Weekly Market Roundup

Abdur Rahman | February 10, 2024 at 03:03 PM GMT+05:00

February 10, 2024 (MLN): The benchmark KSE-100 index concluded the week at 62,944, marking a decrease of 59 points or 0.09%.

The market was shut on Monday and Thursday for public holidays.

Investors had piled into equities ahead of the February 08 elections, betting on an end to the political uncertainty.

However, on the last trading day of the week, the optimism faded as the delay in election results took a significant toll on the market.

"A stable political setup is required to negotiate and implement the IMF program, without which debt sustainability is doubtful," Abdul Kadir Hussain, head of fixed-income asset management at Arqaam Capital in Dubai told Bloomberg.

So far indications are that the political set up will be far from stable, he added.

According to Moody’s, the incoming government will need longer-term financing to meet its very large external debt obligations in the coming years.

“Even under a new IMF program, the new government will be tested on its willingness and ability to implement and sustain reforms, particularly revenue-raising measures that may be politically unpopular but required to improve macroeconomic conditions,” said Grace Lim, an analyst at Moody’s Investors Service in Singapore as reported by Bloomberg.

Meanwhile, the Pakistani Rupee recorded a marginal gain of 0.05% WoW.

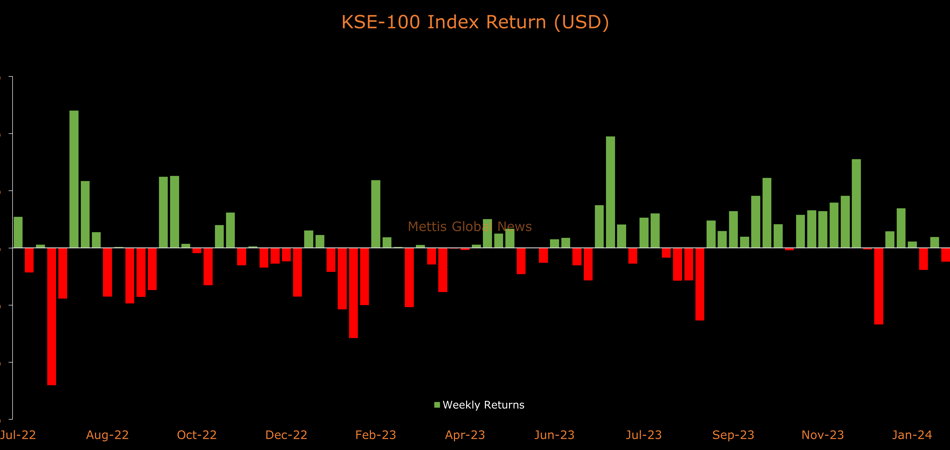

In USD terms, the KSE-100 index lost 0.05% this week.

Throughout the week, KSE-100 oscillated in a range of 2,415 points, between high and low of 64,197 and 61,782 levels, respectively, before settling the week at 62,944.

The market turnover saw a rise during the week, with an average traded volume of 172 million shares worth Rs11.17 billion, marking an increase of 4.38% MoM in the number of shares and 28.40% MoM in traded value.

Meanwhile, the overall PSX average traded volume (All-Share) was recorded at 305m shares worth Rs14.00bn, marking a decrease of 2.48% MoM in the number of shares while an increase of 21.60% MoM in traded value.

Top Index Movers

From the sector-specific lens, Fertilizer was the worst-performing sector, as it took away 76 points from the index.

This was followed by Technology & Communication, Cement, Food & Personal Care Products, and Oil & Gas Marketing Companies as they kept the index in negative territory by taking away 49, 23, 19, and 15 points, respectively.

Contrary to that, Power Generation & Distribution, Miscellaneous, Commercial Banks, Oil & Gas Exploration Companies, and Paper & Board landed in the green zone, as they added 46, 38, 25, 17, and 14 points to the index.

Scrip-wise, ENGRO, OGDC, SYS, FFC, and HBL were the worst-performing stocks during the week as they stripped off 56, 50, 41, 27, and 21 points from the index respectively.

Whereas, HUBC, PPL, PSEL, BAHL, and MARI added 53, 50, 47, 34, and 29 points to the index respectively.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $5.69m worth of equities.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $7.04m.

They allocated the majority of their capital, $5.31m, to Oil and Gas Exploration Companies, while divesting from the Technology and Communication sector, amounting to $0.43m in sales.

On the other hand, the leading sellers were Mutual Funds, with a net sale of $5.46m.

Their most substantial sales activity was in Oil and Gas Exploration Companies, amounting to $3.24m, while they acquired $0.20m of equities in the Technology and Communication.

To note, the KSE-100 has gained 21,491 points or 51.84% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 493 points, equivalent to 0.79%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,496.10 196.19M | -2.30% -3714.58 |

| ALLSHR | 94,227.01 359.74M | -1.95% -1870.28 |

| KSE30 | 48,330.20 95.67M | -2.92% -1451.54 |

| KMI30 | 224,687.33 101.59M | -2.56% -5909.78 |

| KMIALLSHR | 60,839.09 199.88M | -2.16% -1344.18 |

| BKTi | 45,489.96 23.93M | -2.22% -1033.26 |

| OGTi | 32,083.47 15.22M | -1.82% -594.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,400.00 | 71,645.00 67,860.00 | -3130.00 -4.38% |

| BRENT CRUDE | 93.32 | 94.64 83.16 | 7.91 9.26% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 129.00 123.00 | 3.55 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 91.27 | 92.61 78.24 | 10.26 12.67% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes