Weekly Market Roundup

MG News | November 30, 2024 at 02:57 PM GMT+05:00

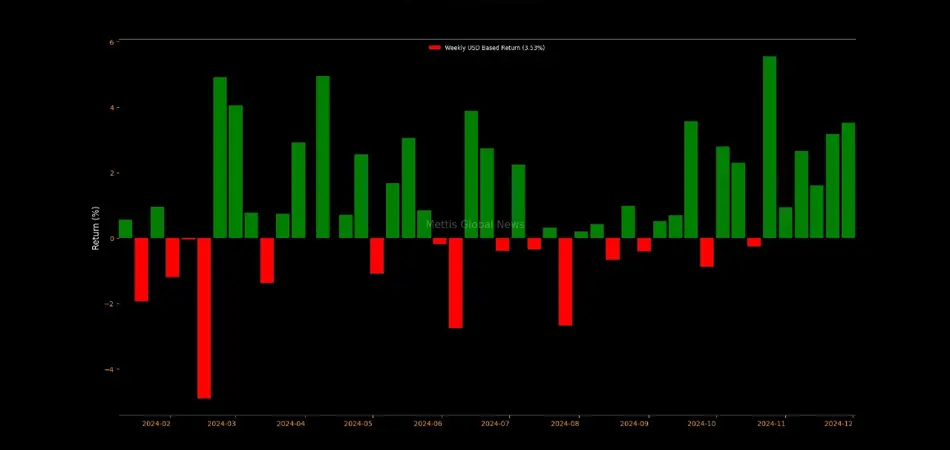

November 30, 2024 (MLN): Pakistan's stock market experienced a volatile week, ultimately concluding with investors celebrating the milestone of the benchmark index surpassing the highly anticipated 100,000 mark, achieving an impressive weekly gain of 3.64%.

This marked its sixth consecutive weekly gain, matching the longest winning streak recorded in April.

Before reaching this historic milestone, the index tested the patience of investors as it suffered a massive drop of 3.57%, its highest single-day loss in nearly a year—or 11 months, to be precise on Tuesday.

This massive sell-off occurred due to the political unrest.

The sorrows were short-lived, as the very next day, the bulls made a strong comeback in the market, demonstrating aggressive buying as concerns over protests and political uncertainty eased. Ultimately, the index posted a remarkable 4.94% gain, marking its highest daily gain in nearly 16 months.

After that, the positivity stemming from the strong investor confidence, supported by positive macroeconomic indicators and falling bond yields, drove the market’s bullish momentum.

Pakistan’s inflation for the outgoing month of November is expected to ease significantly and be recorded as the lowest yearly price gain since April 2018—79 months, to be precise.

Accordingly, the central bank is expected to implement further policy rate cuts of a greater magnitude to stimulate economic growth—another cheerful moment for the bulls.

.jpeg)

During the week, the index traded in a wide range of 7,316 points, marking a high of 101,496 (+3,698) and low of 94,181 (-3,618).

In terms of USD return, the index increased by 3.53% WoW.

Pakistan stock market's average traded volume dropped 1.2% WoW to 978.8 million shares. Meanwhile, traded value increased 7.07% WoW to Rs36.85 billion.

Market capitalization jumped by $1.27bn or 2.82% to $45.34bn over the week. In PKR terms, market capitalization stood at Rs12.89 trillion.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (+1,676pts), Technology & Communication (+349pts), Oil & Gas Exploration companies (+284pts), Oil & Gas marketing companies (+260pts), and Cement (+234pts).

Contrary to that, negative contributions came from Miscellaneous (-52pts), Automobile Assembler (-11pts), Automobile Parts & Accessories (-5pts), Glass & Ceramics (-4pts), and Tobacco (-1pts).

The best-performing stocks during the week were HBL (+694pts), BAHL (+538pts), PPL (+274pts), SYS (+255pts), and BAFL (+205pts).

Whereas, the worst-performing were MEBL (-439pts), EFERT (-78pts), FABL (-57pts), PSEL (-56pts), and SAZEW (-34pts).

An important point to highlight when assessing banks as both top contributors and underperformers is the impact of recent changes in applicable profit rates on deposits.

The State Bank of Pakistan issued a directive exempting the Minimum Profit Rate on the deposits of financial institutions, public sector enterprises and public limited companies, benefitting banks such as HBL, BAFL and BAHL, etc.

On the other side, Islamic Banking Institutions (IBIs) such as MEBL and FABL were required to offer at least 75% of the weighted average gross yield of all pools on their PKR savings deposits. This regulatory adjustment significantly impacted the profitability of the affected banks.

FIPI/LIPI

Foreign investors were net sellers during the week, dumping a significant $15.11m worth of equities.

Flow-wise, the leading sellers were foreign corporations with a net sale of $15.45m. Their most substantial sales activity was in Commercial Banks, amounting to $6.37m.

On the other hand, insurance companies were the dominant buyers, with a net investment of $10.61m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 144,989.23 96.45M | -7.94% -12506.87 |

| ALLSHR | 87,634.97 150.60M | -7.00% -6592.04 |

| KSE30 | 44,435.55 39.42M | -8.06% -3894.66 |

| KMI30 | 205,863.10 35.59M | -8.38% -18824.23 |

| KMIALLSHR | 56,361.24 97.12M | -7.36% -4477.85 |

| BKTi | 42,165.06 14.44M | -7.31% -3324.90 |

| OGTi | 30,063.57 4.39M | -6.30% -2019.90 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,350.00 | 67,795.00 65,685.00 | -945.00 -1.38% |

| BRENT CRUDE | 115.40 | 119.50 99.00 | 22.71 24.50% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 113.23 | 119.48 98.00 | 22.33 24.57% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)