Gold slips as fed rate-cut hopes fade

MG News | November 18, 2025 at 04:52 PM GMT+05:00

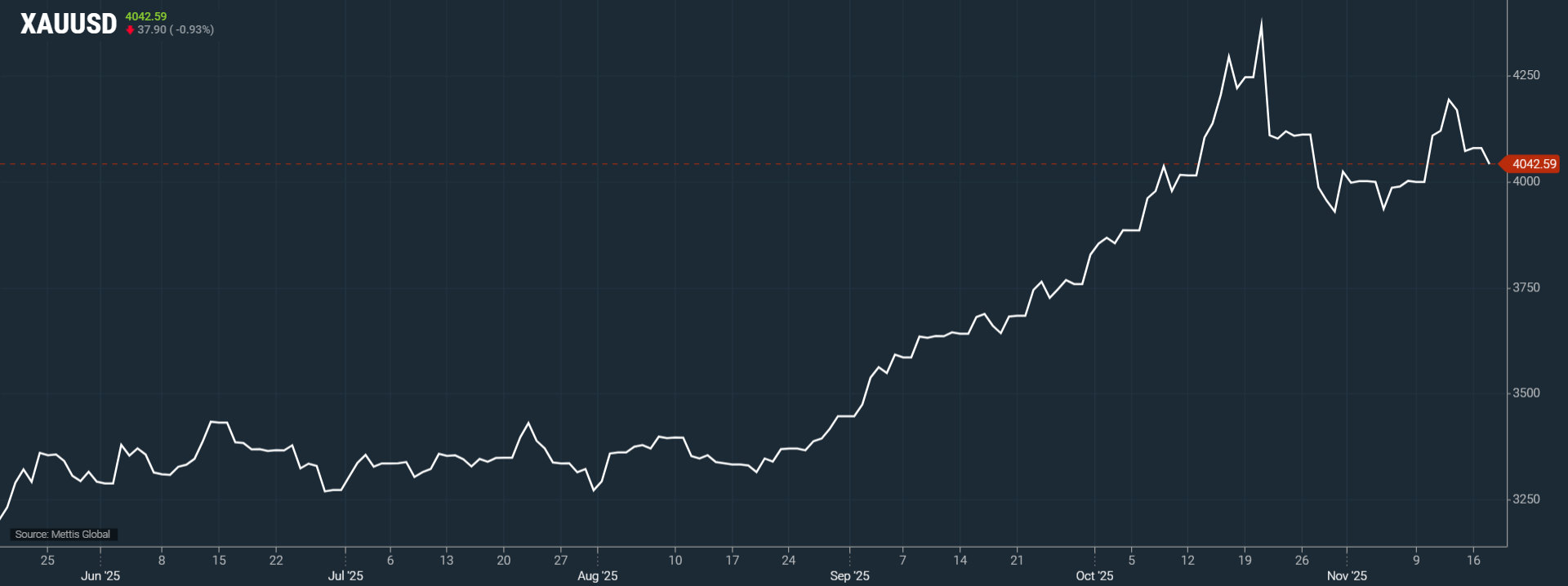

November 18, 2025 (MLN): Gold prices slipped to their lowest level in more than a week on Tuesday, pressured by diminishing expectations of a U.S. Federal Reserve rate cut next month and uncertainty ahead of key economic data releases.

Spot gold was up 0.93%

at $4,042.59 an ounce as of [04:50 pm] PST, according to data reported by

Mettis Global.

“Market participants are increasingly pricing

out a December rate cut after more cautious commentary from the Federal

Reserve,” said Giovanni Staunovo, analyst at UBS. He noted, however,

that gold may soon find a floor as the broader outlook still points to multiple

Fed rate cuts over the coming quarters and continued strong central-bank

demand, as per Reuters.

According to the CME FedWatch

Tool, the probability of a December rate cut has fallen to just over 46%,

sharply down from 67% last week.

The prolonged U.S. government

shutdown which ended only last week halted the release of official economic

indicators, leaving both traders and policymakers without critical data ahead

of the upcoming Fed meeting.

Hopes that updated figures would

strengthen the case for a December cut have faded, especially after Fed officials

signaled a more cautious stance.

Fed Vice Chair Philip Jefferson

reinforced that view on Monday, stating the central bank must “proceed slowly”

on further reductions in interest rates.

Gold, which offers no yield,

typically benefits from lower interest rates and heightened economic

uncertainty. Investors will now turn their attention to Wednesday’s release

of minutes from the Fed’s previous meeting and September non-farm

payrolls due Thursday to gauge the policy path.

Despite the recent dip, analysts

remain optimistic about gold’s medium- to long-term trajectory. “We still see a

supportive fundamental environment for gold. The U.S. economy is cooling,

interest rates should head lower and the dollar is likely to weaken,” said Carsten

Menke of Julius Baer.

In the broader precious metals market, spot silver rose 0.4% to $50.38 per ounce, platinum gained 0.3% to $1,537.55, and palladium advanced 0.6% to $1,400.69.

Copyright Mettis Link

News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,650.00 | 69,740.00 66,385.00 | -830.00 -1.19% |

| BRENT CRUDE | 81.94 | 85.12 78.38 | 4.20 5.40% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 124.15 | 139.50 124.15 | 5.35 4.50% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 75.07 | 77.98 70.41 | 3.84 5.39% |

| SUGAR #11 WORLD | 13.95 | 14.20 13.91 | 0.04 0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance