Refinery sector defy economic slowdown with strong profit growth

Abdur Rahman | May 11, 2024 at 05:30 PM GMT+05:00

May 10, 2024 (MLN): Pakistan’s refinery industry recorded notable profitability growth in the first quarter of 2024 despite an overall economic slowdown.

The KSE-100 listed Refinery sector saw a 26.6% YoY surge in net profit during the quarter, clocking in at Rs3.23 billion compared to a profit of Rs2.55bn in the same period last year (SPLY).

The refinery sector includes; Attock Refinery Limited (PSX: ATRL), Cnergyico PK Limited (PSX: CNERGY), and National Refinery Limited (PSX: NRL).

The profitability growth was largely led by CNERGY, which rebounded during the quarter with a profit of Rs1.2bn compared to a loss of Rs5.1bn in the same quarter last year.

Meanwhile, ATRL, the sector’s largest player, operated at a lower capacity during the quarter mainly due to implementation of an integrated refinery turnaround during February and March 2024.

The last integrated refinery turnaround by the company was carried out in the year 2019.

Accordingly, ATRL’s profits fell 40.3% YoY in the first three months of 2024.

Similarly, escalating operating costs, particularly driven by higher utility tariffs and increased finance costs, forced the NRL's earnings to remain negative in Q1 2024, with a loss that rose by over 5 times compared to the previous year.

Pakistan refiners warn $6bn upgrades at risk due to fuel price deregulation plan

As per the results compiled by Mettis Global of the income statements of the Refinery sector, sales revenue declined by 1.0% YoY to Rs215.9bn as compared to Rs218.07bn in SPLY.

As per the CNERGY’s transmission report, refineries are facing a massive challenge in the form of unchecked smuggled petroleum product.

These concerns were also echoed by ATRL, stating that it is facing serious challenges in disposal of High-Speed Diesel primarily due to availability of smuggled product, resulting in low uptake by Oil Marketing Companies.

The free flow of smuggled product all over the country poses an existential risk to refineries as they continuously face very low product upliftment issues.

In addition, the change of weather conditions and overall economic slowdown has affected the country’s oil consumption in current period as well.

On a year to-date basis, the overall oil consumption has been reduced by 5% from previous quarter.

Meanwhile, the sale of High Speed Diesel (HSD) reduced by 17% in current quarter thus causing massive operational challenges for refineries to continue their production smoothly.

During the quarter, the cost of sales rose by 4.1% YoY, which hurt the gross profit significantly by 55.7% YoY to Rs8.22bn in Q1 2024.

The gross margins worsened to 3.81% as compared to 8.51% in SPLY.

During the period under review, other income rose 85.2% YoY to stand at Rs4.88bn in Q1 2024 as compared to Rs2.63bn in SPLY.

The sector’s finance cost fell 58.0% YoY and stood at Rs4.84bn as compared to Rs11.53bn in SPLY.

On the tax front, the sector paid a lower tax worth Rs2.16bn against the Rs4.15bn paid in the corresponding period of last year, depicting a fall of 48.0% YoY.

| Unconsolidated (un-audited) Financial Results for quarter ended March 31, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Mar-24 | Mar-23 | YoY % Change | |

| Net Sales / Revenue | 215,903,768 | 218,072,471 | -1.0% |

| Cost of sales | (207,680,065) | (199,519,020) | 4.1% |

| Gross Profit/ (loss) | 8,223,703 | 18,553,451 | -55.7% |

| Selling And Distribution Expenses | (275,814) | (558,058) | -50.6% |

| Administrative Expenses | (1,034,154) | (865,225) | 19.5% |

| Other income | 4,878,212 | 2,633,492 | 85.2% |

| Other operating expenses | (1,397,035) | (1,462,155) | -4.5% |

| Profit/ (loss) Before Interest And Tax | 10,394,912 | 18,301,505 | -43.2% |

| Finance cost | (4,839,125) | (11,533,630) | -58.0% |

| Others | (159,542) | (60,771) | 162.5% |

| Profit/ (loss) before taxation | 5,396,245 | 6,707,104 | -19.5% |

| Taxation | (2,161,357) | (4,152,340) | -47.9% |

| Profit/ (loss) After Tax | 3,234,888 | 2,554,764 | 26.6% |

Outlook

The country’s economy and overall business climate are anticipated to remain challenging, characterized by escalating costs of operations, high inflation, and unstable refining margins.

Moreover, the policy rate set by the central bank stands at a record 22%.

Such elevated financing rates pose sustainability challenges for any business over the long term.

The government has given due consideration to refineries’ concerns relating to brownfield refining policy 2023 and after due deliberations, it announced the amended ‘Pakistan Oil Refining Policy for upgrade of Brownfield Refineries 2023’.

However, due to delays, the upgrade agreements could not be signed within the stipulated time frame.

Once the agreements are signed, it is expected that the new policy would not only provide reasonable support for the upgrade of sector’s fuel refinery but would also help in sustainability of operations.

Cnergyico to invest over $1bn in Euro V refinery upgrade

To note, the government had approved the Pakistan Refinery Policy 2023 for existing brownfield refineries in August 2023.

The policy offers fiscal incentives for the upgrade of existing refineries, subject to certain terms and conditions.

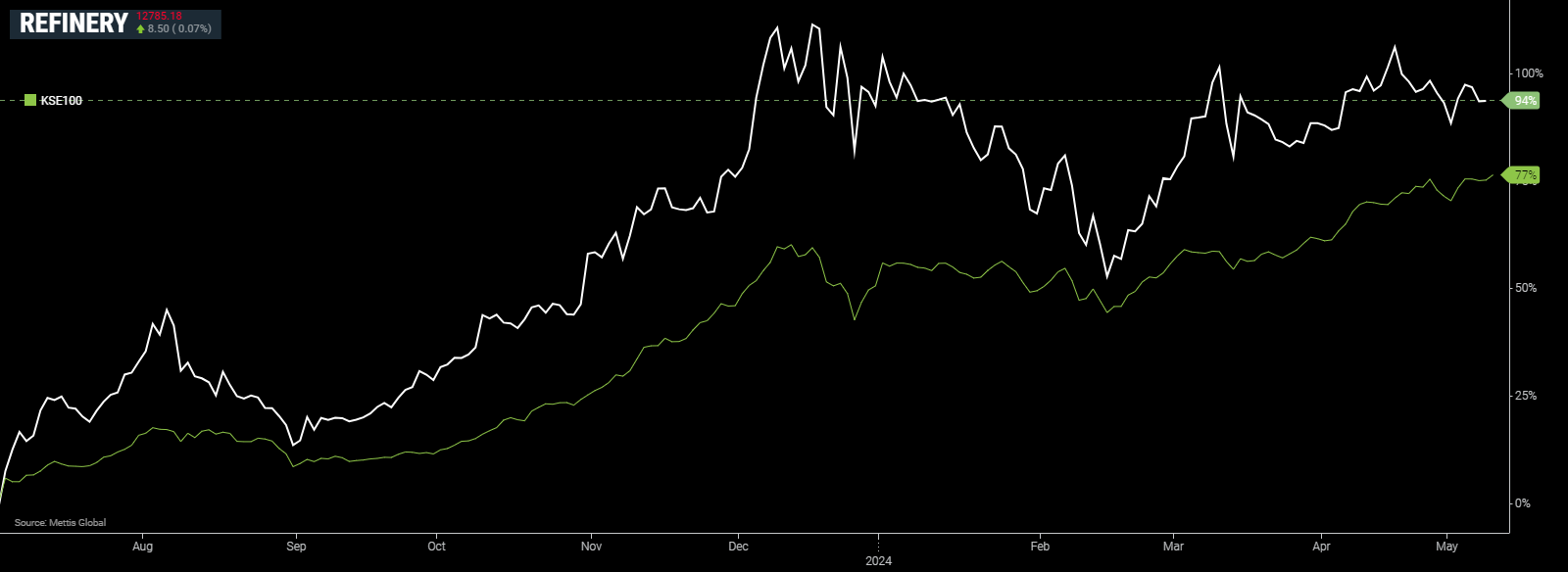

Refinery Sector vs. KSE100 FYTD Performance

Note: Sector in chart includes all share companies

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account