Weekly Market Roundup

By MG News | December 21, 2024 at 04:44 PM GMT+05:00

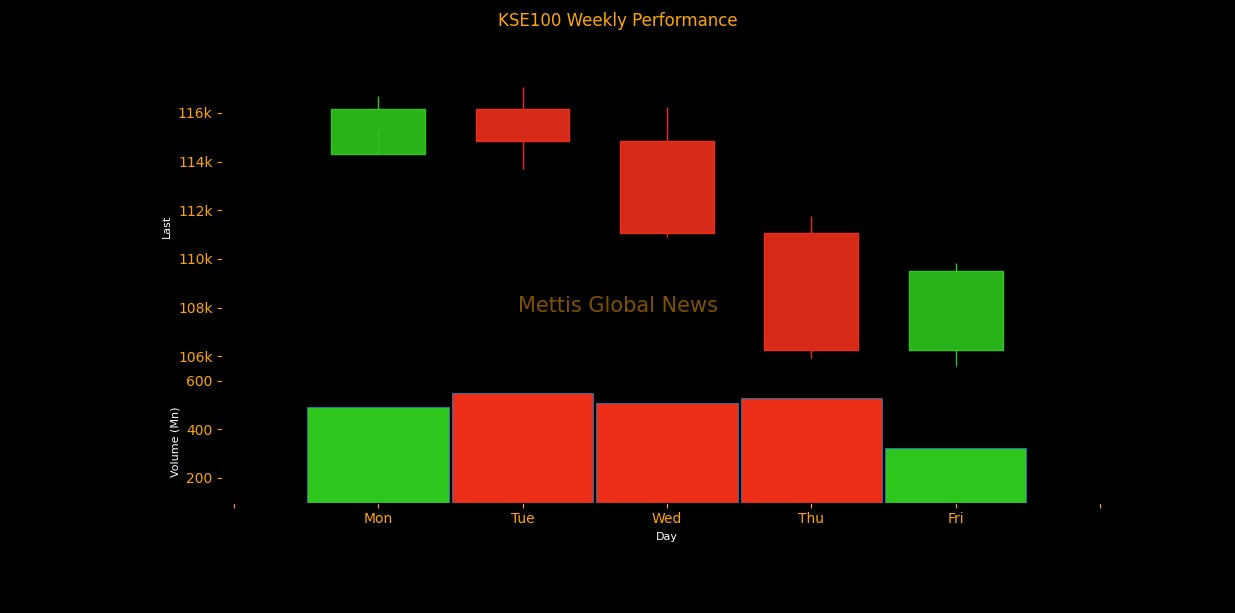

December 21, 2024 (MLN): Investors at the local bourse experienced a turbulent voyage this week. Fueled by a 200bps cut in the interest rate, the benchmark KSE-100 index started the week on a positive note.

However, despite the optimism from the SBP’s announcement of a current account surplus of $729 million in November 2024- the highest in a decade with a significant improvement from the $148m deficit in November 2023, the market quickly shifted direction.

On Tuesday, the index started losing its ground. Wednesday and Thursday saw historic single-day declines of approximately 3,700 points and 4,800 points, respectively.

Mutual fund redemptions and year-end profit-taking by institutional investors were the major reasons behind this correction.

Analysts believed this steep drop was a buying opportunity for those who missed the earlier bullish rally.

It seemed the analysts were right, as the week ended positively with Friday's session closing in the green. Investor confidence remained intact despite the selling pressure.

The confidence stemmed from a decline in PIB cut-off yields across various tenors by 4 to 55 basis points. Additionally, SBP reserves increased by $31m, reaching $12.1bn.

During the week, the benchmark KSE-100 Index lost 4,788.7 points, down 4.2% to close at 109,513.14.

The index reached an intraday high of 117,039 (+7,525.86) in early trading hours and a low of 105,601 (-3,912.14) on Friday’s first trading session.

In USD terms, the index posted a drop of 4.3% this week. Last week, the USD-based return stood at 4.77%.

Positive economic triggers strengthened the confidence of the bulls and surged the KSE-100 index calendar year's returns to 75.35%, while for the fiscal year, they stand at 39.6%.

Top Index Movers

Sector-wise, negative contributors were Oil & Gas Exploration Companies -1305.39pts), Fertilizer (-954.04pts), Cement (-797.99pts), Commercial Banks (-445.47pts), and Technology & Communication (-252.27pts).

Contrary to that, Oil & Gas Marketing Companies, Cable & Electrical Goods, and Power Generation & Distribution added 113.24, 72.09, and 57.31 points, respectively.

Stock-wise, MARI was the worst-performing stock of the week, losing 965.46 points. LUCK, FFC, ENGRO, EFERT, PPL, and NBP followed suit with losses of 429.50, 324.40, 308.66, 200.46, 182.20, and 180.70 points, respectively.

On the other hand, PSO, HUBC, and INDU made positive contributions to the index, adding 229.13, 166.40, and 90.41 points, respectively.

FIPI/LIPI

Foreign investors were net sellers once again during the week, offloading a significant $11.58m worth of equities.

Flow-wise, the leading sellers were foreign corporates, with a net sale of $16m.

On the other hand, local investors remained net buyers worth $11.58m. Among them, individuals emerged as the dominant buyers, with an investment of $25.8m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

Central Government Debt

Central Government Debt

CPI

CPI