Weekly Market Roundup

By Abdur Rahman | June 22, 2024 at 02:40 AM GMT+05:00

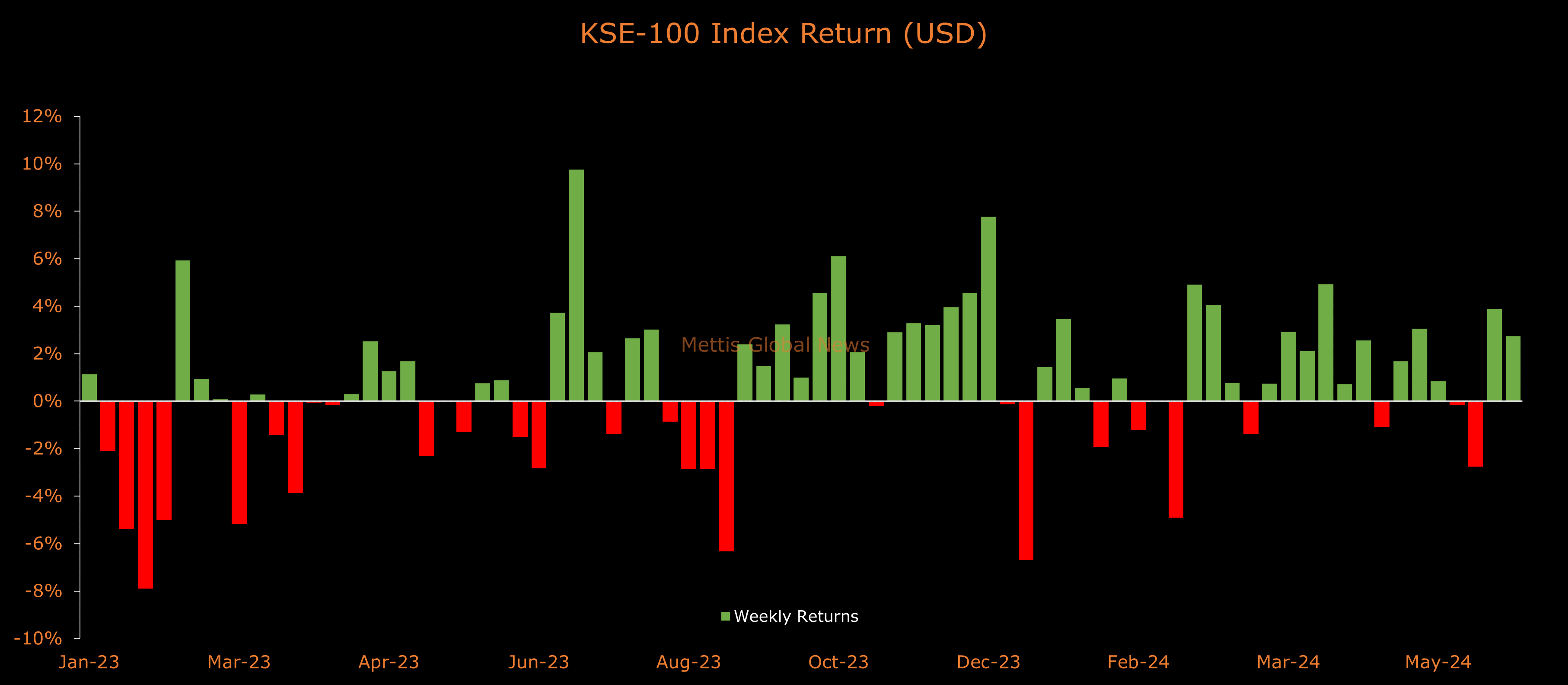

June 22, 2024 (MLN): Pakistan stocks extended their record-breaking rally in a holiday-shortened week, driven by strengthened prospects for an International Monetary Fund deal.

Despite just two trading sessions this week, Pakistan's key benchmark KSE-100 index closed at 78,810, a jump of 2,104 points or 2.7% (USD terms also).

Throughout the week, KSE-100 traded in a wide range of 3,163 points, between a high of 80,060 (+3,353) and a low of 76,897 (+190) points.

PSX average traded volume was recorded at 461.99 million shares worth Rs20.58 billion, marking an increase of 12.8% WoW in the number of shares and 21.8% WoW in traded value.

Meanwhile, the PSX market capitalization increased by $830.4m or 2.3% to $37.38bn over the week.

In PKR terms, market capitalization stood at Rs10.41 trillion, after briefly crossing an all-time high level of Rs10.55tr during Friday's intraday session.

The global ratings agency Fitch on Tuesday said that the federal budget 2024-25 strengthens prospects for an IMF deal.

Moreover, Moody's Ratings on Friday said that the budget will likely support Pakistan’s ongoing negotiations with the IMF for a new Extended Fund Facility (EFF) program.

The gains are further attributed to the central bank's decision to initiate monetary easing after a four-year period.

The State Bank of Pakistan (SBP) lowered its key policy rate by 150 basis points to 20.5% on June 10, a bigger margin than expected by market analysts.

In economic news, Pakistan posted a current account deficit of $270m in May, largely due to a significant increase in primary income deficit.

Meanwhile, the cash-strapped nation attracted $511.4m total foreign investment in May 2024.

To note, the KSE-100 has gained 37,358 points or 90.1% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 16,359 points, equivalent to 26.2%.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (1,486pts), Power Generation & Distribution (398pts), Fertilizer (156pts), Chemical (76pts), and Textile Composite (55pts).

Contrary to that, negative contributions came from Cement (89pts), Technology & Communication (67pts), Oil & Gas Marketing Companies, (41pts), Leather & Tanneries (17pts), and Insurance (12pts).

The best-performing stocks during the week were UBL (403pts), HUBC (397pts), MCB (278pts), HBL (248pts), and BAHL (193pts).

Whereas, LUCK, SYS, MARI, ENGRO, and PSO collectively took away 254 points from the index.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $0.64m worth of equities.

Flow-wise, companies were the dominant buyers, with a net investment of $7.97m.

They allocated the majority of their capital, $1.83m, to All other Sectors, while divesting from the Technology and Communication sector, amounting to $0.23m in sales.

On the other hand, the leading sellers were Banks / Dfi, with a net sale of $10.05m.

Their most substantial sales activity was in Commercial Banks, amounting to $4.25m, while they acquired $0.19m of equities in the Technology and Communication.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 133,142.13 143.32M |

0.43% 565.15 |

| ALLSHR | 83,291.81 490.35M |

0.37% 308.13 |

| KSE30 | 40,459.65 22.18M |

0.25% 100.85 |

| KMI30 | 191,102.57 28.33M |

0.20% 375.25 |

| KMIALLSHR | 55,835.94 245.18M |

0.25% 137.47 |

| BKTi | 36,589.57 8.36M |

0.96% 347.51 |

| OGTi | 28,177.90 2.79M |

-0.51% -145.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,890.00 | 112,170.00 111,395.00 |

-355.00 -0.32% |

| BRENT CRUDE | 70.09 | 70.42 69.91 |

-0.10 -0.14% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.21 | 68.57 68.04 |

-0.17 -0.25% |

| SUGAR #11 WORLD | 16.54 | 16.61 16.08 |

0.41 2.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances