Weekly News Roundup

MG News | February 02, 2020 at 03:47 PM GMT+05:00

February 2, 2020 (MLN): This past week brought along a series of significant events, amongst which the most important one was the announcement of monetary policy for the next two months wherein the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) decided to maintain the Policy Rate at 13.25 percent. Apart from this, the following events of importance took place last week:

On Friday, the Oil and Gas Regulatory Authority (OGRA) issued a price-revision notification of Liquefied Petroleum Gas (LPG) for the month of February according to which the authority decreased the locally produced LPG price by Rs. 111.27 per cylinder of 11.8 kilogram.

Meanwhile, the Insurance Association of Pakistan (IAP) held two separate consultative meetings with the non-life insurance sector and life insurance sector with the Chairman SECP, Mr Aamir Khan on January 30, 2020, at Karachi. The comprehensive discussions involved challenges related to the implementation of the International Financial Reporting Standard No 17 (IFRS-17) on insurance contracts.

Furthermore, the Asian Development Bank (ADB) on Friday approved the establishment of ADB Ventures, a new venture platform that will support and invest in startups offering impact technology solutions, besides contributes to the achievement of the Sustainable Development Goals (SDGs) in Asia and the Pacific.

With regards to GIDC, Engro Fertilizers (EFERT) welcomed the decision of Government of Pakistan to reduce GIDC on urea. In line with the decision and to support the valued farmers of the country, EFert decided to fully pass on the benefit of change in GIDC rates by announcing a 160/bag reduction in urea prices, effective February 1, 2020

The same day, SBP conducted an open market operation (OMO) in which it purchased of GOP Ijara worth R.s. 14.40 Billion at cut-off price of R.s.109.7966 on Bai Mujjal basis.

Moreover, the Petroleum Division on Friday signed a Petroleum Concession Agreement (PCA) with Pakistan Oilfields Limited (POL) and Mari Petroleum Company Limited (MARI) for Taung block, located in Jamshoro Sindh.

An important development in IT sector was witnesses as Ministry of Science and Technology (MoST) announced to present a $30 billion export plan of the non-traditional exports having big share of bio-technology before Prime Minister Imran Khan, this week, which would pave the way for the transformation of country’s economy.

On equity front, Systems Limited via notification to PSX has informed that its subsidiary EP Systems Pvt Limited has signed an agreement with The International Finance Corporation (IFC), a member of the World Bank Group for an equity investment in EP Systems. The global financial institution will purchase approximately 20 percent of the company making OneLoad IFCs first fintech investment in Pakistan.

In a historic move, the 330 MW Thar Coal-based Power Generation Project on Thursday achieved Financial Closing.

With regards to privatization, Federal Minister on Thursday, chaired a review meeting on the transaction of six targeted entities for the current financial year. Federal Minister Mohammad Mian Soomro reviewed the current status of six entities including two power plants Haveli Bahadarshah and Balloki to be privatized in the current year.

The same day, Excelerate Energy L.P. (Excelerate) and Engro Elengy Terminal Ltd (EETL) signed a Heads of Agreement (HOA) for the expansion of the EETL liquefied natural gas (LNG) import terminal located in Port Qasim, Pakistan.

Another important development was draft agreement between Saudi Arabia and Pakistan on renewable energy development approved by the Saudi Shoura Council on Thursday.

In addition to this, the Asian Development Bank (ADB) approved a $15 million loan that will help seven cities in Punjab province in Pakistan design comprehensive investment and public service delivery plans in preparation for upcoming urban development projects.

on Wednesday, the Economic Coordination Committee (ECC) of the Cabinet approved several proposals related to supplementary grants, establishment of trust fund, waiving off.

Additionally, Privatization Commission approved Financial Advisors for divestment of shares in Oil and Gas Development Company Limited and Pakistan Petroleum Limited.

Besides, Ministry of Energy, Petroleum Division via notification, informed that the ECC of the Cabinet, in its meeting held on Jan 20, 2020, has approved reduction in GIDC on gas consumed by Fertilizer Manufacturers to Rs 5/MMBTU so that this benefit could be passed on to the farmers.

On Tuesday, State Bank of Pakistan (SBP) extended the scope of Long Term Financing Facility (LTFF) to cover all permissible export oriented sectors. This step is aimed at setting up of diverse export-oriented projects in Pakistan and to boost exports in multiple sectors.

Meanwhile, Federal Minister for Privatisation and Chairman Privatisation Commission Mohammed Mian Soomro chaired Transaction Committee Meeting followed by PC Board Meeting to discuss and recommend prequalification of the potential investors who have submitted Statements of Qualification (SOQs)for the privatization of National Power Parks Management Company(Pvt)Ltd (NPPMCL).

To restore investor confidence, Securities and Exchange Commission of Pakistan (SECP) initiated public consultation on the proposed new broker regime which primarily aims to strengthen the capital markets.

On Monday, High Commissioner of Malaysia to Pakistan Ikram Muhammad Ibrahim called on Minister for Energy Omar Ayub Khan in Islamabad. During the discussion, he invited Malaysian investors to fully participate in the auction of Oil and Gas blocks that will be offered to foreign investors with 18 initial blocks in the first phase.

The same day, Finance Division stated that CDNS is committed to mitigating the deficiency to improve customer service delivery and to comply with the FATF recommendation to safeguard the investors’ interests.

On the upside, Pakistan’s economic freedom overall score improved by 0.6 percent with higher scores for judicial effectiveness and property rights outpacing modest performance in monetary freedom and fiscal health. According to a report compiled by Washington based Heritage Foundation, Pakistan's economic freedom score is 55 and its economy is the 131st freest in the 2019 index.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,313.86 435.47M | -0.08% -133.44 |

| ALLSHR | 103,015.58 1,065.49M | 0.03% 32.70 |

| KSE30 | 51,854.06 241.67M | 0.04% 22.42 |

| KMI30 | 242,259.69 133.89M | -0.76% -1853.91 |

| KMIALLSHR | 66,724.18 452.80M | -0.67% -452.45 |

| BKTi | 46,861.43 131.81M | 1.70% 784.69 |

| OGTi | 33,615.26 10.50M | -1.02% -347.09 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 86,655.00 | 86,960.00 85,930.00 | 690.00 0.80% |

| BRENT CRUDE | 60.02 | 60.67 59.75 | 0.34 0.57% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 2.30 2.59% |

| ROTTERDAM COAL MONTHLY | 96.50 | 96.50 95.90 | 0.85 0.89% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.14 | 56.85 55.91 | 0.33 0.59% |

| SUGAR #11 WORLD | 14.76 | 14.89 14.72 | -0.06 -0.40% |

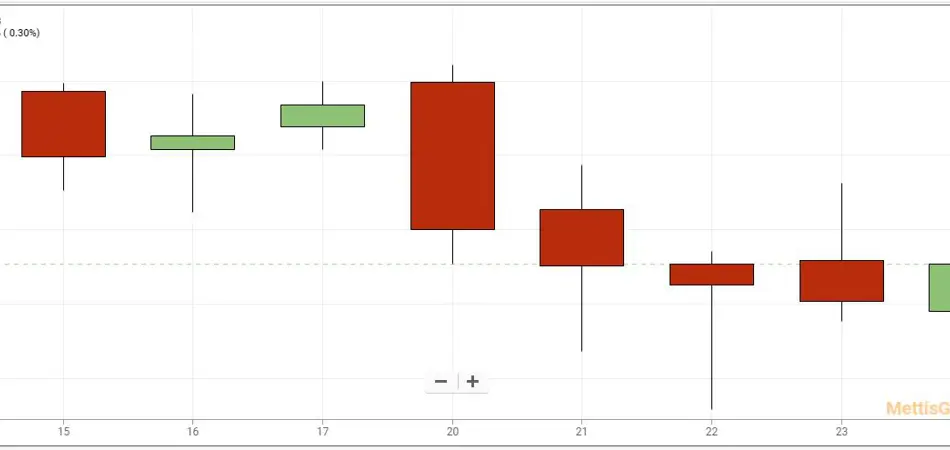

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MPC Meeting

MPC Meeting