VIS reaffirms Entity Ratings of International Industries Limited

MG News | October 23, 2024 at 10:30 AM GMT+05:00

October 23, 2024 (MLN): VIS Credit Rating Company Limited (VIS) has reaffirmed entity ratings of International Industries Limited (IIL) at ‘AA-/A-1’, according to the press release issued yesterday.

A medium to long-term rating of 'AA-' indicates high credit quality; protection factors are strong.

Risk is modest but may vary slightly from time to time because of economic conditions. A short-term rating of 'A-1' suggests a strong likelihood of timely repayment of short-term obligations with excellent liquidity factors.

Outlook on the assigned ratings remains ‘Stable’. The previous action was announced on November 13, 2023.

IIL, a key player in the steel and polymer pipes manufacturing sector, operates two facilities in Karachi and one in Sheikhupura.

The company’s subsidiaries, IIL Americas Inc. and IIL Australia Pty. Inc. facilitate market diversification, while IIL Construction Solutions (Pvt.) Ltd. offers local engineering services.

IIL is part of the Amir S. Chinoy Group, which has operated in Pakistan's industrial sector for over seven decades, with interests spanning steel, and electrical products through entities such as International Steels Limited and Pakistan Cables Limited.

Assigned ratings incorporate IIL’s group position as one of the prominent and established market player in Pakistan’s industrial sector.

The business risk profile of the steel sector remains high, due to its close ties to the construction and cement industries, making it highly sensitive to economic cycles. Profitability is constrained by the sector’s exposure to commodity prices, energy-intensive nature and intense competition limits pricing power.

Reliance on imported raw materials, vulnerable to exchange rate fluctuations, adds additional pressure to an already competitive industry.

During the year, the lacklustre performance of the construction, infrastructure and automobile sector due to prolonged import restrictions, high discount rates, high levels of inflation as well as political uncertainty prevailing in the country continued to dampen steel demand.

Assessment of financial performance reflects revenue increase for the Company on account of higher average prices, although sales volumes are reduced.

Export sales also remained dampened due to the global slowdown of developed economies. Consequently, exchange earnings were impacted relative to previous years.

Despite lower sales volumes, profitability was supported by effective working capital management, margin optimization, and significant dividends from the subsidiary.

The liquidity profile, while remaining sound, is exposed to an extended receivable cycle, which has depicted improvement year over year.

While the decline in operating profitability has impacted the coverage metrics, income from subsidiaries provided support to debt servicing.

Going forward, ratings are expected to remain sensitive to the Company's ability to sustain its financial risk profile amidst external challenges.

The group's investment in new business initiatives is anticipated to support future demand and contribute to incremental revenue streams.

However, a sustained focus on managing energy costs, and working capital requirements will remain crucial in the wake of demand challenges.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,277.19 471.37M | 1.06% 1611.47 |

| ALLSHR | 94,348.18 1,076.75M | 0.89% 835.46 |

| KSE30 | 47,063.22 194.28M | 1.21% 563.54 |

| KMI30 | 223,849.80 250.88M | 1.57% 3467.85 |

| KMIALLSHR | 63,265.69 539.59M | 0.90% 566.38 |

| BKTi | 42,116.21 179.13M | 1.12% 468.14 |

| OGTi | 31,247.50 31.17M | 1.21% 373.42 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 112,060.00 | 0.00 0.00 | 105.00 0.09% |

| BRENT CRUDE | 65.67 | 67.05 65.07 | -1.32 -1.97% |

| RICHARDS BAY COAL MONTHLY | 87.75 | 0.00 0.00 | -0.75 -0.85% |

| ROTTERDAM COAL MONTHLY | 94.80 | 95.40 94.80 | -0.70 -0.73% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.97 | 0.00 0.00 | 0.10 0.16% |

| SUGAR #11 WORLD | 15.58 | 15.74 15.51 | -0.11 -0.70% |

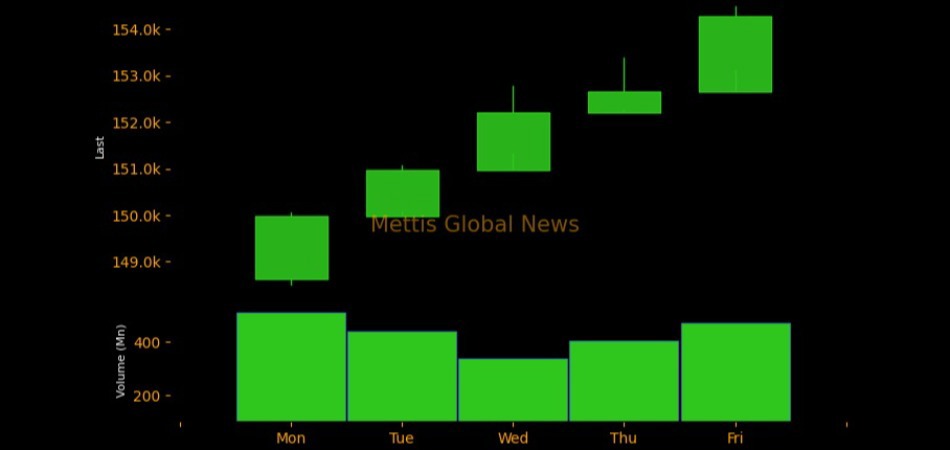

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Fixed Rate PIB Auction

Fixed Rate PIB Auction