Weekly Market Roundup

By Abdur Rahman | November 02, 2024 at 04:21 PM GMT+05:00

November 02, 2024 (MLN): Pakistan stocks closed in green after a whipsaw week, as investors weighed signs of overextension in the record-breaking stock rally against the central bank's continued dovish stance.

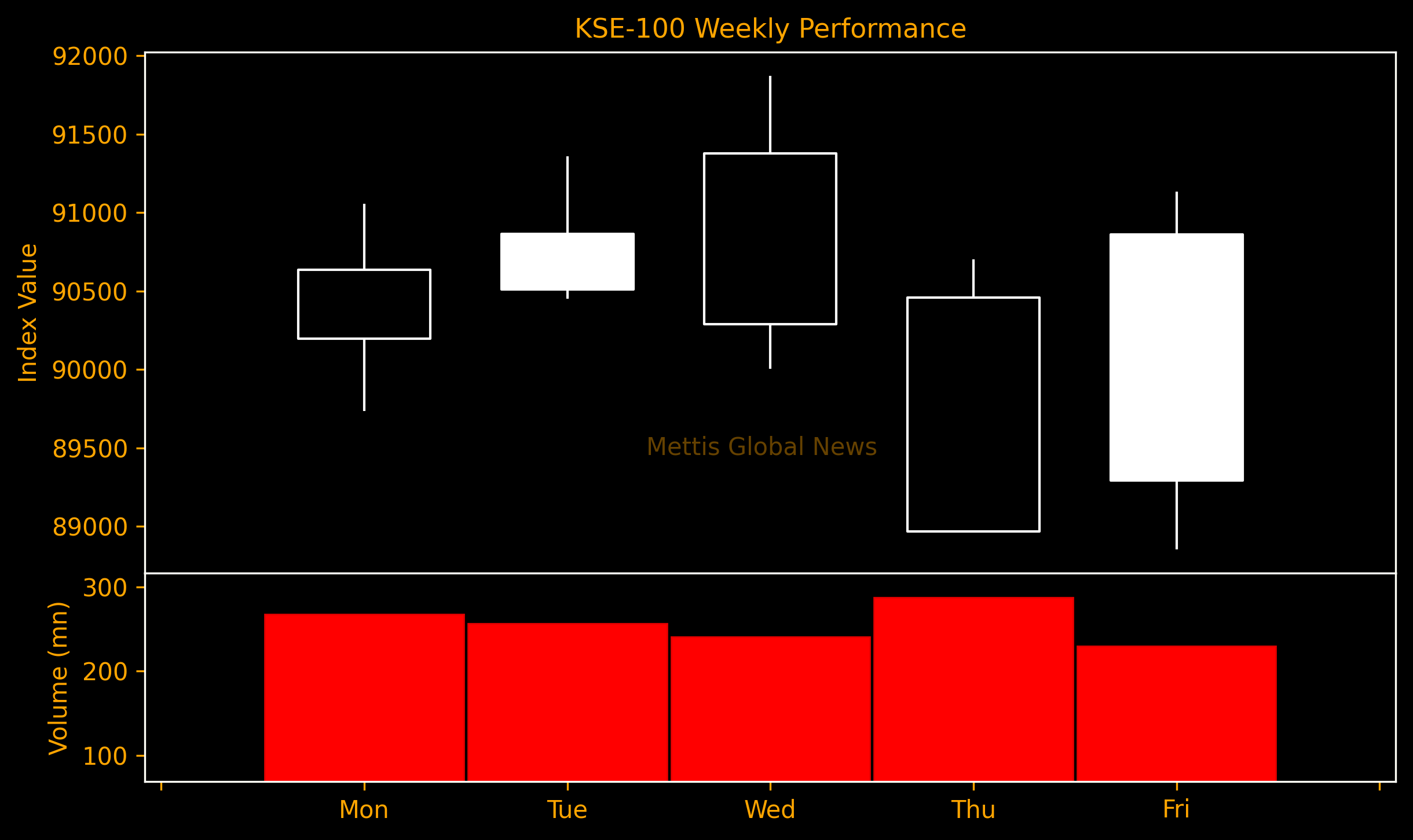

The benchmark KSE-100 Index closed at 90,860 showing an increase of 866 points or 1.0% (0.9% USD terms).

Throughout the week, KSE-100 traded in a wide range of 3,020 points, between a high of 91,873 (+1,879) and a low of 88,853 (-1,141) points.

Pakistan stock market's average traded volume fell 16.5% WoW to 559.36 million shares. Traded value also decreased 9.3% WoW to Rs26.39 billion.

Market capitalization increased by $55.02m or 0.1% to $42.16bn over the week. In PKR terms, market capitalization stood at Rs11.71 trillion.

In economic news, official report Friday showed consumer prices rose 7.17% over the prior year in October compared to a gain of 6.93% last month, and higher than the market expectations of 6.8%.

A slightly hotter inflation report did little to alter bets that SBP will continue to deliver big cuts in efforts to revive a fragile economy.

The State Bank of Pakistan is scheduled to meet on Monday to review monetary policy, wherein it is expected to cut its key interest rate further by 200 basis points.

The central bank has slashed the benchmark policy rate to 17.5% from an all time-high of 22% in three consecutive policy meetings since June, having last reduced it by 200 bps in September.

Government conducted three auctions during the week, picking up Rs820bn through T-bills at lower yields, Rs529bn through floating rate PIBs, and buying back Rs200bn via T-bill buyback auction.

SBP slashed T-bill yields across all tenors, with the decline going as much as 140bps.

Top Index Movers

Sector-wise, top positive contributors were Oil & Gas Exploration Companies (+365pts), Technology & Communication (+300pts), Pharmaceuticals (+172pts), Cement (+152pts), and Power Generation & Distribution (+110pts).

Contrary to that, negative contributions came from Fertilizer (-310pts), Leather & Tanneries (-70pts), Engineering (-48pts), Refinery (-45pts), and Inv. Banks / Inv. Cos. / Securities Cos. (-39pts).

The best-performing stocks during the week were PPL (+341pts), SYS (+331pts), UBL (+248pts), CHCC (+162pts), and GLAXO (+137pts).

Whereas, the worst-performing were EFERT (-220pts), MARI (-147pts), NBP (-113pts), ENGRO (-107pts), and MEBL (-99pts).

FIPI/LIPI

Foreign investors turned to net buyers after eight consecutive weeks of selling. They bought $2m worth of equities.

Flow-wise, Insurance companies were the dominant buyers, with a net investment of $7.1m. They allocated the majority of their capital, $6.0m, to Commercial Banks.

On the other hand, the leading sellers were Banks / Dfi, with a significant net sale of $13.1m.

Their most substantial sales activity was in Oil and Gas Exploration Companies, amounting to $3m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 133,258.61 128.05M |

0.51% 681.62 |

| ALLSHR | 83,403.58 429.27M |

0.51% 419.90 |

| KSE30 | 40,483.76 19.73M |

0.31% 124.96 |

| KMI30 | 191,292.66 24.51M |

0.30% 565.34 |

| KMIALLSHR | 55,937.17 213.61M |

0.43% 238.70 |

| BKTi | 36,600.76 7.94M |

0.99% 358.70 |

| OGTi | 28,188.18 2.62M |

-0.48% -135.23 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,765.00 | 112,170.00 111,395.00 |

-480.00 -0.43% |

| BRENT CRUDE | 70.20 | 70.42 69.91 |

0.01 0.01% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.34 | 68.57 68.04 |

-0.04 -0.06% |

| SUGAR #11 WORLD | 16.54 | 16.61 16.08 |

0.41 2.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances