Weekly Market Roundup

Nilam Bano | February 09, 2025 at 12:10 PM GMT+05:00

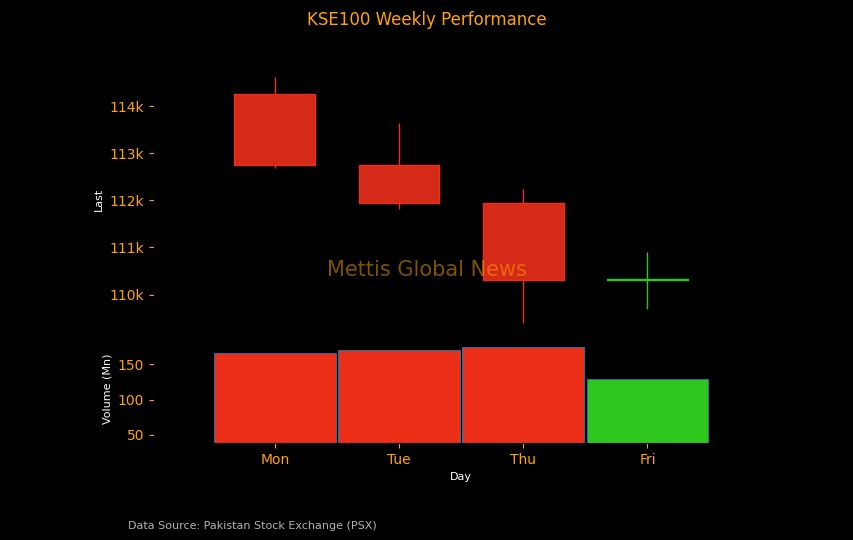

February 09, 2025 (MLN): The local bourse witnessed significant selling pressure throughout the week as investors opted to book profit ahead of IMF review which led the benchmark KSE-100 index to close at 110,322.93, down by 3,932.79 points or -3.44% compared to the previous week’s close of 114,255.72points.

Intraday swings were significant, with the index reached a low of 109,405.53 (-917.40 points) and a high of 114,620.79 (+4,297.86 points).

Market cap

The KSE-100 market capitalization stood at Rs3.39 trillion, down -3.58% from the previous week’s Rs3.52tr. In USD terms, the market cap was recorded at $12.17 billion, compared to $12.73bn in the prior week, reflecting a decline of $456.82 million or -3.61%.

This week, the index return in USD terms remained negative at -3.47%, compared to last week’s return of -0.61%.

On the economic front, Pakistan's inflation slowed to 2.4% in January 2025- marking a 9-year low, compared to 4.1% in the previous month and 28.3% in January 2024.

Further, the country’s trade deficit stood at $2.31bn in January 2025, reflecting a 5.47% improvement compared to December 2024.

Moreover, the State Bank of Pakistan (SBP) conducted an auction on Tuesday selling Market Treasury Bills (MTBs) worth Rs451.92bn. The target was to raise Rs450bn while the maturity amount was Rs426bn.

On the same day, the Central Bank also conducted an auction for floating rate Pakistan Investment Bonds in which it sold almost Rs651bn for 2, 5 and 10 years semiannual bonds against a target of Rs350bn

The total cement dispatches stood at 3.895 million tons for January 2025, reflecting a 6% decline compared to 4.154 million tons in December 2024.

The sales volume of oil marketing companies (OMCs) in Pakistan increased by 8% month-on-month (MoM) in January 2025, reaching a total of 1.4 million tons, while the year-on-year (YoY) change remained flat.

The foreign exchange reserves held by the SBP increased by $45.9m or 0.40% WoW to $11.42bn during the week ended on January 31, 2025.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 40.63%. However, on CYTD return stood at -4.17%.

Top Index Movers

During the week, Oil & Gas Exploration Companies, Inv. Banks, Commercial Banks, and Fertilizer dragged the index down by -820.54, -689.73, -589.41, and -478.48, respectively.

On the flip side, Insurance and Food & Personal Care Products contributed only 23.31 and 12.22 points to the index, respectively.

Among individual stocks, ENGROH eroded -661.338 points from the index while MARI, FFC, and PPL dented the index by - 290.85, -240.75, and - 234.53, respectively.

Conversely, LUCK, SAZEW, and NBP added 81.26, 56.15, and 26.41, respectively.

FIPI/LIPI

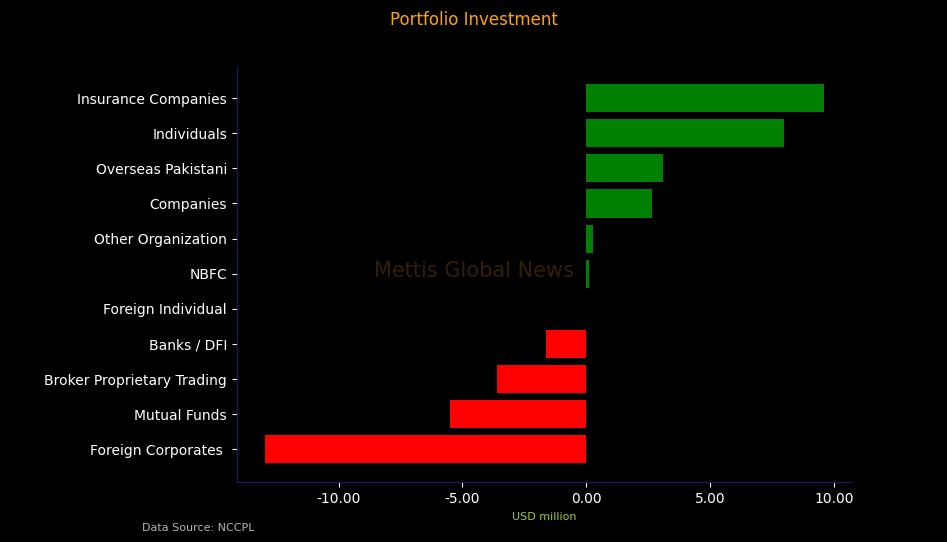

This week, Foreign Investors emerged as net sellers, offloading the equities worth $9.87m.

Among them, Foreign Corporates led the selling activity worth $12.97m while Overseas Pakistanis purchased securities worth $3.09m.

On the other hand, this week, local Investors were net buyers, purchasing equities worth $9.87m.

Insurance Companies and individuals bought securities worth $9.59m and $7.95m, respectively.

However, Mutual Funds, and Broker Proprietary Tradaing sold securities worth $5.49m, and $3.6m, respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,665.50 299.28M | 1.68% 2285.53 |

| ALLSHR | 85,699.50 778.48M | 1.24% 1051.15 |

| KSE30 | 42,353.14 103.20M | 1.94% 806.91 |

| KMI30 | 195,182.04 107.99M | 1.81% 3462.27 |

| KMIALLSHR | 56,389.15 437.73M | 1.01% 561.42 |

| BKTi | 38,422.98 17.31M | 1.57% 595.37 |

| OGTi | 27,718.26 13.25M | 0.17% 47.58 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,555.00 | 120,265.00 117,720.00 | -75.00 -0.06% |

| BRENT CRUDE | 69.55 | 69.63 68.27 | 1.03 1.50% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 0.95 0.99% |

| ROTTERDAM COAL MONTHLY | 105.00 | 105.00 105.00 | -0.15 -0.14% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 67.58 | 67.69 66.29 | 1.20 1.81% |

| SUGAR #11 WORLD | 16.75 | 16.88 16.54 | 0.19 1.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

.jpeg)

PIB Auction

PIB Auction