Weekly Market Roundup

MG News | July 05, 2024 at 08:23 PM GMT+05:00

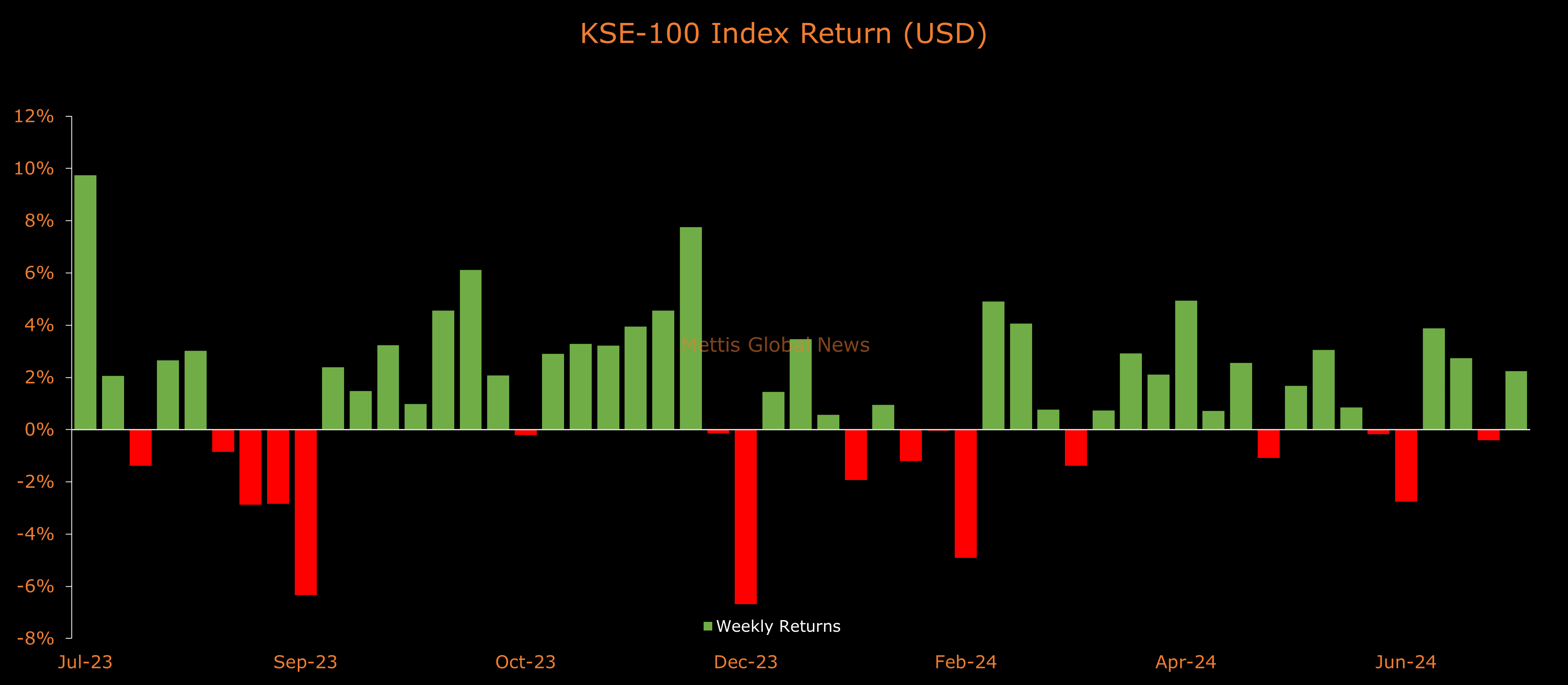

July 05, 2024 (MLN): The benchmark KSE-100 index closed this week at 80,213 showing an increase of 1,768 points or 2.3% (2.2% USD terms).

Throughout the week, KSE-100 traded in a range of 2,461 points, between a high of 80,889 (+2,444) and a low of 78,428 (-17) points.

PSX average traded volume was recorded at 440.31 million shares worth Rs18.28 billion, marking an increase of 23.8% WoW in the number of shares and 31.3% WoW in traded value.

Meanwhile, the PSX market capitalization increased by $783.9m or 2.1% to $38.06bn over the week. In PKR terms, market capitalization stood at Rs10.59 trillion.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (1,031pts), Oil & Gas Exploration Companies (175pts), Oil & Gas Marketing Companies (116pts), Inv. Banks / Inv. Cos. / Securities Cos. (106pts), and Fertilizer (98pts).

Contrary to that, negative contributions came from Automobile Parts & Accessories (39pts), Chemical (26pts), Miscellaneous, (25pts), Synthetic & Rayon (20pts), and Textile Composite (15pts).

The best-performing stocks during the week were HBL (280pts), NBP (158pts), POL (132pts), PPL (110pts), and BAHL (104pts).

Whereas, OGDC, ENGRO, THALL, IBFL, and PSEL collectively took away 170 points from the index.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $7.69m worth of equities.

Flow-wise, Banks / Dfi were the dominant buyers, with a net investment of $5.62m.

They allocated the majority of their capital, $3.49m, to Commercial Banks, while divesting from the All other Sectors sector, amounting to $1.38m in sales.

On the other hand, the leading sellers were Mutual Funds, with a net sale of $13.65m.

Their most substantial sales activity was in All other Sectors, amounting to $4.17m, while they acquired $0.37m of equities in the Debt Market.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,000.00 | 119,740.00 116,460.00 | -295.00 -0.25% |

| BRENT CRUDE | 73.52 | 73.63 71.75 | 1.01 1.39% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.37 | 70.51 68.45 | 1.16 1.68% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)