Weekly Market Roundup

By Abdur Rahman | January 06, 2024 at 03:08 PM GMT+05:00

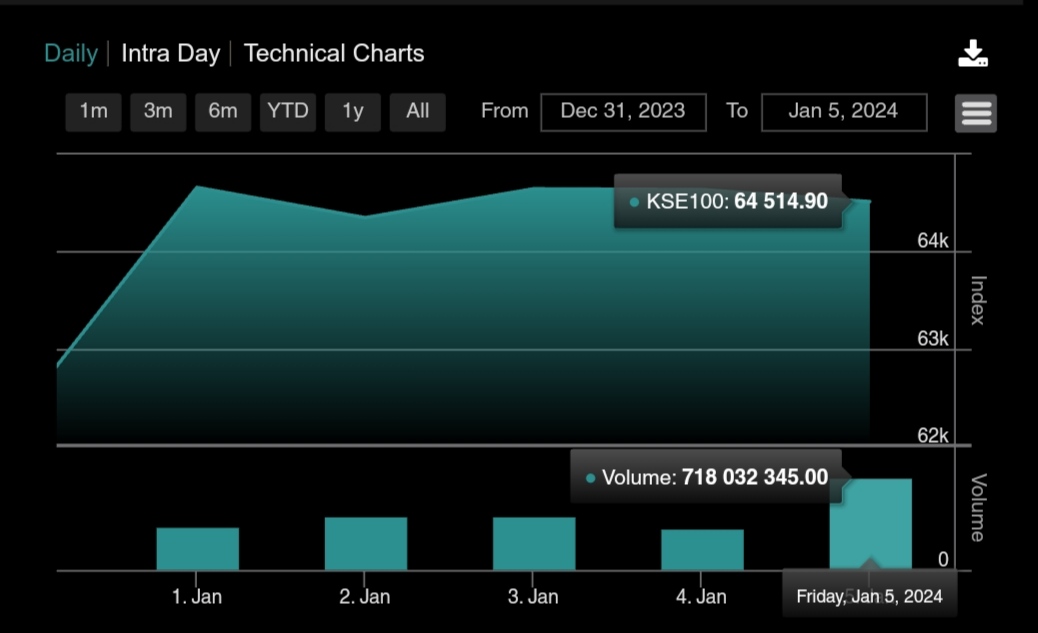

January 06, 2024 (MLN): The benchmark KSE-100 index closed the first week of 2024 at 64,515, showing an increase of 2,064 points or 3.30% WoW.

Despite the high and persistent inflation posing some headwinds, market sentiments remained positive amid low valuations and anticipation of a strong earnings season ahead.

Moreover, the central bank's foreign exchange reserves surged to their highest level since July 2023, while trade numbers released this week also showed a significant achievement by the country.

In a related development, The Organic Meat Company Limited (PSX: TOMCL) achieved a major breakthrough by successfully exporting cooked beef to China.

Furthermore, K-Electric Limited (PSX: KEL) entered into a Power Purchase Agency Agreement (PPAA) and Tariff Differential Subsidy Agreement (TDSA) with the federal government, which are expected to resolve most of the company's issues.

On the currency front, the Pakistani Rupee recorded a marginal gain of 0.16% WoW, its 8th consecutive weekly win against the US Dollar.

