Tech Beat: PSX Index on Edge of a Bearish Reversal

By Abdur Rahman | December 24, 2023 at 08:38 PM GMT+05:00

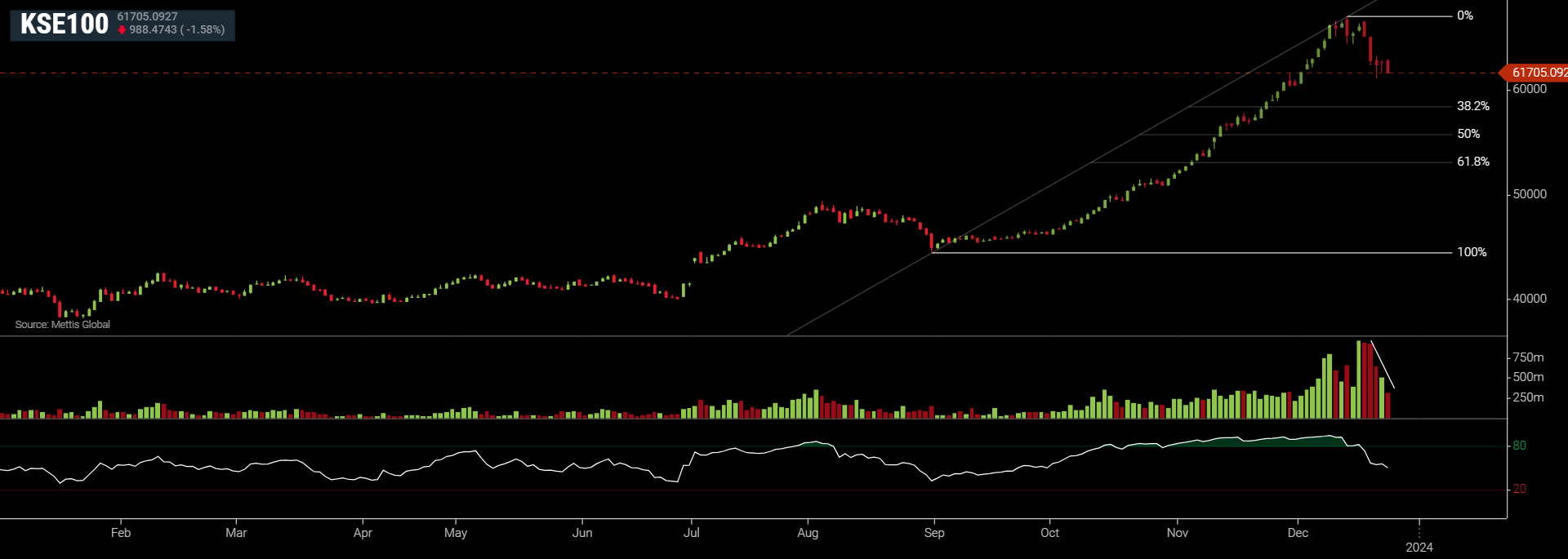

December 24, 2023 (MLN): The benchmark index of Pakistan Stock Exchange (PSX) faces a critical test this week as it approaches the candle closure for both the month and year.

From a technical perspective, a close below ~60,700 would confirm a gravestone doji formation on the monthly chart, which is a bearish reversal candlestick pattern.

In simpler terms, it indicates that despite the bulls' efforts to drive the index to new highs during the month, bears managed to pull it back toward the opening level (60,668) by month's close.

| Support Levels | ||

|---|---|---|

| 60,600 | 58,500 | 56,200 |

| S1 | S2 | S3 |

| Resistance Levels | ||

|---|---|---|

| 62,000 | 63,300 | 64,500 |

| R1 | R2 | R3 |

To note, the KSE-100 index closed this week at 61,705, down by 4,425 points or 6.69%, recording the largest weekly drop since the Covid-19 crash.

The bearish sentiment was also evident in the declining volume, which showed a possible exhaustion of demand for trend continuation.

KSE-100 DailyTime-Frame Chart

Moreover, as mentioned earlier, the market’s current state/environment can also be gauged by observing the performance of high-risk stocks (like WTL, KEL, KOSM) experiencing heightened activity.

This is because, in an optimal risk-on environment, investors are more inclined to invest in riskier assets.

Usually, these stocks start to gain momentum when the market is in the last/final stages of its rally.

In the past few weeks, we have seen increased activity in these stocks.

However, it is pertinent to note that the local stock market remains in an overall uptrend as long as it stays above the previous all-time high.

A correction is natural and healthy for sustaining long-term rallies.

The index has effectively cooled off its highly overbought oscillators, such as the RSI, which has fallen from 95.84 to 52.21.

In the upcoming week, holding 60,680 support level would be important for any relief bounces. While a break of this level would open the way for a deeper correction, possibly towards ~56,200.

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,686.66 280.01M |

0.26% 342.63 |

| ALLSHR | 81,305.25 897.01M |

0.35% 281.26 |

| KSE30 | 39,945.45 114.02M |

0.09% 37.19 |

| KMI30 | 190,698.05 148.61M |

0.61% 1163.05 |

| KMIALLSHR | 55,074.15 495.43M |

0.53% 290.50 |

| BKTi | 34,568.40 28.73M |

-1.07% -372.33 |

| OGTi | 28,739.35 22.59M |

1.57% 443.29 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 110,290.00 | 110,525.00 110,260.00 |

-125.00 -0.11% |

| BRENT CRUDE | 68.85 | 69.14 68.32 |

-0.26 -0.38% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

-0.75 -0.76% |

| ROTTERDAM COAL MONTHLY | 108.45 | 109.80 108.45 |

-0.55 -0.50% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 67.16 | 67.18 67.00 |

0.16 0.24% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI