PKR breaks losing streak, gains 25 paisa/USD

Nilam Bano | November 22, 2022 at 05:17 PM GMT+05:00

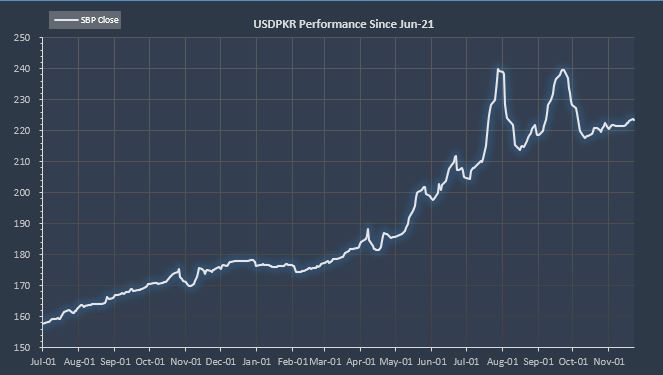

November 22, 2022 (MLN): Snapping its 6-day losing streak, the Pakistani rupee (PKR) has gained some of its ground back by 25 paisa against the US dollar in today's interbank session as the currency settled the trade at PKR 223.42 per USD, compared to the previous closing of PKR 223.66 per USD.

During the session, the rupee traded in a band of one rupee per USD showing an intraday high bid of 224 and low offer of 223.45 while in the open market, PKR was traded at 228.5/231 per USD.

After a long spell of depreciation, the local unit took a breather today as no big payments were made by SBP. However, this breather will be short-lived due to upcoming dollar payments on imports.

However, this cash-strapped economy like Pakistan should not follow the mechanism of free float exchange due to the presence of speculative elements in the market, Amin Yosuf, CEO AKY Securities told Mettis Global.

Thus, the difference between open market rates and interbank rates has been increasing continuously, he added.

Speaking about Exchange Companies (ECs), he was of the view that currencies should only be dealt with by banks while ECs should be available at airports and shopping malls.

In FYTD, PKR lost 18.56 rupees or 8.31%, while it plummeted by 46.9 rupees or 20.99% against the USD in CYTD, as per data compiled by Mettis Global.

Alternatively, the currency lost 16 paisa to the Pound Sterling as the day's closing quote stood at PKR 264.66 per GBP, while the previous session closed at PKR 264.49 per GBP.

On the other hand, PKR's value strengthened by 28 paisa against EUR which closed at PKR 229.31 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 14.90%/15.10%, whereas the 1-week rate was 15.05%/15.15%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|