Weekly Market Roundup

MG News | February 02, 2020 at 03:53 PM GMT+05:00

February 2, 2020 (MLN): The KSE-100 index lost nearly 1,002 points during the week, and closed at 41,630 level, i.e. lower by 2.35 percent in comparison to the previous week's closing of 42,633 points.

According to a research report by Aba Ali Habib Securities, the index took a serious hit on the back of economic concerns stemming from near-term expected hike in inflation, weak agricultural output and possible downgrade in FY20 growth rate as discussed in monetary policy briefing.

During the week, Commercial Banks snatched around 428 points from the benchmark index, followed by E&P Companies and Power Generation sector as the took away 304 points and 112 points respectively. Company wise, the scrips of MCB (-125), PPL (-108), UBL (-96), HBL (-95) AND HUBC (-95) endured the highest losses.

Likewise, the All-Share Market Index declined by $674.2 million, before settling at $50.8 billion.

Foreign investors were the net sellers during the week, with the total sale of securities being recorded at $7.9 million. Amongst these, Foreign Corporates emerged as the largest group of buyers as they sold securities worth $7.6 million.

On the contrary, local investors were the net buyers, with Individual Investors and Broker Propriety Trading making the largest sale at $9.7 million and $2.0 million respectively.

Forex Roundup:

PKR continued to benefit from inflows into government securities, gaining 8 paisa against the dollar in the outgoing week.

PKR extended it run of successive gains against the dollar to the fifth week and has regained 55 paisa during the period. Furthermore, in the previous 14 weeks, Pak Rupee has appreciated in all but one week.

10 day volatility decreased from 0.62% to 0.50%.

However, forward/Swaps for 2 month and above increased between 34 to 88 paisa.

Fixed Income:

Contrary to the cut off yield in the latest MTB auction which registered a meagre decline of 4 basis points for 3 months T-Bills, the secondary market yields for the tenor increased by 10 bps over the week, while the yields for 6 and 12 months remained relatively unchanged.

PIB yields for 3, 5 and 10 years registered a minor increase of up to 5 basis points.

With the January inflation numbers going well over projection, the upcoming PIB auction should reveal the market sentiment regarding medium term interest rates.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

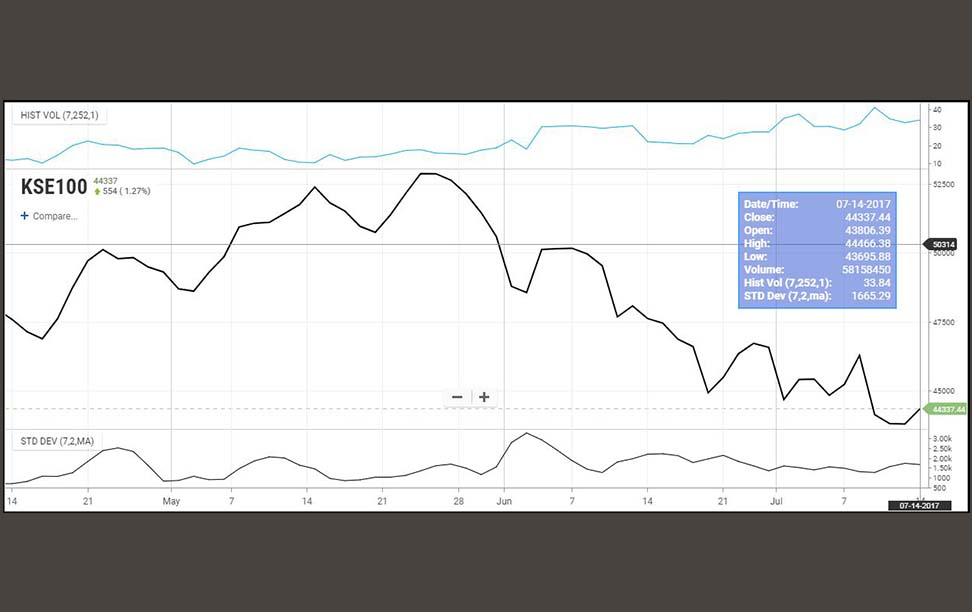

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves