Roshan Packages takes bull by horns with vertical integration

By Nilam Bano | November 28, 2024 at 01:02 PM GMT+05:00

November 28, 2024 (MLN): Roshan Packages Limited (PSX: RPL) is set to strengthen its market position through vertical integration with its subsidiary, Roshan Sun Tao Paper Mill Pvt Ltd (RSTPL) which will produce 100,000 tons of brown paper annually for corrugated packaging.

It will help the company meet internal demand and take steps toward entering the export market.

At present, the mill is under development, will produce 100,000 tons of brown paper annually for corrugated packaging.

The aforementioned information was shared by the company’s management during its corporate briefing session held yesterday.

The management further informed that due to its location as it is located in the Special Economic Zone (SEZ), the mill will benefit from a 10-year tax exemption and lower import duties on plant and machinery.

In response to a query to market penetration, the management responded that along with big brands like Unilever, Nestle, Coca-Cola, Dalda, Sunridge, Lu, Peak Freans, Abbott, Haier, Pepsi, and Imtiaz, they are also focusing on ecommerce businesses including Daraz and SMEs.

The house was also informed that the raw material prices are stable and expected to reduce further due to decreasing demand.

Since the FY24 remained a bit rough for the company in terms of recycling paper, the company initiated backward integration to recycle paper in-house through recycle its corrugated boxes.

In its flexible packaging segment, all materials are currently imported. Meanwhile, on the paper side, the company uses a mix of imported pulp wood and recycled materials.

The total power consumption for corrugated and flexible packaging is 2.0 MW and 1.5 MW, respectively, the management said.

On a broader spectrum, the management believed that granting industry status to packaging companies could significantly address the issue of the undocumented economy.

This strategic move would create a level playing field for companies and government policies applicable to industries would extend to this sector.

Such recognition would not only facilitate exports but also attract investments into the industry, fostering growth and development.

With regards to finances, the management informed that sustained sales by retaining volume from key accounts through implementing better pricing strategies iimproved lliquidity.

The net cash generated from operations of Rs1,476 million in 2024 as against Rs 810 million last year.

Going forward, the management is optimistic that declining interest rates will reduce financing costs and create expansion opportunities.

Additionally, the anticipated stabilization of inflation rates is expected to provide a significant boost to the packaging sector.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

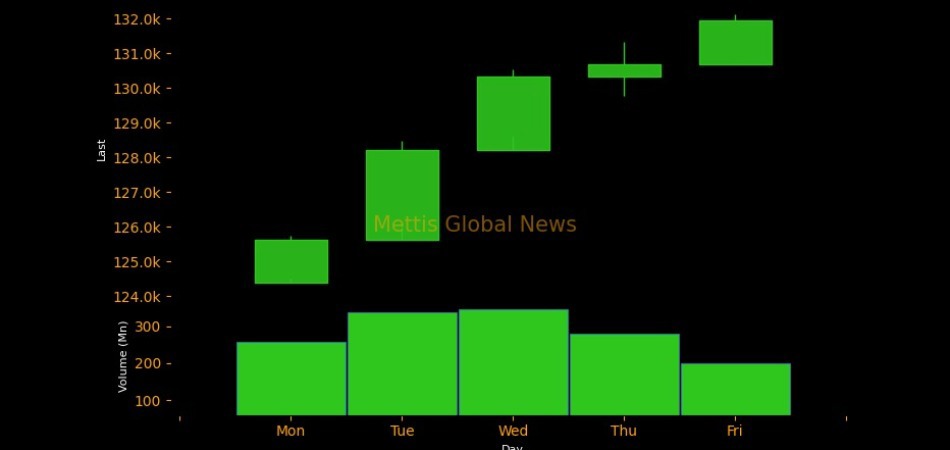

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI