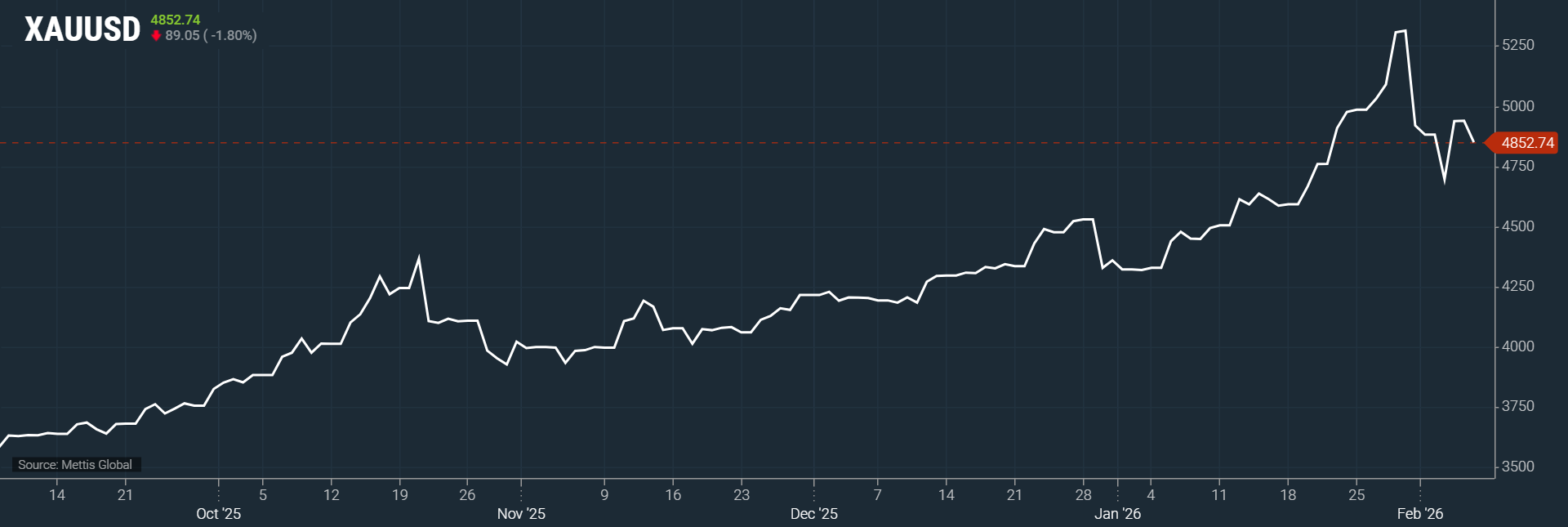

Gold holds, silver dips amid tech selloff

MG News | February 06, 2026 at 12:56 PM GMT+05:00

February 06, 2026 (MLN): Gold and silver saw modest gains on Friday, even as both metals were on track for a second consecutive week of losses.

Earlier this week’s rebound was erased by a global tech

stock selloff and a firmer U.S. dollar, which pressured precious metals.

Spot gold fell 1.80% to $4,852.74 an ounce as of

[12:54 PM] PST, according to data reported by Mettis Global.

Spot silver climbed 0.4% to $71.50 per ounce, rebounding

after a staggering 19.1% drop in the previous session.

The metal experienced extreme volatility on Friday, rising

as much as 3% after falling more than 10% below $65, marked a 1½-month low.

For the week, silver dropped nearly 16%, following an 18%

decline the week before—its steepest weekly fall since 2011.

Silver’s sharp movements were attributed to weakening risk

sentiment globally. “Risk appetite is clearly diminished.

Stocks are sliding and Bitcoin is facing pressure, with

overall risk-off sentiment on the rise.

In this environment, gold has stayed relatively steady,

while silver has come under stronger pressure, according to CNBC.

Despite global equities extending losses for a third

straight session, gold managed to maintain stability.

The U.S. dollar remained near a two-week high, positioning

it for its strongest weekly performance since November.

A stronger greenback tends to make dollar-denominated

assets, including precious metals, more expensive for holders of other

currencies, further weighing on prices.

Other precious metals also faced turbulence. Spot platinum

fell 3.6% to $1,916.60 per ounce after reaching an all-time high of $2,918.80

on January 26.

Palladium, meanwhile, rose 1.4% to $1,639.18, though both

metals recorded weekly declines.

With ongoing market volatility and a strong U.S. dollar,

investors may continue to monitor precious metals closely in the near term,

seeking opportunities amid price swings.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,893.09 355.32M | 2.59% 4266.79 |

| ALLSHR | 100,888.78 687.85M | 1.91% 1889.56 |

| KSE30 | 51,723.30 154.72M | 2.74% 1380.77 |

| KMI30 | 236,793.15 125.14M | 3.40% 7778.72 |

| KMIALLSHR | 64,642.45 317.23M | 2.51% 1584.54 |

| BKTi | 49,503.80 58.63M | 0.97% 475.26 |

| OGTi | 32,753.55 16.04M | 2.00% 643.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile