SAZEW likely to hit Rs1,613 per share by end of FY25

MG News | July 08, 2024 at 10:49 AM GMT+05:00

July 08, 2024 (MLN): Sazgar Engineering Works Limited (PSX: SAZEW), one of the best-performing stocks of the Pakistan Stock Exchange (PSX) in FY24, is poised for substantial growth, with its share price expected to reach Rs1,613 by the end of June 2025, as per a report by Topline Securities.

The brokerage house has used DCF-based FCFE methodology to arrive at the target price that offers a total return of 98% for the stock.

SAZEW has demonstrated exceptional performance in terms of securing gross margins, surpassing its industry peers by a significant margin.

The company posted gross margins of 29% in Q3 FY24 compared to the range of 8.4%-14.7% for INDUS and HCAR, the listed players in the same quarter.

SAZEW is able to secure high gross margins as it operates completely in the SUV segment, while, Lucky Motors Corp (LMC) operates multiple categories, Hatchback (Picanto), compact SUV (Stonic) and SUV (Sportage).

As per the management of SAZEW, their customers are less sensitive to changes in price range since they operate solely in SUVs.

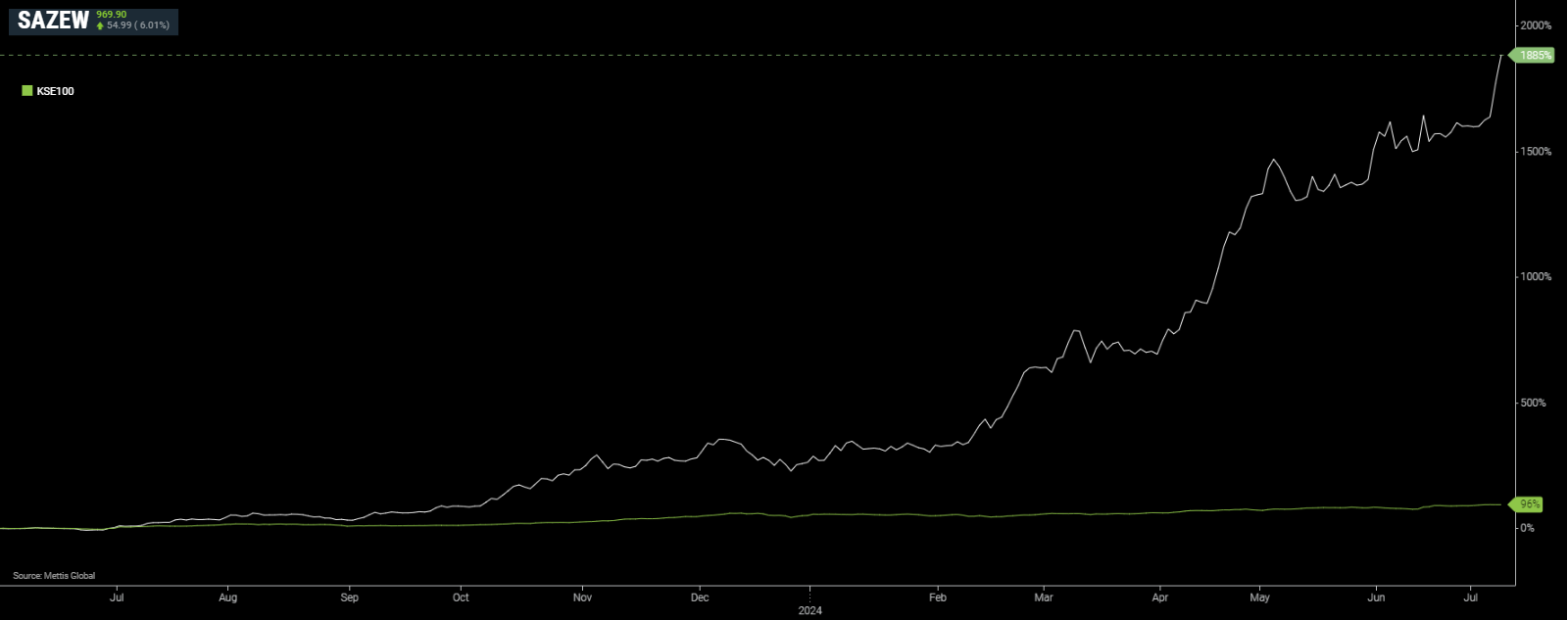

SAZEW vs KSE-100

Topline Securities has used a Risk-free rate of 14.1% (10-year PIB), a risk premium of 6%, and a beta of 1.36 for computations.

The higher beta (actual beta of last 1 year) is used to reflect a risk premium for this company given its new operations in 4-wheelers.

Higher beta allocation in the DCF valuation reflects that risk premium, and target price of Rs1,613, the brokerage house arrives at a PE of 5.11x for FY26 earnings, suggesting a premium of 11% from the market (lower than the market premium of 40% assigned to the auto sector in general).

As a result, it reached the cost of equity of 22.3% (required return). Meanwhile, the terminal growth rate used is of 3%

Historically, the auto sector (HCAR/INDU) has traded at a forward PE of 9.82x, 40% higher than the forward market average PE of 7x.

“Our target forward market PE for Jun 2025 is 4.6x, with 40% premium, auto sector fair multiple reaches to 6.45x,” the report reads.

This suggests the June 2025 target price of Rs2,038 for SAZEW using FY26 EPS of Rs316, translating into an upside of 140%.

The report further highlights key risks to these projections which include; lower-than-expected auto sales, the launch of similar category models by other players, currency fluctuation and change in regulatory duty structure.

Furthermore, sponsors and management have a relatively newer experience in managing the 4-wheelers segment and their restricted approach to addressing analyst/investor queries except for analyst briefing may delay the efficient price discovery of the company.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account