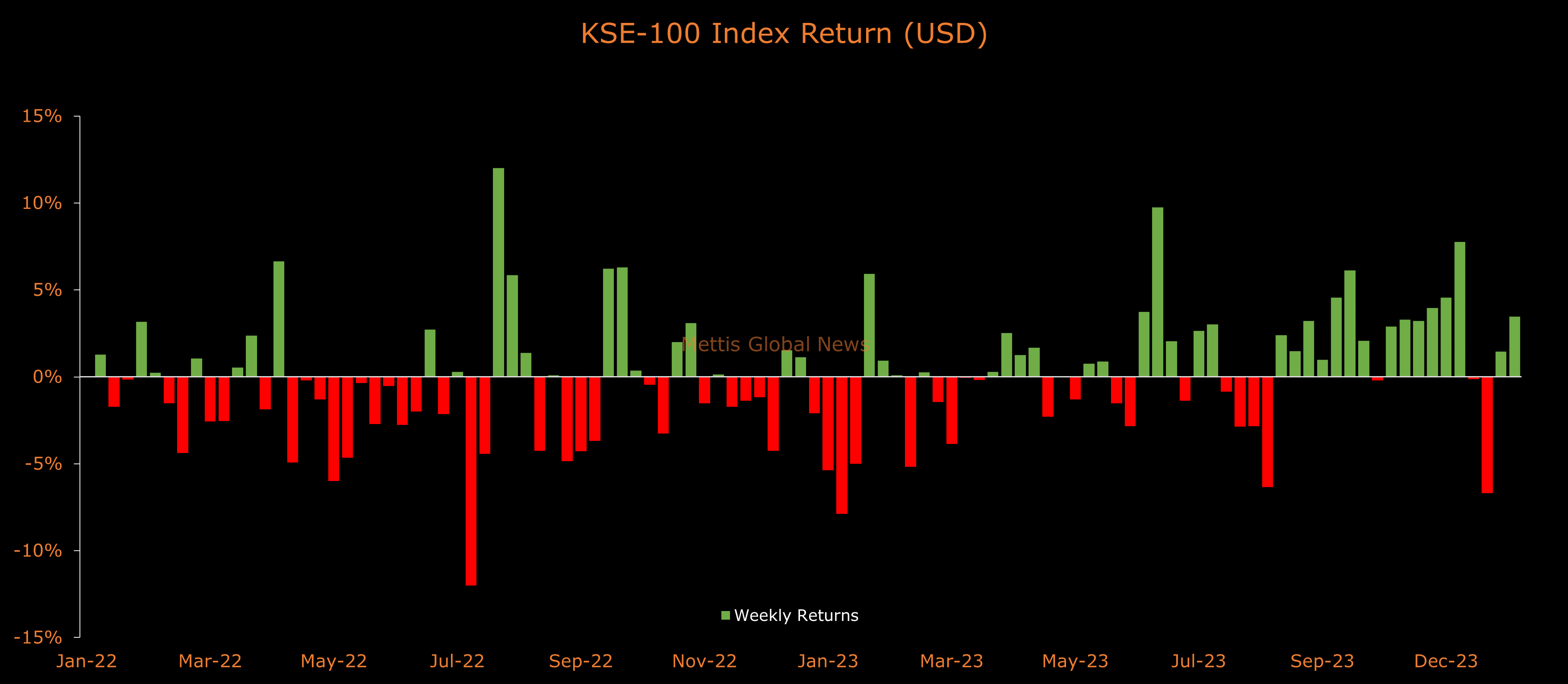

In USD terms, the KSE-100 index gained 3.47% this week.

Throughout the week, KSE-100 oscillated in a range of 2,661 points, between high and low of 65,334 and 62,673 levels, respectively, before settling the week at 64,515.

The market turnover saw a rise during the week, with an average traded volume of 444 million shares worth Rs14.69 billion, marking an increase of 16.03% MoM in the number of shares and 9.16% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 687m shares worth Rs19.59bn, marking an increase of 5.43% MoM in the number of shares while an increase of 11.41% MoM in traded value.

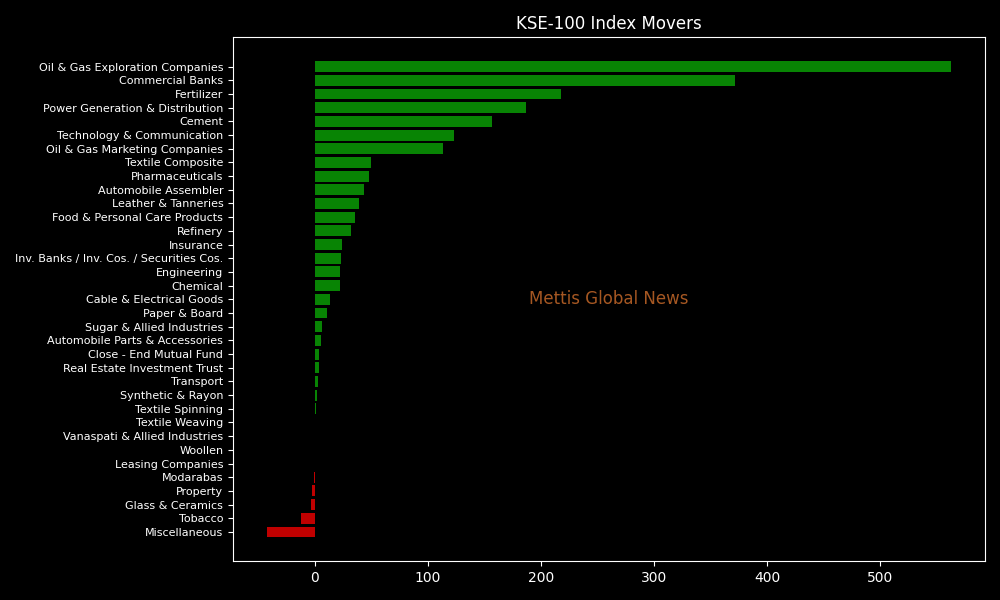

Top Index Movers

From the sector-specific lens, Oil & Gas Exploration Companies were the best-performing sector, as they added 562 points to the index.

This was followed by Commercial Banks, Fertilizer, Power Generation & Distribution, and Cement as they kept the index in positive territory by adding 371, 217, 187, and 157 points, respectively.

Contrary to that, Miscellaneous, Tobacco, Glass & Ceramics, and Property remained red, as they took away 42, 12, 4, and 2 points from the index.

Scrip-wise, PPL, OGDC, HBL, FFC, and HUBC were the best-performing stocks during the week as they added 252, 247, 117, 113, and 103 points to the index respectively.

Whereas, PSEL, PAKT, PABC, LCI, and AKBL collectively took away 65 points from the index.

FIPI/LIPI

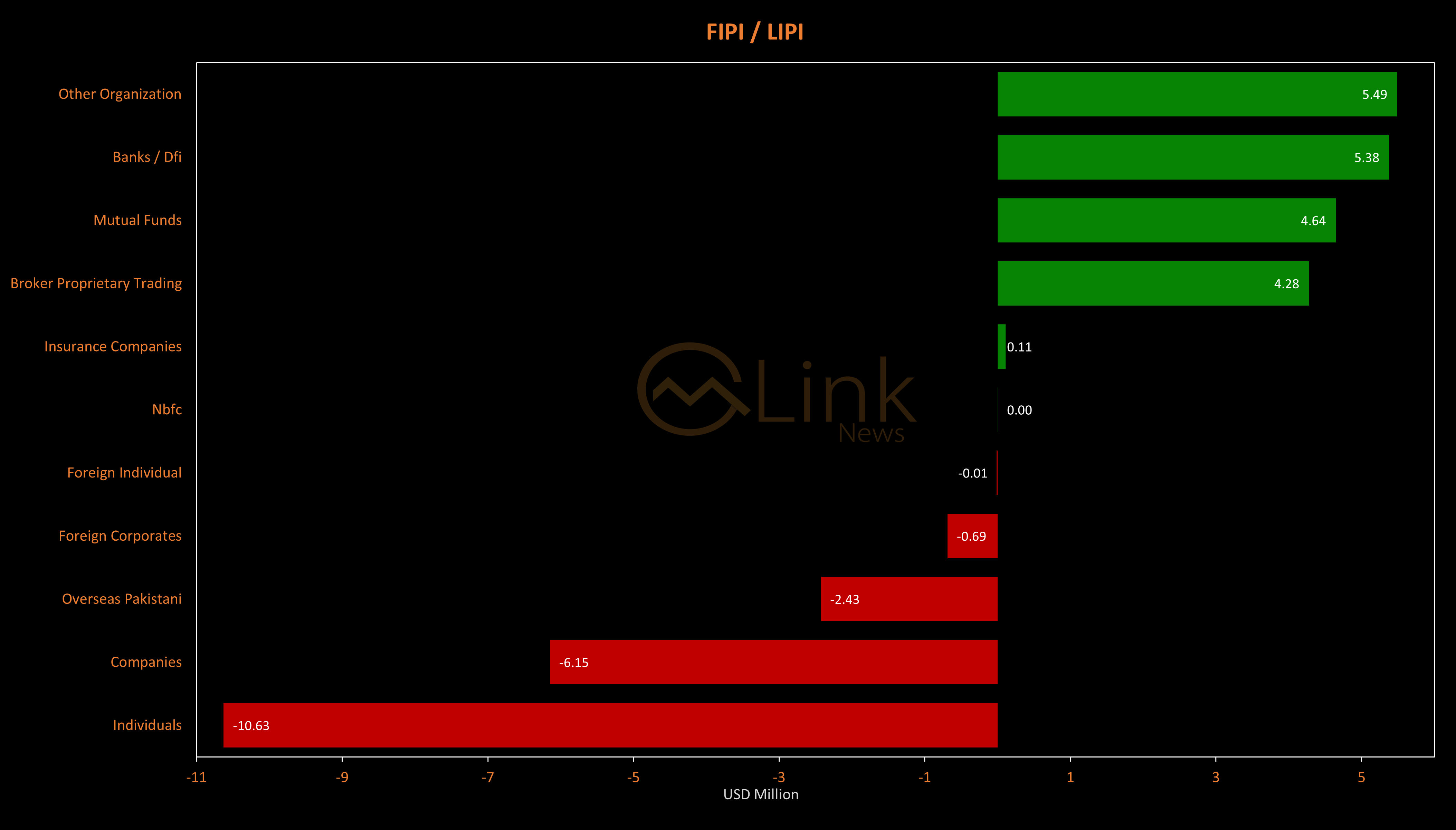

Foreign investors were net sellers during the week, offloading $3.12m worth of equities.

Flow-wise, Other Organization were the dominant buyers, with a net investment of $5.49m.

They allocated the majority of their capital, $5.40m, to Oil and Gas Exploration Companies, while divesting from the Fertilizer sector, amounting to $0.32m in sales.

On the other hand, the leading sellers were Individuals, with a net sale of $10.63m.

Their most substantial sales activity was in Commercial Banks, amounting to $2.98m, while they acquired $1.21m of equities in the Food and Personal Care Products.

To note, the local stock market has been on a bullish streak amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency amid government-backed administrative efforts, and a possible slash in the interest rates.

The KSE-100 has gained 23,062 points or 55.64% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 2,064 points, equivalent to 3.3%.

Analysts expect this trend to continue in 2024 owing to robust earnings growth, attractive valuation, and steady economic growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 133,267.33 130.26M |

0.52% 690.34 |

| ALLSHR | 83,401.71 437.58M |

0.50% 418.04 |

| KSE30 | 40,488.38 19.92M |

0.32% 129.59 |

| KMI30 | 191,302.18 24.80M |

0.30% 574.86 |

| KMIALLSHR | 55,942.23 218.17M |

0.44% 243.75 |

| BKTi | 36,619.83 7.98M |

1.04% 377.77 |

| OGTi | 28,194.07 2.63M |

-0.46% -129.34 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,715.00 | 112,170.00 111,395.00 |

-530.00 -0.47% |

| BRENT CRUDE | 70.30 | 70.42 69.91 |

0.11 0.16% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.45 | 68.57 68.04 |

0.07 0.10% |

| SUGAR #11 WORLD | 16.54 | 16.61 16.08 |

0.41 2.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances