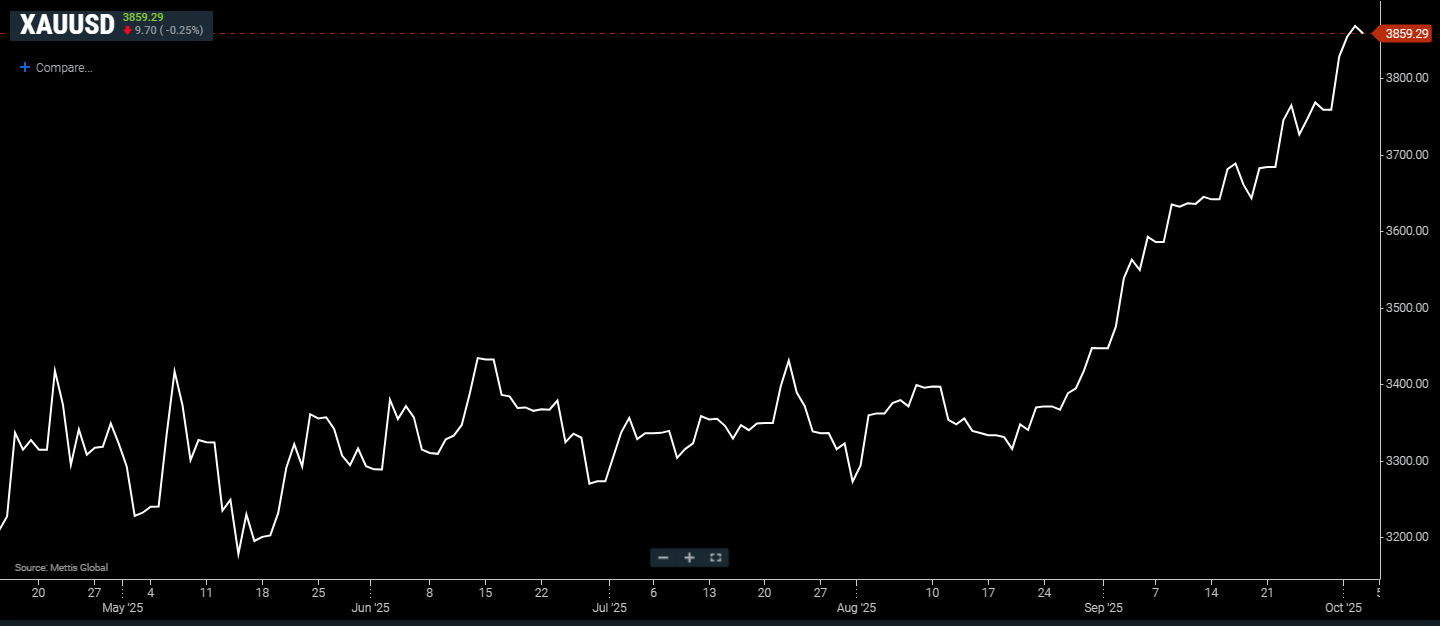

Gold holds firm, set for seventh weekly gain

MG News | October 03, 2025 at 04:25 PM GMT+05:00

October 03, 2025 (MLN): Gold prices

were steady on Friday and on track to log a seventh straight weekly advance,

supported by mounting expectations of further U.S. interest rate cuts and

unease over the economic fallout from a continuing government shutdown.

Spot gold was down 0.25% at $3,859.29 an ounce as of [4:19

pm] PST, according to data reported by Mettis Global.

The shutdown, which entered its third day on Friday, has

already disrupted the release of key economic indicators, including the

September non-farm payrolls report.

Alternative

figures from both private and public sources indicated the U.S. labor market

showed little progress last month, with weak hiring activity and an unchanged

unemployment rate.

Traders are heavily betting on further monetary policy

easing. CME Group’s FedWatch tool shows markets pricing in a 97% chance of a

25-basis-point cut in October, along with an 88% likelihood of another

reduction in December.

Dallas Fed President Lorie Logan commented that the

central bank’s recent rate cut was a prudent step to safeguard against a sharp

downturn in employment but cautioned against moving too aggressively.

Gold, traditionally favored as a safe-haven asset during

periods of political and financial instability, tends to benefit in a low-rate

environment. Prices have already surged 47% since the start of the year.

Physical demand also showed resilience. In India,

purchases rose despite record-high prices, while trading in China remained shut

due to a holiday.

Among other precious metals, spot silver gained 0.6% to $47.24 per ounce, platinum rose 0.5% to $1,576.25, and palladium advanced 1.4% to $1,258.25.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes