Weekly Outlook: Trump Tariff Policy Taking Center Stage

Asad Rizvi | January 11, 2025 at 10:33 PM GMT+05:00

January 11, 2025 (MLN): The most important piece of economic news for the new year was the release of the US jobs report. The unemployment rate was 4.1% instead of the 4.2% that was anticipated, and the non-farm payroll increased to 256.000 instead of 160.000.

Faster growth and expectations of slower Fed rate cuts have caused the US Index to rise above 109 and US 10-year Treasury yields to reach their highest level in nearly 16 months, at 4.762%.

ISM had already shown a noticeable increase in growth earlier last week. In order to determine the US interest rate trend for this year, the market will now turn its attention to this week's US CPI data following Friday's announcement of a stronger employment report.

The market is now seeing fewer rate cuts this year than it did earlier.

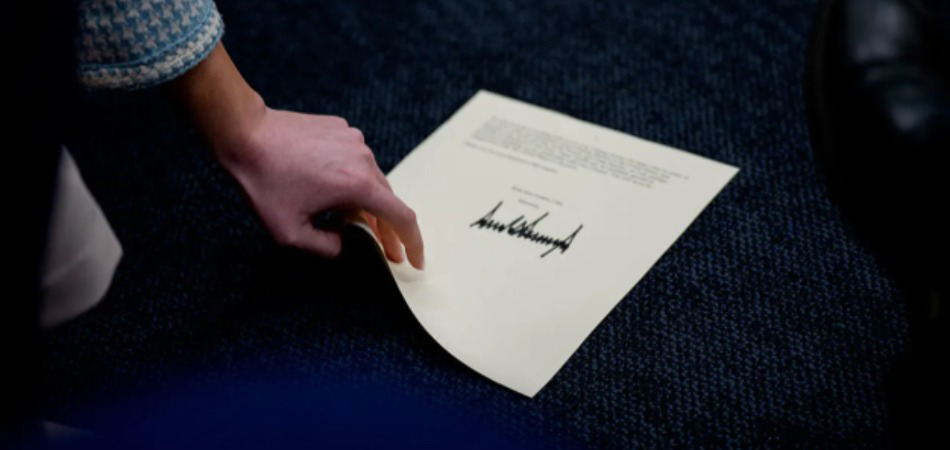

I think the main factor influencing the market, which will be more focused, will be the tariffs policy of the incoming Trump administration.

The Fed minutes that were released last week also had a hawkish tone, suggesting that the US Dollar will be reasonably stable in the weeks/months ahead.

There are already indications that the economy and labour market are doing well and imposing tariffs on trading partners will surely increase import costs that could fuel inflation.

This deviates from the original forecasts, and it is certainly anticipated that authorities will choose to adopt an extended pause and slow down the rate of interest rate cuts.

Meanwhile, a combination of negative factors caused Pound Sterling to plummet. Bonds declined as the economy slowed, raising the possibility of quicker rate reduction due to uncertainties in the UK debt market.

Market players anticipate that higher taxes will be imposed in order to boost spending. The fear of US tariffs ruins the mood even more. But taking a further dip, Pound Sterling may make a minor upward adjustment.

In order to increase spending, market investors expect the UK to impose additional taxes.

Further dampening the mood is the potential of US tariffs. But the Pound Sterling may correct a little before falling any further.

#GOLD @ $ 2689.80- Initially, gold will try to break above $ 2702-05 for a test of $ 2728 levels, which looks tough. On the contrary, a decline below $ 2662 will support a move towards $2645-48 zones.

#EURO @ 1.0244- Euro may not give up in the beginning, support at 1.0110 is likely to hold. On the upside Euro will have to break through 1.0380 and 1.0490 in order to gain upward momentum, which appears to be difficult, and will thereafter decline after failing to rise.

#GBP @ 1.2204-Pound Sterling could inch up a bit, but it could struggle to move beyond 1.2360-80 and is likely to dip again. Break of 1.2105 would push it towards 1.1980-00.

#JPY 157.69- Support for the USD is seen at 156.20 and 155.10. Most likely, it will remain above. However, to be able to achieve 160.40, $ must clear 159.50. New targets can only be reached if the resistance and support are broken.

The writer is the former Country Treasurer of Chase Manhattan Bank

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|