KSE-100 suffers largest single-day drop of 2024

Rafay Malik | November 26, 2024 at 11:00 PM GMT+05:00

November 26, 2024 (MLN): Investors who were eagerly anticipating the market to break its destined 100,000 mark well ahead of the December target are now shifting towards severe concerns after what was witnessed in today's session.

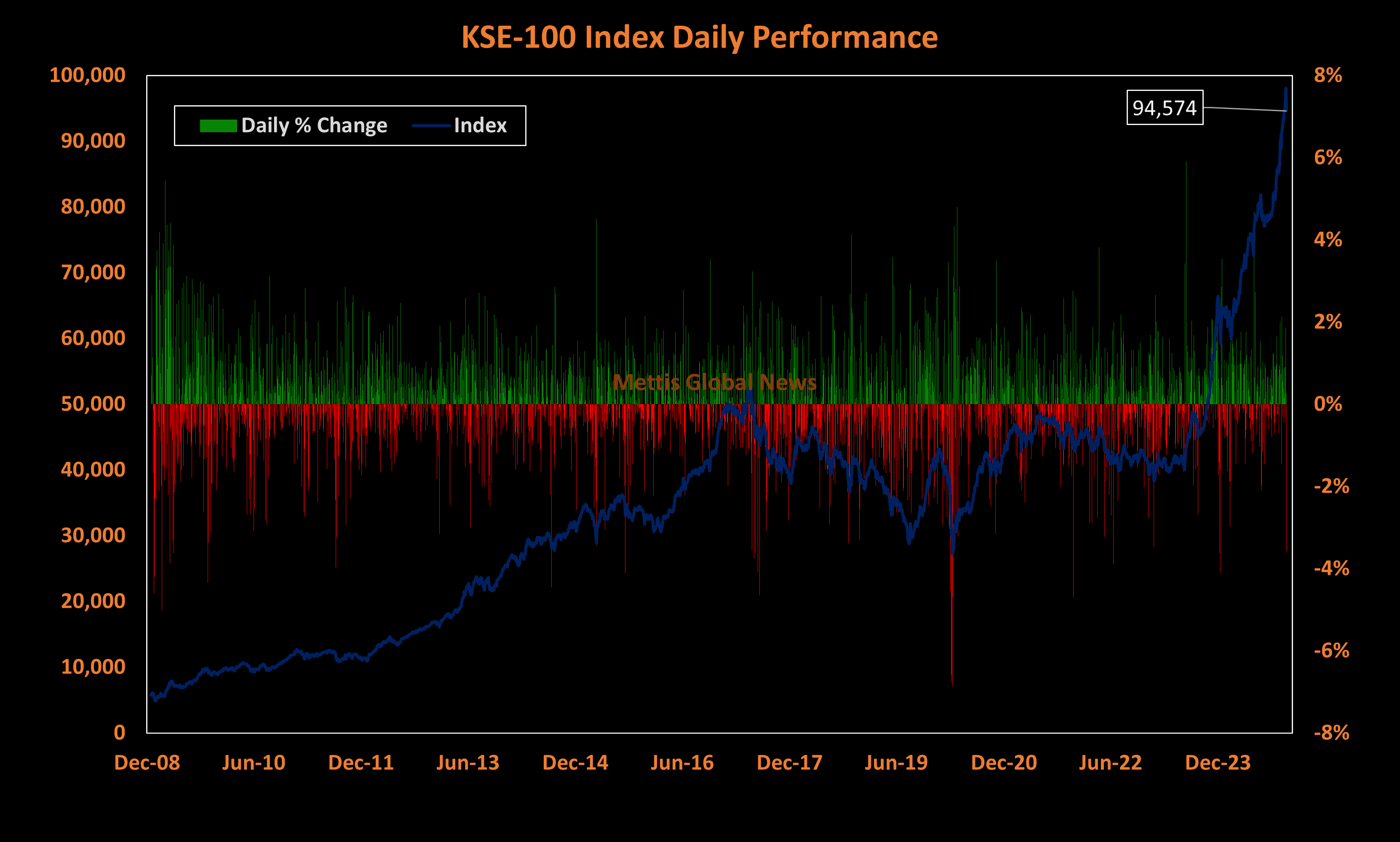

KSE-100 Index, the key gauge of the Pakistan Stock Exchange (PSX) suffered a massive drop of 3.57%, its highest single-day loss in nearly a year—or 11 months, to be precise.

In terms of index points, the index shed off 3,505.62 points, a historic decline never witnessed before.

The aggressive bears took center stage at the trading desk and triggered a massive sell-off due to the political unrest currently prevailing in the country—a situation and result with which the country as well as the bourse is quite familiar.

Trading activity surged to exceptionally high levels, with the benchmark's volume reaching 517.94 million shares, while the broader market recorded 1,116.32m shares. This marked a significant increase compared to the previous day's volumes of 281.10m shares and 640.26m shares, respectively.

Interestingly, out of the 35 sectors composing the KSE-100 index, all sectors ended up in red despite three which added just meager points.

Despite the day being labeled a "bloodbath" due to the closing performance, it is worth noting that the index also reached a new all-time intraday high of 99,819.59 points, falling just 200 points short of the psychological milestone of 100,000.

Banks stepped in to provide support. To clarify, it was the non-Islamic banks that extended this support after the State Bank of Pakistan issued a directive exempting the Minimum Profit Rate on the deposits of financial institutions, public sector enterprises and public limited companies.

On the other side, Islamic banks such as MEBL and FABL went to dust with their scrip price plummeting by 10% after SBP decided that Islamic Banking Institutions (IBIs) must pay a profit on their PKR savings deposits equivalent to at least 75% of the weighted average gross yield of all pools of an IBI.

However, the political unrest triggered a massive sell-off which erased all gains and caused a massive decrease in the index.

According to NCCPL data, mutual funds that were previously on a buying spree have now shifted to selling. Over the two trading sessions this week, mutual funds sold stocks worth $18.19 million.

Another possible reason for this sudden plunge could be a market correction, as the index had been on a record-breaking streak. However, if it was indeed a correction, the country's political instability may have heightened the situation.

Pakistan's benchmark stock index has already surged by most in over two decades in 2024 on signs of improvement in the nation’s economy under the International Monetary Fund loan program, declining bond yields, a stable rupee and external indicators.

The KSE-100 Index has advanced 53.63% in US Dollar terms to 97,798 this year and is on track to post its biggest annual gain since 2003.

Furthermore, analysts expect the KSE-100 to rally above 120,000 by the end of next year on the back of improving macro indicators and falling bond yields which is flushing more liquidity in equities.

The positivity stems from the strong investor confidence, supported by positive macroeconomic indicators and falling bond yields, which drove the market’s bullish momentum.

Additionally, the future earnings multiple of the index remains significantly lower than its 10-year average, providing further justification that the target is likely to be achieved.

A point to note here is that all positive elements could be eliminated if the country continues to face political protests, disturbances, and conflicts. This was evident today, which will likely be remembered as one of the most troublesome days—until a new one emerges.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction