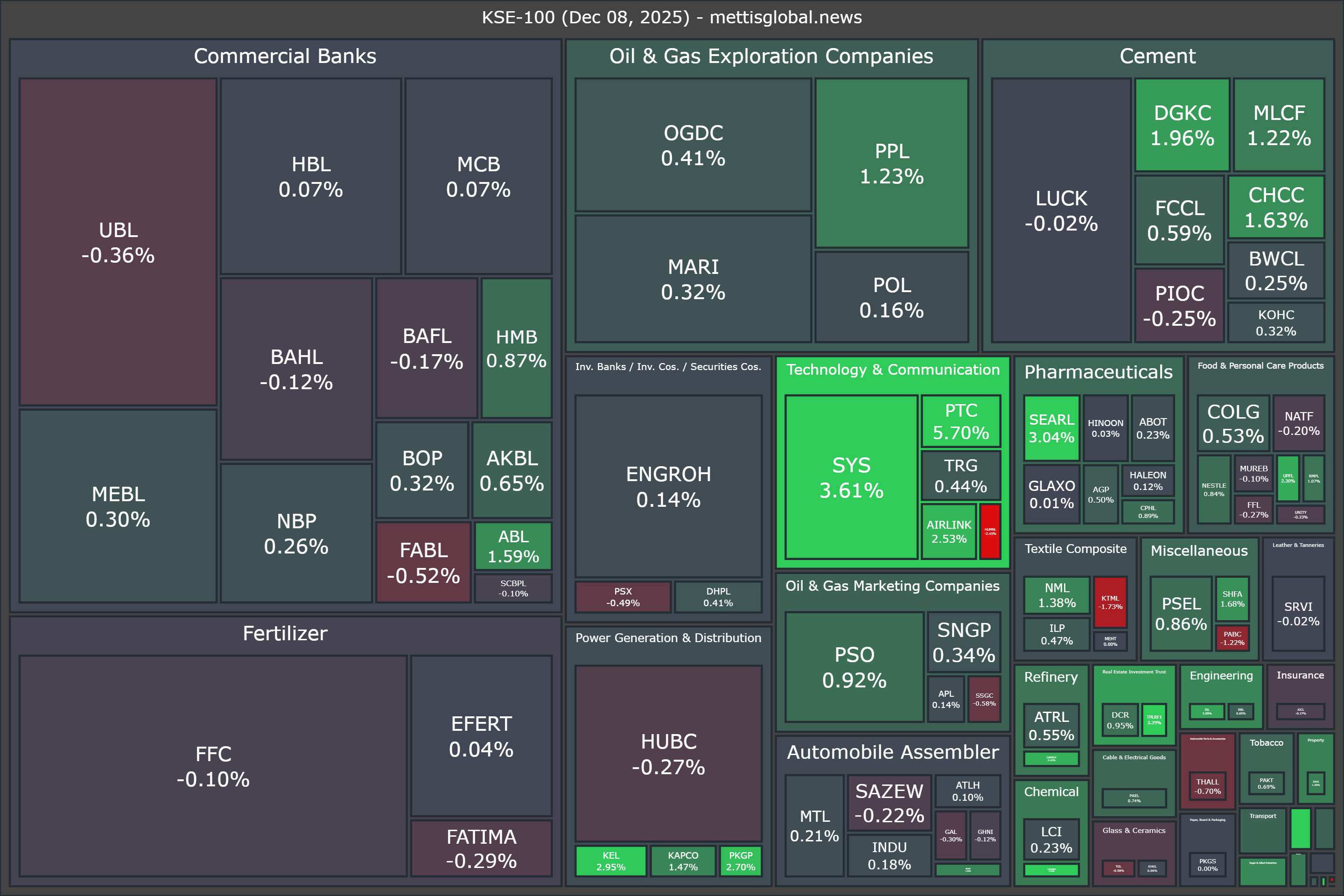

Top gainers during early trade included IBFL (+10.00%), YOUW (+6.76%), PTC (+5.70%), LOTCHEM (+3.76%), and SYS (+3.61%).

Meanwhile, the notable laggards were HUMNL (-2.45%), BNWM (-2.22%), KTML (-1.73%), PABC (-1.22%), and THALL (-0.70%).

In terms of index-point contributions, the companies providing the strongest uplift were SYS (+178.34pts), followed by PPL (+65.36pts), PTC (+55.77pts), DGKC (+36.78pts), and PSO (+36.58pts).

Conversely, major drags on the index included UBL (-43.28pts), HUBC (-20.26pts), FFC (-17.49pts), KTML (-11.13pts), and HUMNL (-8.09pts).

Sector-wise, the KSE-100 Index drew strength from Technology & Communication (+249.34pts), Oil & Gas Exploration Companies (+116.00pts), Cement (+90.88pts), Pharmaceuticals (+39.10pts), and Oil & Gas Marketing Companies (+38.84pts).

On the other hand, sectors weighing on the index included Fertilizer (-20.80pts), Glass & Ceramics (-2.69pts), Insurance (-1.33pts), Leather & Tanneries (-0.28pts), and Woollen (-0.28pts).

In the broader market, the All-Share Index stood at 101,713.93, posting a net gain of 493.22 points or 0.49% during the session.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 158,564.73 115.81M | -1.64% -2645.95 |

| ALLSHR | 94,757.60 211.55M | -1.39% -1339.69 |

| KSE30 | 48,684.86 55.46M | -2.20% -1096.88 |

| KMI30 | 226,064.08 66.42M | -1.97% -4533.03 |

| KMIALLSHR | 61,159.28 120.50M | -1.65% -1023.99 |

| BKTi | 45,937.10 10.74M | -1.26% -586.11 |

| OGTi | 32,128.83 9.77M | -1.68% -549.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,500.00 | 71,645.00 70,455.00 | -1030.00 -1.44% |

| BRENT CRUDE | 84.72 | 84.73 83.16 | -0.69 -0.81% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -9.60 -8.81% |

| ROTTERDAM COAL MONTHLY | 125.00 | 125.00 125.00 | 3.50 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 80.06 | 80.19 78.24 | -0.95 -1.17% |

| SUGAR #11 WORLD | 13.71 | 13.82 13.61 | -0.02 -0.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes