Weekly Market Roundup

By Abdur Rahman | March 15, 2024 at 07:33 PM GMT+05:00

March 15, 2024 (MLN): Pakistan stock market remained under pressure throughout the week amid dampening hopes for an interest rate cut at the upcoming Monetary Policy Committee meeting.

Investors are closely monitoring the MPC’s meeting on Monday. For the first time in months, market is divided on the appropriate action for the State Bank of Pakistan.

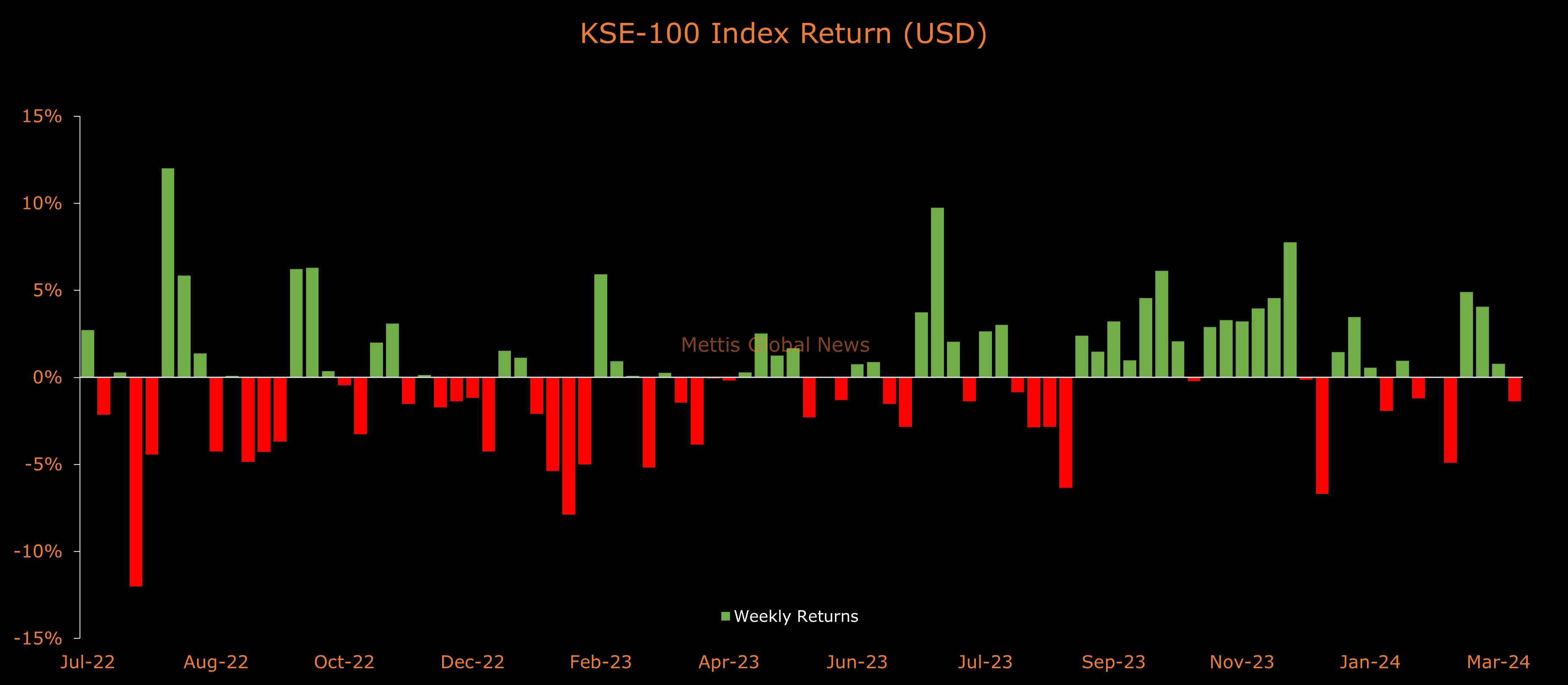

The benchmark KSE-100 index closed this week at 64,816 showing a decrease of 977 points or 1.49% WoW.

Meanwhile, the Pakistani Rupee recorded a gain of 0.11% WoW.

In USD terms, the KSE-100 index lost 1.38% this week.

Throughout the week, KSE-100 oscillated in a range of 2,263 points, between high and low of 66,119 and 63,857 levels, respectively, before settling the week at 64,816.

The market turnover saw a significant fall during the week largely due to Ramadan's shorter trading sessions.

KSE-100's average daily traded volumes arrived at 148 million shares worth Rs6.35 billion, marking a decrease of 25.08% MoM in the number of shares and 41.56% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 339m shares worth Rs11.45bn, marking a decrease of 20.21% MoM in the number of shares and 30.64% MoM in traded value.

In a major development, the International Monetary Fund (IMF) has started the second review of Stand-By Arrangement.

This would be the final review of SBA, and once Staff level agreement is reached, final tranche of $1.1bn will be disbursed, following the approval of Executive Board of IMF.

The government conducted two auctions during the week, picking up Rs56bn through PIBs at slightly lower yields, and Rs93.6bn through GIS auction.

Top Index Movers

From the sector-specific lens, Inv. Banks / Inv. Cos. / Securities Cos. was the worst performing sector, as it took away 216 points from the index.

This was followed by Oil & Gas Exploration Companies with 190, Commercial Banks with 174, Oil & Gas Marketing Companies with 103, and Power Generation & Distribution with 55 points, respectively.

Contrary to that, Automobile Parts & Accessories, Paper & Board, Chemical, Real Estate Investment Trust, and Glass & Ceramics landed in the green zone, as they added 20, 6, 4, 2, and 1 points to the index.

Scrip-wise, DAWH, OGDC, ENGRO, BAHL, and UBL were the worst-performing stocks during the week as they stripped off 203, 108, 78, 68, and 68 points from the index respectively.

Whereas, MEBL, EFERT, LUCK, THALL, and PTC added 62, 52, 47, 20, and 18 points to the index respectively.

FIPI/LIPI

Foreign investors remained net buyers during the week, acquiring $2.66m worth of equities.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $4.25m.

They allocated the majority of their capital, $1.87m, to Cement, while divesting from the Oil and Gas Exploration Companies sector, amounting to $0.77m in sales.

On the other hand, the leading sellers were Companies, with a net sale of $2.52m.

Their most substantial sales activity was in Commercial Banks, amounting to $1.35m, while they acquired $0.33m of equities in the Oil and Gas Exploration Companies.

To note, the KSE-100 has gained 23,364 points or 56.36% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 2,365 points, equivalent to 3.79%.

Last week, the index had gained 468 points or 0.72%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,135.00 | 106,200.00 105,440.00 |

385.00 0.36% |

| BRENT CRUDE | 67.18 | 67.29 67.05 |

0.07 0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.49 | 65.65 65.34 |

0.04 0.06% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI