Crude markets hold ground as geopolitical risks mount

MG News | September 23, 2025 at 03:07 PM GMT+05:00

September 23, 2025 (MLN): Oil prices remained largely steady on Tuesday as traders weighed the effects of continuing geopolitical tensions in the Middle East and Russia, alongside concerns that trade tariffs could curb fuel demand.

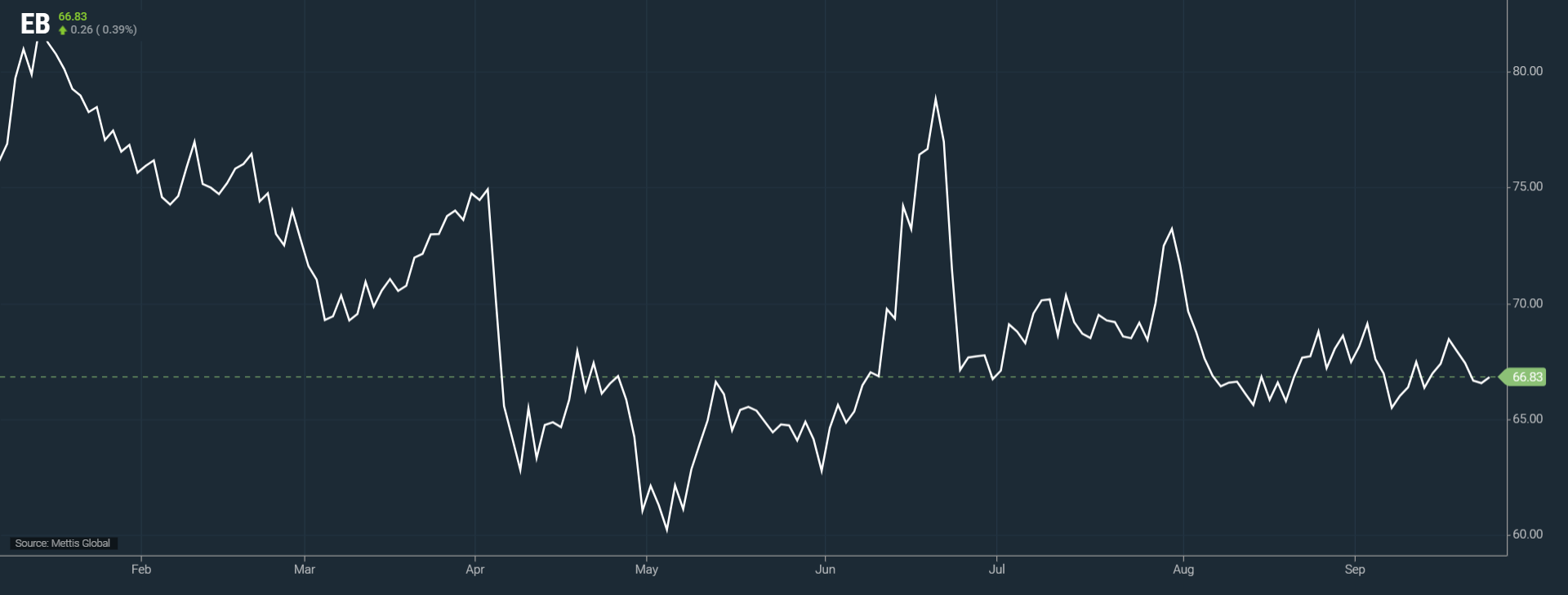

Brent crude

futures went up by $0.26, or 0.39%, to $66.83 per barrel.

West Texas

Intermediate (WTI) crude futures decreased by $0.35, or 0.56%, to $62.63 per

barrel by [3:05 pm] PST.

Two hospitals in

Gaza City have been forced to suspend operations as Israel’s ground offensive

intensifies and ongoing airstrikes cause severe damage, the Gaza Health

Ministry reported, while Israeli tanks continue to push deeper into the

territory.

In a parallel

diplomatic development, dozens of world leaders convened at the United Nations

on Monday to endorse the recognition of a Palestinian state, marking a historic

shift nearly two years into the Gaza conflict.

The move faces

strong opposition from Israel and its close ally, the United States.

Meanwhile,

tensions are mounting in Eastern Europe. Ukraine has stepped up drone attacks

on Russian energy infrastructure in recent weeks, targeting refineries and

export terminals.

The European

Union also informed plans to accelerate a ban on Russian LNG imports, moving it

up by a year as part of its 19th sanctions package on Moscow, following

pressure from U.S. President Donald Trump.

“Crude oil was

relatively unchanged as the market absorbed the impact of the EU’s efforts to

limit Russian supplies,” said ANZ analyst Daniel Hynes.

NATO allies

accused Russia of violating alliance airspace over Estonia and Poland on

Monday, with Britain warning that such actions could escalate into armed

conflict.

Russia, for its

part, reported that its forces had captured the settlement of Kalynivske in

Ukraine’s Dnipropetrovsk region.

On the energy

supply front, Saudi Arabia’s crude exports in July fell to their lowest level

in four months, according to data released Monday by the Joint Organizations

Data Initiative (JODI).

At the same time, Iraq, OPEC’s second-largest oil producer, increased its exports under the OPEC+ agreement, the state oil marketer SOMO reported

Copyright Mettis Link

News

.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes