Weekly Market Roundup

.jpeg?width=950&height=450&format=Webp)

MG News | May 25, 2025 at 10:26 PM GMT+05:00

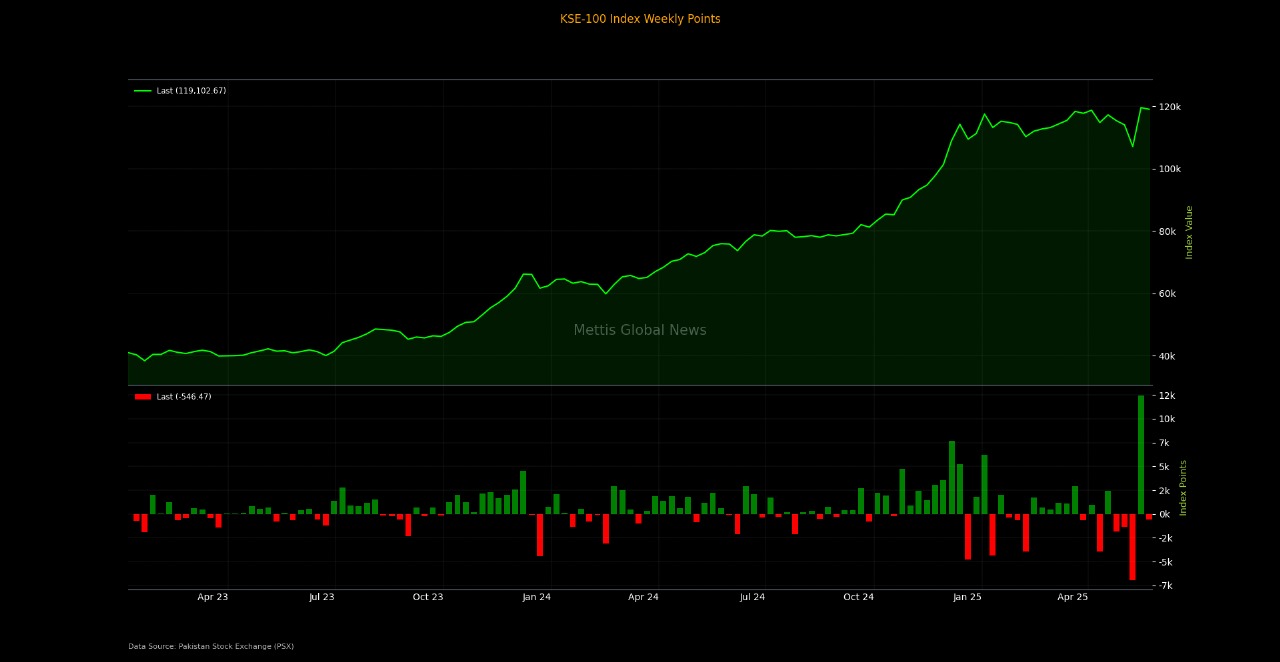

May 25, 2025 (MLN): Market participants adopted a cautious stance through smart trading strategies; however, the market remained sideways and volatile, as both buying and selling continued due to the upcoming Federal Budget for FY2025- 26 and the discussions on the IMF’s 11 conditions.

Accordingly, the Index lost 546.47 points or 0.46%, closing the session at 119,102.67 compared to the previous week’s close of 119,649.14.

Intraday swings were significant, with the index reaching a high of 120,699.17 (+1,596.50 points) and a low of 118,527.09 (-575.8 points).

Market cap

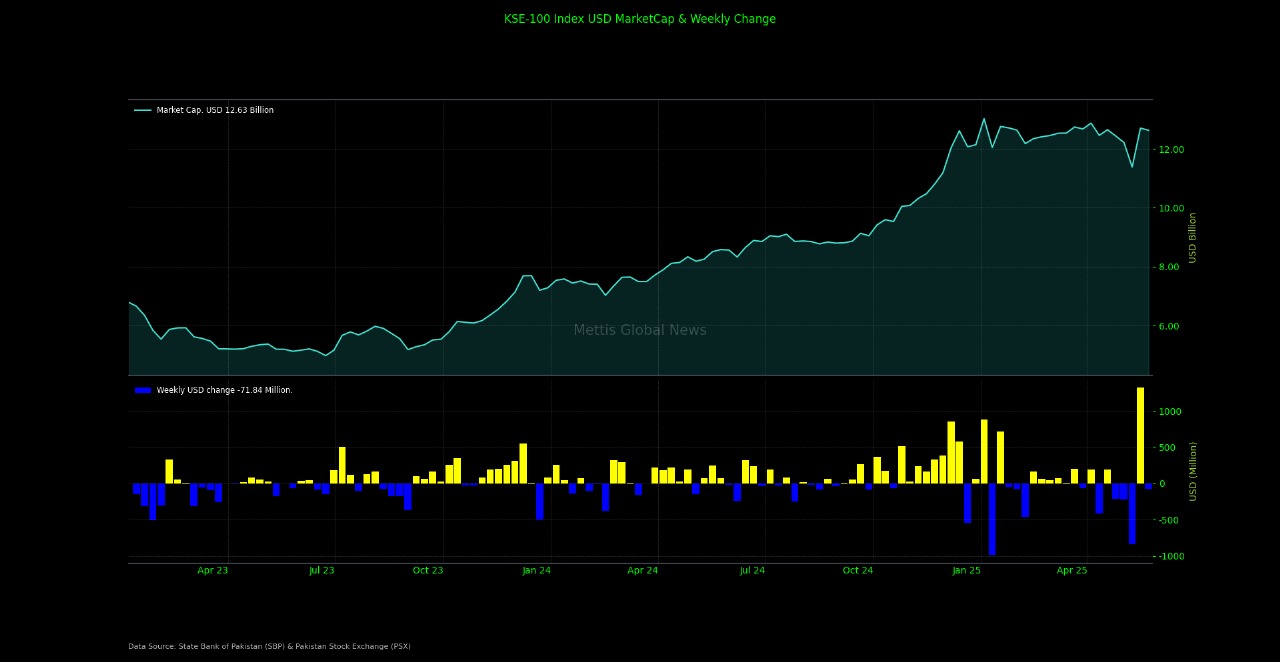

The KSE-100 market capitalization stood at Rs3.56 trillion, down 0.46% from the previous week’s Rs3.57tr. In USD terms, the market cap was recorded at $12.63 billion, compared to $12.70bn in the prior week.

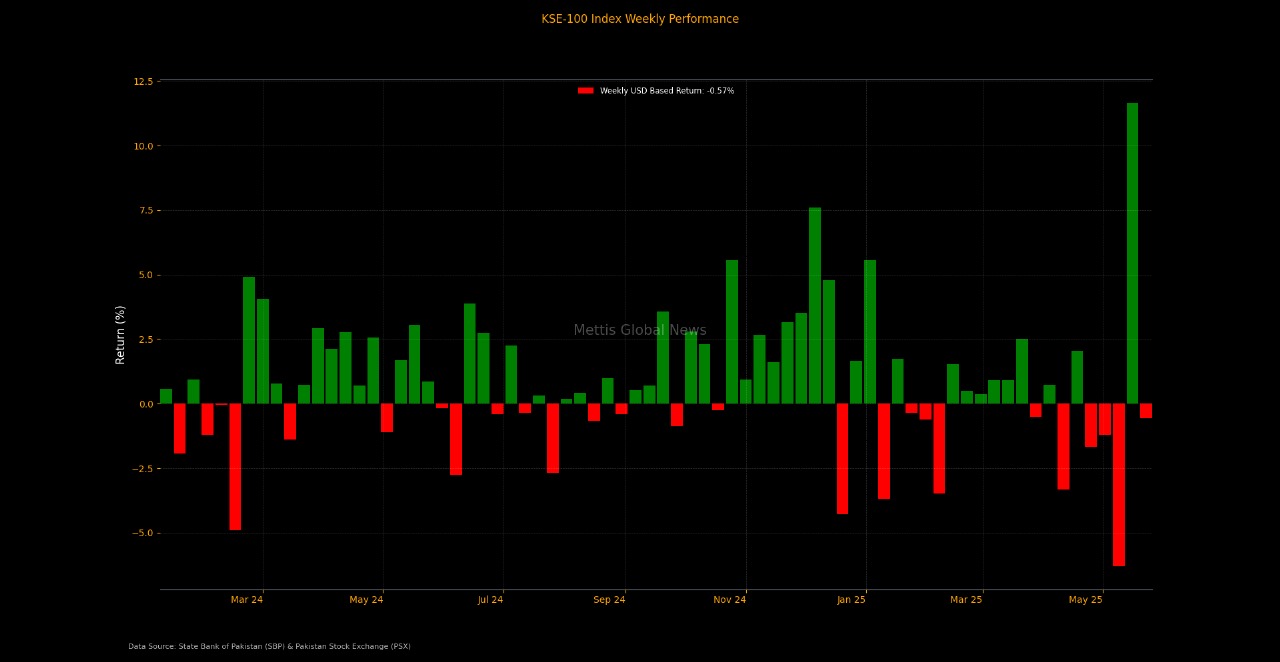

This week, the index return in USD terms was -0.56%, compared to 11.655% the previous week.

On the economic front, foreign investors' repatriation of profit and dividends rose 108.63% YoY in 10MFY25 to $1.84 billion compared to $882.55m worth of repatriation in the same period last year.

The foreign exchange reserves held by the State Bank of Pakistan (SBP) surged by $1.04 billion or 10.03% WoW to $11.45bn during the week ended on May 16, 2025.

The sharp rise in reserves came after Pakistan received SDR 760 million, equivalent to approximately $1,023m from the IMF under the Extended Fund Facility (EFF) on May 13, 2025.

Automobile financing in Pakistan has increased by 11.72% to Rs257.36bn, compared to the same period last year when the figure for financing was reported at Rs235.69bn.

The positive economic cues helped stabilise investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 51.82%, while CYTD return stood at 3.45%.

Top Index Movers

During the week, Cement, Oil & Gas Exploration Companies, Fertilizer, and Automobile Assembler lost -339.22, -267.82, -222.62, and -55.06 points, respectively.

On the other hand, Inv. Banks, and Power Generation & Distribution added 184.11, and 60.05, respectively.

Among individual stocks LUCK, FFC, MARI, and MCB lost -257.91, -237.55, -211.09 and -131.34, respectively.

FIPI/LIPI

This week, foreign investors remained net sellers, offloading equities worth $0.33m.

Foreign Corporates led the selling spree worth $1.44m while Overseas Pakistanis bought equities worth $1.11m.

On the other hand, local investors were net buyers this week, purchasing equities worth $0.33m.

Individuals and Insurance Companies bought securities worth $13.08 and $7.54m, respectively, while Mutual Funds sold securities worth $10.11m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,853.10 424.99M | 3.29% 5702.68 |

| ALLSHR | 107,335.86 693.28M | 2.85% 2972.30 |

| KSE30 | 54,676.69 210.97M | 3.52% 1860.41 |

| KMI30 | 250,620.93 139.36M | 2.14% 5257.28 |

| KMIALLSHR | 68,647.30 398.45M | 1.89% 1273.91 |

| BKTi | 52,773.10 107.33M | 7.09% 3494.44 |

| OGTi | 35,032.42 34.95M | 0.79% 274.54 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,525.00 | 68,570.00 66,910.00 | -340.00 -0.50% |

| BRENT CRUDE | 69.05 | 69.37 67.36 | 1.63 2.42% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.80 | 64.08 62.04 | 1.54 2.47% |

| SUGAR #11 WORLD | 13.54 | 13.69 13.47 | 0.06 0.45% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

Roshan Digital Account

Roshan Digital Account