The Big Question: Should US rethink the 2% inflation target?

MG News | August 02, 2023 at 11:37 AM GMT+05:00

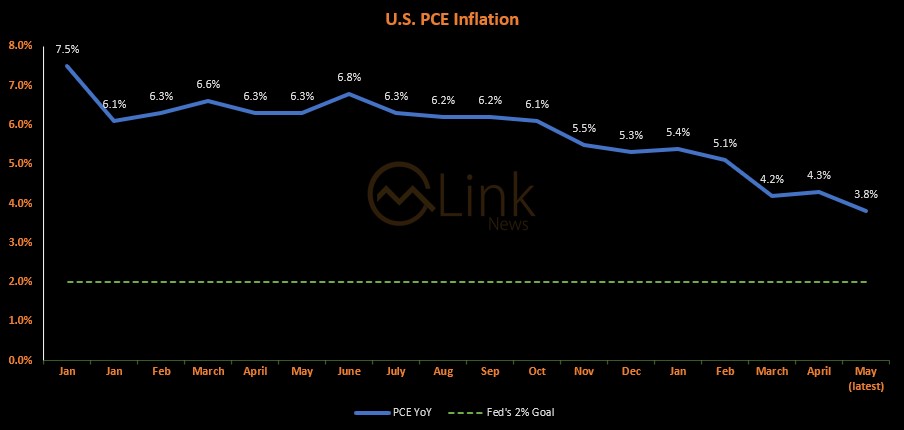

August 02, 2023 (MLN): Both the US Federal Reserve and the European Central Bank seem committed to achieving their 2% inflation target. However, some experts are questioning whether this target is truly the best option.

In a Big Question discussion, Michael J. Boskin, John Cochrane, Brigitte Granville, and Kenneth Rogoff share their perspectives on whether it's time to reconsider the 2% target.

Michael Boskin believes that 2% is likely a better target compared to higher or lower values. He argues that accurately measuring inflation is crucial, as current measures may have an upward bias, leading to a discrepancy between reported and actual inflation rates.

Additionally, he raises questions about the optimum inflation rate and whether a stable or varying inflation rate is preferable. He suggests that sticking with the 2% target appears to be the best option.

John Cochrane disagrees with the 2% target, proposing that central banks and governments should instead focus on targeting the price level.

He argues that stable expectations regarding the price level are essential for economic and monetary activities.

Embracing declining inflation and gradually moving towards a price-level target would have been more beneficial during the zero-bound era, according to Cochrane.

Brigitte Granville presents empirical evidence suggesting that the 2% inflation target is arbitrary. She contends that inflation rates of up to around 5% have little impact on real economic growth, as long as inflation is not too volatile.

She warns against persistently tightening monetary policies to reach a 2% inflation rate, as this could lead to more macroeconomic volatility and social disruptions.

Instead, she suggests that slightly higher inflation could benefit productivity and investment demand.

Kenneth Rogoff acknowledges that 2% is not a magical number but argues that there are valid reasons to consider a higher inflation target.

One convincing argument is that it allows for more flexibility in wage adjustments, benefiting relative wages within firms.

However, Rogoff dismisses the argument that the zero lower bound on nominal interest rates restricts policymakers from raising the target.

He suggests that negative nominal-interest-rate policies could be implemented effectively, rendering the need for higher inflation targets less pressing.

The debate highlights the complexity of monetary policymaking and the need for careful consideration of various factors and empirical evidence.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves