PSX roars into 2026 with record 6-day gain

MG News | January 07, 2026 at 12:26 PM GMT+05:00

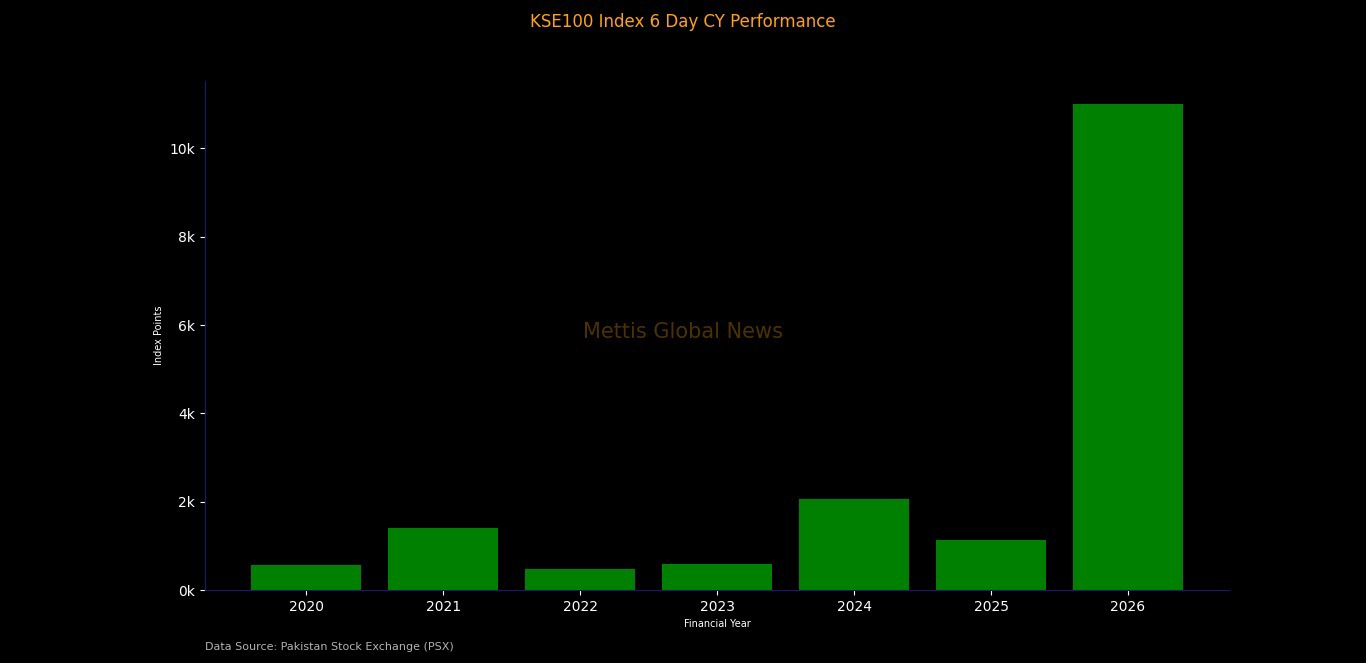

January 07, 2026 (MLN): Pakistan’s equity market has staged an exceptional rally,

with the benchmark KSE-100 Index recording a historic 6-day calendar year (CY)

gain of around 11,000 points in 2026.

This surge marked one of the strongest short-term

performances in the history of the Pakistan Stock Exchange (PSX).

Investor sentiment remains upbeat on expectations of further

monetary easing, backed by an improving external account, ongoing reform

momentum, and political stability.

The rally far exceeds gains recorded in prior years, emphasized

a sharp shift in market confidence and strong buying interest across key

sectors.

A comparison with past years shows that the index added

561.15 points in 2020, followed by a stronger rise of 1,398.04 points in 2021,

before retreating to gains of 486.23 points in 2022 and 587.07 points in 2023

amid heightened macroeconomic uncertainty.

Momentum improved notably in 2024, when the KSE-100 Index

advanced by 2,063.86 points over a 6-day CY period, while 2025 saw a

still-respectable increase of 1,128.22 points, setting the stage for the

unprecedented rally witnessed in 2026.

|

Fiscal Year (FY) |

1st Half Year (1HY) |

2nd Half Year (2HY) |

|

2013 |

22.49% |

24.25% |

|

2014 |

20.26% |

17.38% |

|

2015 |

8.36% |

7.06% |

|

2016 |

-4.60% |

15.14% |

|

2017 |

26.53% |

-2.60% |

|

2018 |

-13.09% |

3.56% |

|

2019 |

-11.56% |

-8.54% |

|

2020 |

20.16% |

-15.50% |

|

2021 |

27.11% |

8.23% |

|

2022 |

-5.83% |

-6.85% |

|

2023 |

-2.70% |

2.55% |

|

2024 |

50.66% |

25.61% |

|

2025 |

46.76% |

9.12% |

|

2026 |

38.55% |

?? |

Market participants attribute the sharp upswing in 2026 to

improving macroeconomic indicators, easing inflation expectations, growing

optimism over potential monetary easing, and sustained participation from both

local and foreign institutional investors.

Attractive equity valuations and renewed confidence in

economic reforms have further supported the bullish trend as continued growth

across key sectors and a 6% increase in OMC sales for December has surged the

market momentum.

Historically, the Pakistan Stock Exchange has tended to slow

in the second half of the fiscal year, with several years showing weaker or

negative 2HY performance after a stronger first half.

This pattern was evident across much of FY13–FY23, showing

recurring macroeconomic and political challenges that dampened momentum later

in the year.

In contrast, recent years suggest a clear shift. FY24 and

FY25 both delivered strong first-half gains and remained positive in the second

half, while FY26 has already posted a solid 38.55% return in 1HY.

If recent trends persist, the second half of FY26 may also

remain positive.

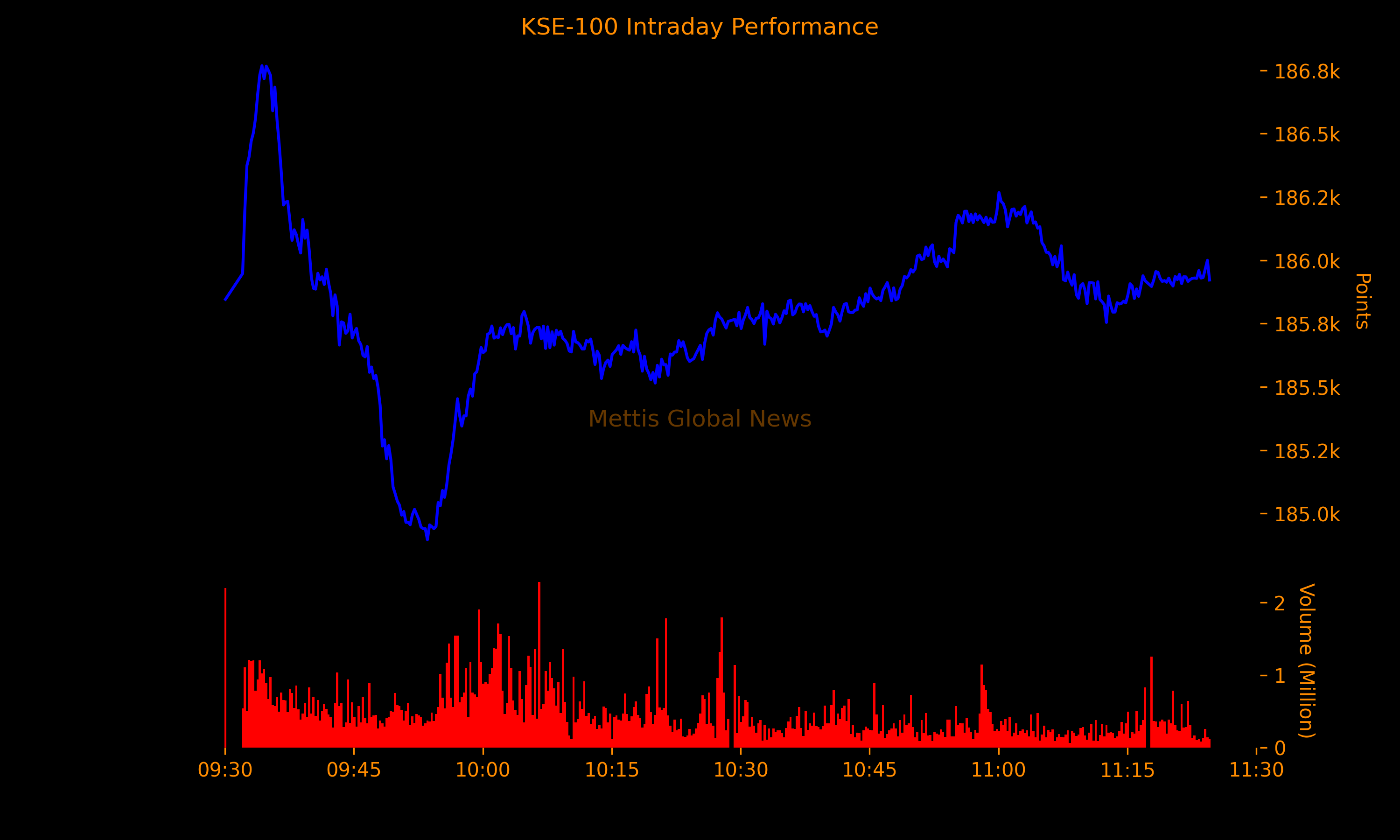

In the ongoing trading session, the benchmark KSE-100 Index

was trading at 185,956.24, up by 894.14 points or 0.48%.

A wide intraday range of 1,871.36 points, touching a high of

186,768.06, up 1,705.96 points.

While the day’s low was recorded at 184,896.70, down 165.40

points.

Total volumes on the KSE-100 Index stands at 216.71 million

shares.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 186,777.89 126.67M | 0.14% 259.17 |

| ALLSHR | 111,308.69 373.09M | 0.17% 190.03 |

| KSE30 | 57,526.23 59.89M | 0.09% 49.14 |

| KMI30 | 264,282.41 62.18M | 0.18% 486.87 |

| KMIALLSHR | 71,546.22 138.64M | 0.27% 194.81 |

| BKTi | 54,421.62 10.96M | -0.45% -243.50 |

| OGTi | 36,519.22 4.92M | 0.54% 195.36 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,320.00 | 91,840.00 90,730.00 | 85.00 0.09% |

| BRENT CRUDE | 60.29 | 60.44 60.13 | 0.33 0.55% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -0.45 -0.52% |

| ROTTERDAM COAL MONTHLY | 98.90 | 99.40 97.85 | 0.25 0.25% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.29 | 56.46 56.14 | 0.30 0.54% |

| SUGAR #11 WORLD | 14.97 | 15.04 14.69 | 0.21 1.42% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes