Weekly Market Roundup

Abdur Rahman | September 27, 2024 at 07:26 PM GMT+05:00

September 27, 2024 (MLN): The rally in Pakistan stocks that drove them to their all-time highs hit a wall this week as market experienced the widely known 'buy the rumor, sell the news' phenomenon after the International Monetary Fund approved the much-awaited $7 billion loan package.

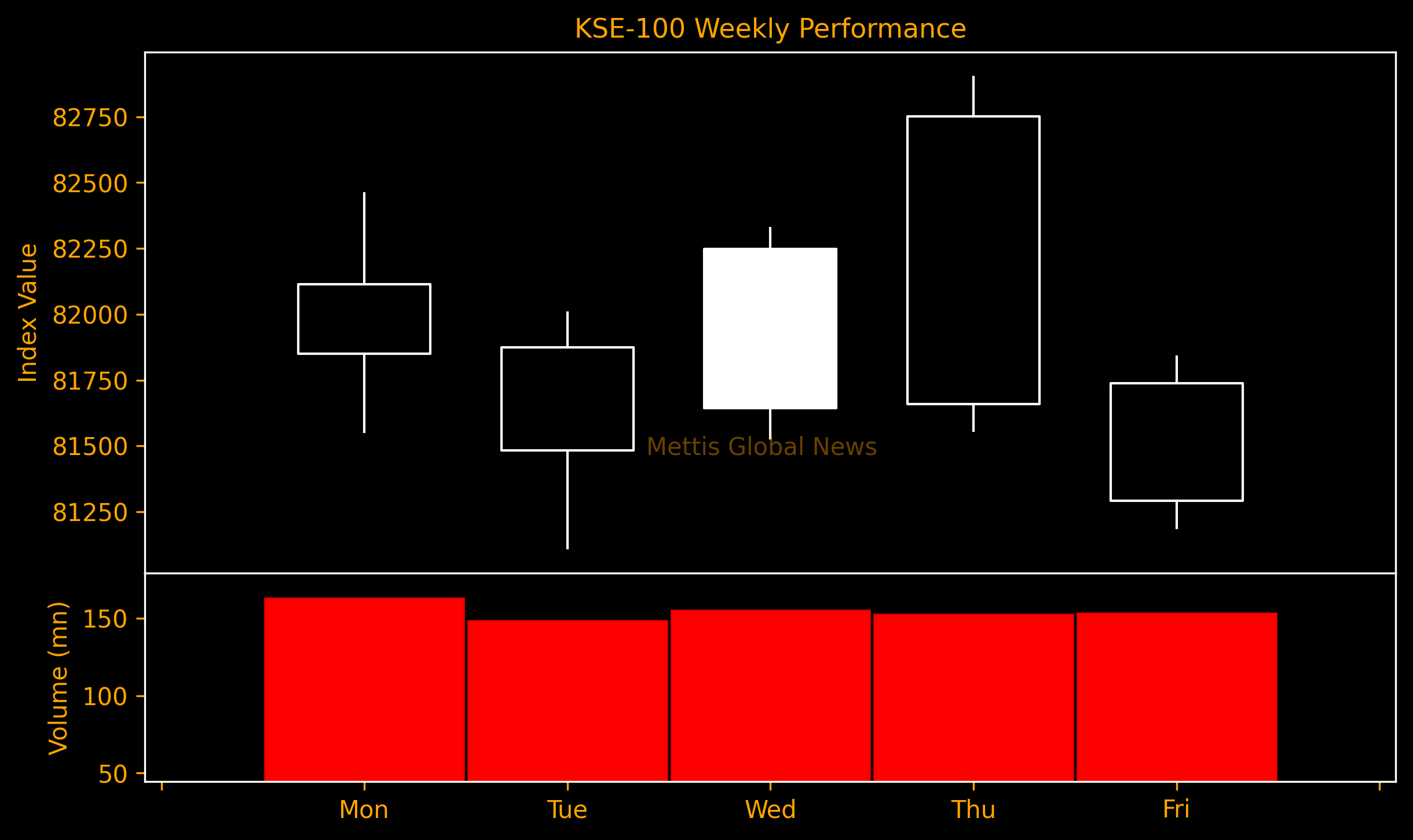

The benchmark KSE-100 Index fell 782 points or 1.0% from last week to 81,292. In USD terms, it lost 0.9%.

The Executive Board of the IMF on Wednesday approved a 37-month Extended Arrangement under the Extended Fund Facility (EFF) for Pakistan worth around $7bn. The Board’s decision allows for an immediate disbursement of about S$1bn.

Traders had piled into stocks in anticipation, which had sent the equity market to fresh records. However, the index closed in the red on both Thursday and Friday following the approval.

Throughout the week, KSE-100 traded in a range of 1,798 points, between a high of 82,906 (+831) and a low of 81,107 (-967) points.

PSX average traded volume was recorded at 391.07 million shares worth Rs16.94 billion, a decrease of 16.7% WoW in the number of shares and 8.0% WoW in traded value.

The PSX market capitalization decreased by $222.22m or 0.6% to $38.37bn over the week. In PKR terms, market capitalization stood at Rs10.65 trillion.

Top Index Movers

Sector-wise, the largest drags on the index were Power Generation & Distribution with (-800pts), Oil & Gas Exploration Companies (-368pts), Technology & Communication (-117pts), Oil & Gas Marketing Companies (-101pts), and Textile Composite (-58pts).

Contrary to that, the positive contributions came from Fertilizer (+528pts), Commercial Banks (+230pts), Leather & Tanneries (+33pts), Automobile Parts & Accessories (+29pts), and Pharmaceuticals (+19pts).

The worst-performing stocks during the week were HUBC (-609pts), MARI (-331pts), PPL (-122pts), ENGRO (-102pts), and SYS (-75pts).

Whereas, FFC, UBL, BAHL, EFERT, and FFBL added 454, 160, 119, 86, and 59 points to the index respectively.

FIPI/LIPI

Foreign investors remained net sellers for the fourth week in a row, dumping $12.44m worth of equities.

Last week, foreigners sold a significant $23.2m of Pakistani equities, their biggest selling on a net basis in almost three years.

The persistent selling is likely due to FTSE rebalancing, which demoted Pakistan from Secondary Emerging to Frontier Market in July.

Flow-wise, Mutual funds were the dominant buyers, with a net investment of $16.21m.

They allocated the majority of their capital, $7.10m, to Oil and Gas Exploration Companies, while divesting from the Power Generation and Distribution sector, amounting to $4.01m in sales.

On the other hand, the leading sellers were Foreign Corporates , with a net sale of $13.22m.

Their most substantial sales activity was in Oil and Gas Exploration Companies, amounting to $6.25m, while they acquired $2.73m of equities in the Technology and Communication.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction