Weekly Market Roundup

Abdur Rahman | September 13, 2024 at 07:24 PM GMT+05:00

September 13, 2024 (MLN): Pakistan's equities closed the week in green on optimism around a larger-than-anticipated interest rate cut and the upcoming meeting between Pakistan and the IMF on September 25 to finalize the $7 billion Extended Fund Facility (EFF) program.

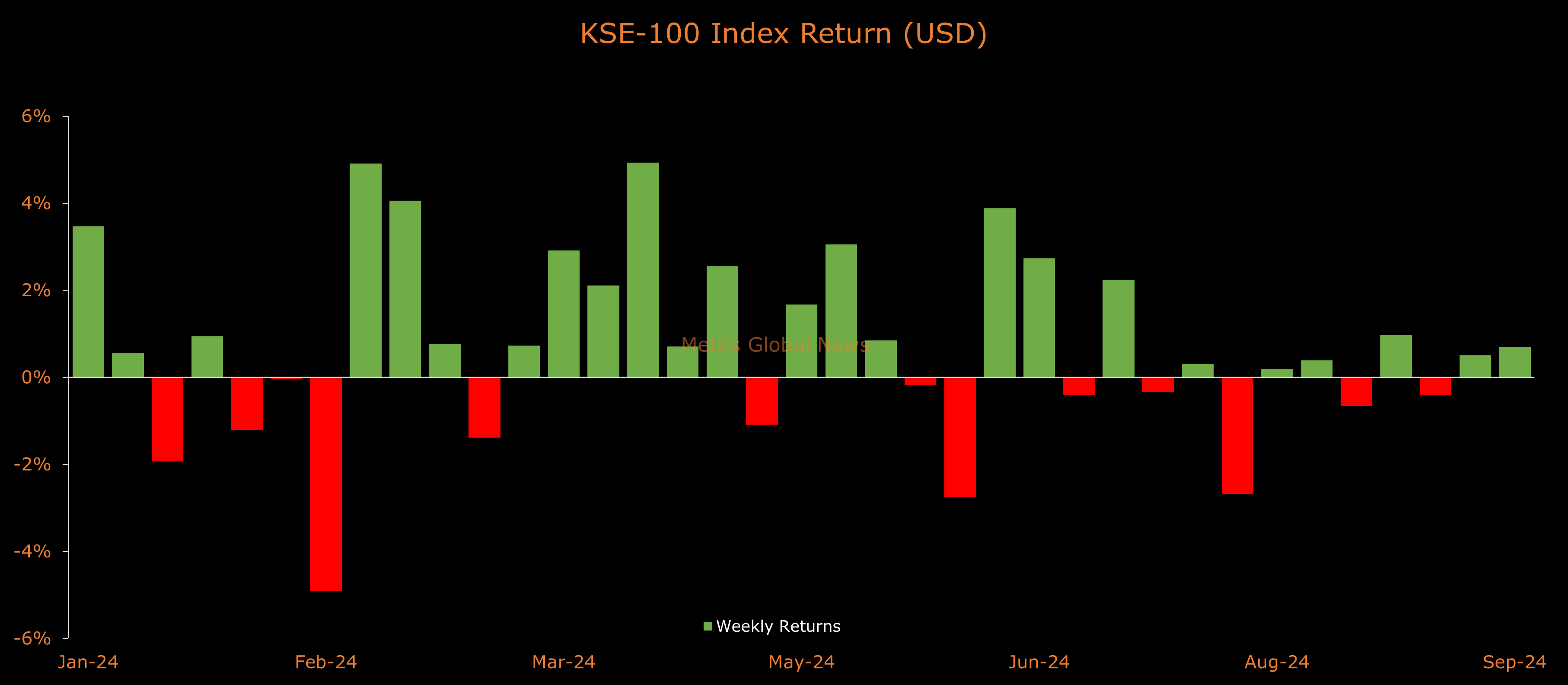

The benchmark KSE-100 Index rose 435 points or 0.6% to close the week at 79,333.

On the currency front, the Pakistani Rupee jumped 0.14% against the Dollar, the largest weekly gain in almost six months. In USD terms, the KSE-100 Index gained 0.7%.

Investor sentiment was mixed earlier in the week as uncertainty lingered over the magnitude of the central bank's rate cut in Thursday's meeting.

Moreover, there was no update on the International Monetary Fund (IMF) executive board's approval of Pakistan's $7 billion bailout package, which kept the investors on their toes.

However, a risk-on tone returned on Thursday as investors bet on an increased rate reduction. After the market close, the State Bank of Pakistan delivered a 200 basis point cut, bringing the policy rate down to 17.5%.

In economic news, Pakistan's automobile sales increased by 14.8% from a year ago to 8,699 units in August.

Meanwhile, the cash-strapped nation received $2.94 billion in remittances during August, which increased by 40.5% compared to last year.

Throughout the week, KSE-100 traded in a range of 1,471 points, between a high of 80,017 (+1,119) and a low of 78,546 (-352) points.

Pakistan stock market average traded volume was recorded at 606.74 million shares worth Rs15.24 billion, marking a decrease of 10.2% WoW in the number of shares while an increase of 4.7% WoW in traded value.

The market capitalization increased by $290.62m or 0.8% to $37.9bn over the week. In PKR terms, market capitalization stood at Rs10.54 trillion.

Top Index Movers

Sector-wise, top positive contributors were Cement (+148pts), Fertilizer (+141pts), Oil & Gas Exploration Companies (+99pts), Leather & Tanneries (+82pts), and Pharmaceuticals (+55pts).

Contrary to that, negative contributions came from Commercial Banks (-127pts), Automobile Assembler (-116pts), Power Generation & Distribution, (-79pts), Automobile Parts & Accessories (-17pts), and Refinery (-17pts).

The best-performing stocks during the week were EFERT (+135pts), OGDC (+110pts), SRVI (+82pts), LUCK (+68pts), and BAFL (+64pts).

Whereas, MTL, MEBL, MARI, HBL, and HUBC collectively took away 442 points from the index.

FIPI/LIPI

Foreign investors were net sellers during the week, dumping a significant $7.54m worth of equities.

Flow-wise, individuals were the dominant buyers, with a net investment of $7.22m.

They allocated the majority of their capital, $2.46m, to Power Generation and Distribution, while divesting from the Oil and Gas Marketing Companies sector, amounting to $0.47m in sales.

On the other hand, the leading sellers were Other Organization, with a net sale of $6.19m.

Their most substantial sales activity was in All other Sectors, amounting to $1.34m, while they acquired $0.00m of equities in the Debt Market.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves