Golden Morning: KSE-100 rockets past 160,000

MG News | September 26, 2025 at 09:35 AM GMT+05:00

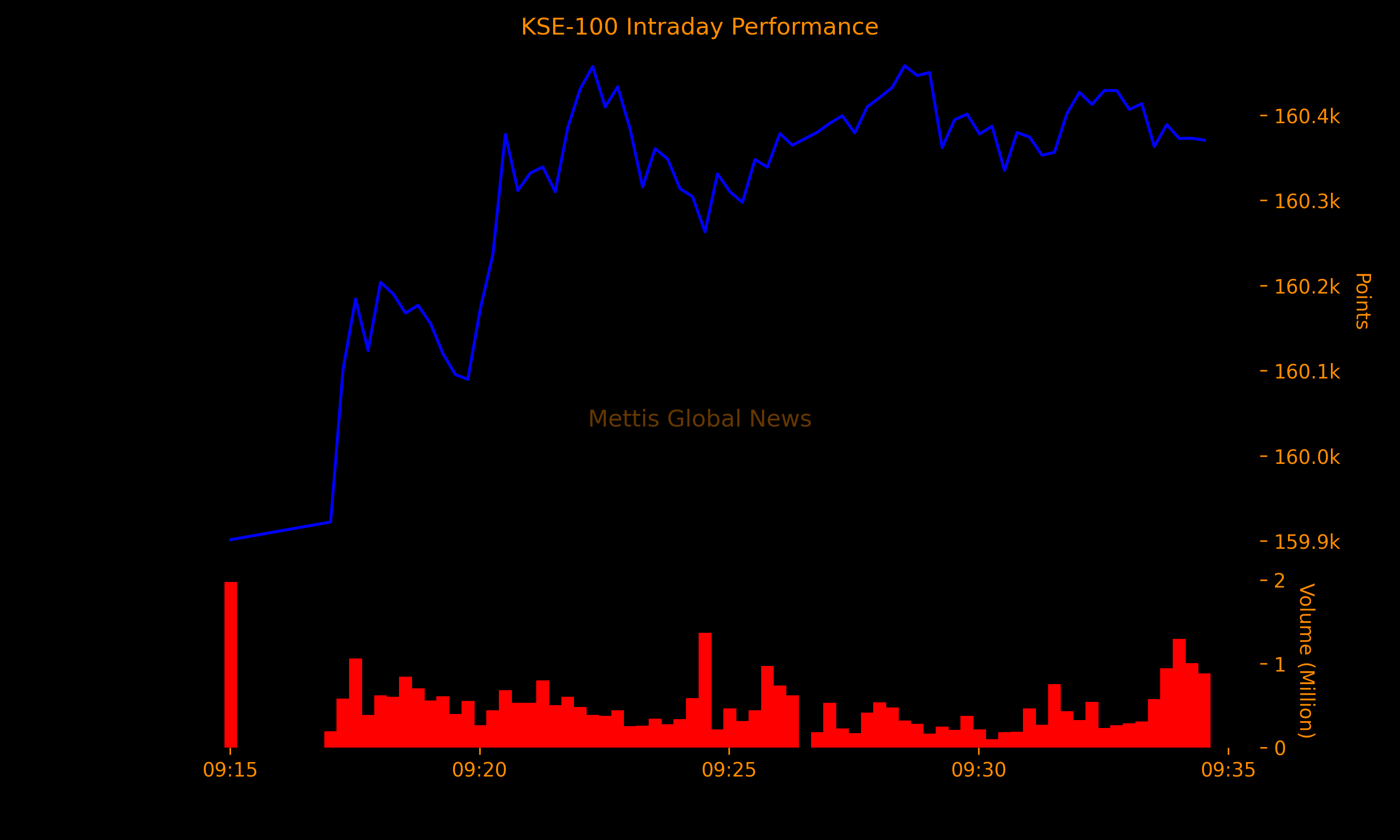

September 26, 2025 (MLN): Extending the recent bullish momentum, Pakistan Stock Exchange (PSX)'s benchmark KSE-100 index surged past the 160,000 mark immediately after the market opened.

The index is currently trading at 160,347.59, showing an increase of 1,067.50 points or 0.67% compared to the previous close.

The rally was fueled by a blend of political and economic tailwinds.

Investor confidence strengthened after former US President Donald Trump lauded Prime Minister Shehbaz Sharif and Army Chief General Asim Munir during their visit to Washington yesterday.

The development was seen as a diplomatic boost, signalling stronger international ties.

Adding to the positive sentiment, an IMF delegation arrived in Pakistan for fresh talks, bolstering hopes of continued financial support and reforms.

Meanwhile, broader economic indicators are showing signs of improvement, with increased liquidity and optimism driving equities higher.

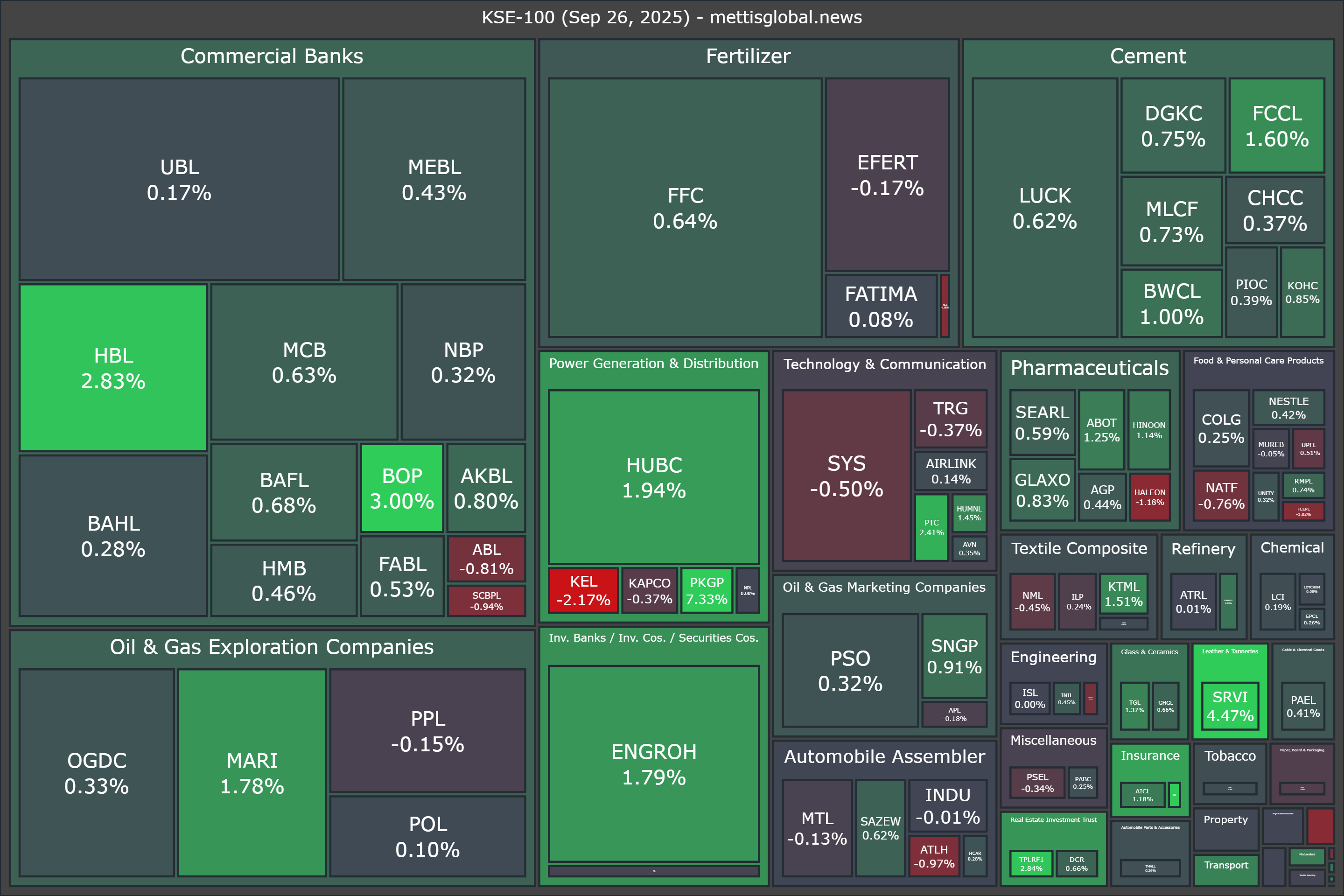

Top gainers were PKGP (+7.33%), EFUG (+4.84%), SRVI (+4.47%), BOP (+3.00%), and TPLRF1 (+2.84%).

On the other hand, top losers were KEL (-2.17%), HALEON (-1.18%), HGFA (-1.12%), AGL (-1.06%), and FCEPL (-1.02%).

In terms of index-point contributions, companies that propped up the index were HBL (+141.43pts), ENGROH (+139.78pts), HUBC (+132.94pts), MARI (+99.77pts), and FFC (+79.40pts).

Meanwhile, companies that dragged the index lower were SYS (-22.33pts), KEL (-14.57pts), EFERT (-7.33pts), PPL (-6.84pts), and HALEON (-5.67pts).

Sector-wise, the KSE-100 Index was supported by Commercial Banks (+305.41pts), Power Generation & Distribution (+150.22pts), Inv. Banks / Inv. Cos. / Securities Cos. (+139.30pts), Cement (+121.71pts), and Oil & Gas Exploration Companies (+115.33pts).

While the index was let down by Technology & Communication (-7.46pts), Food & Personal Care Products (-4.02pts), Vanaspati & Allied Industries (-0.18pts), Textile Spinning (-0.05pts), and Synthetic & Rayon (+0.00pts).

In the broader market, the All-Share Index trading at 51,240.61 with a net gain of 341.13 points or 0.67%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes