Red Sea shipping woes further support oil prices after 3% weekly rise

.jpg?width=950&height=450&format=Webp)

MG News | December 26, 2023 at 10:15 AM GMT+05:00

December 26, 2023 (MLN): Oil prices steadied on Monday after recording the largest weekly climb in more than two months, with shipping disruptions in the Red Sea in focus after attacks against vessels in the vital waterway.

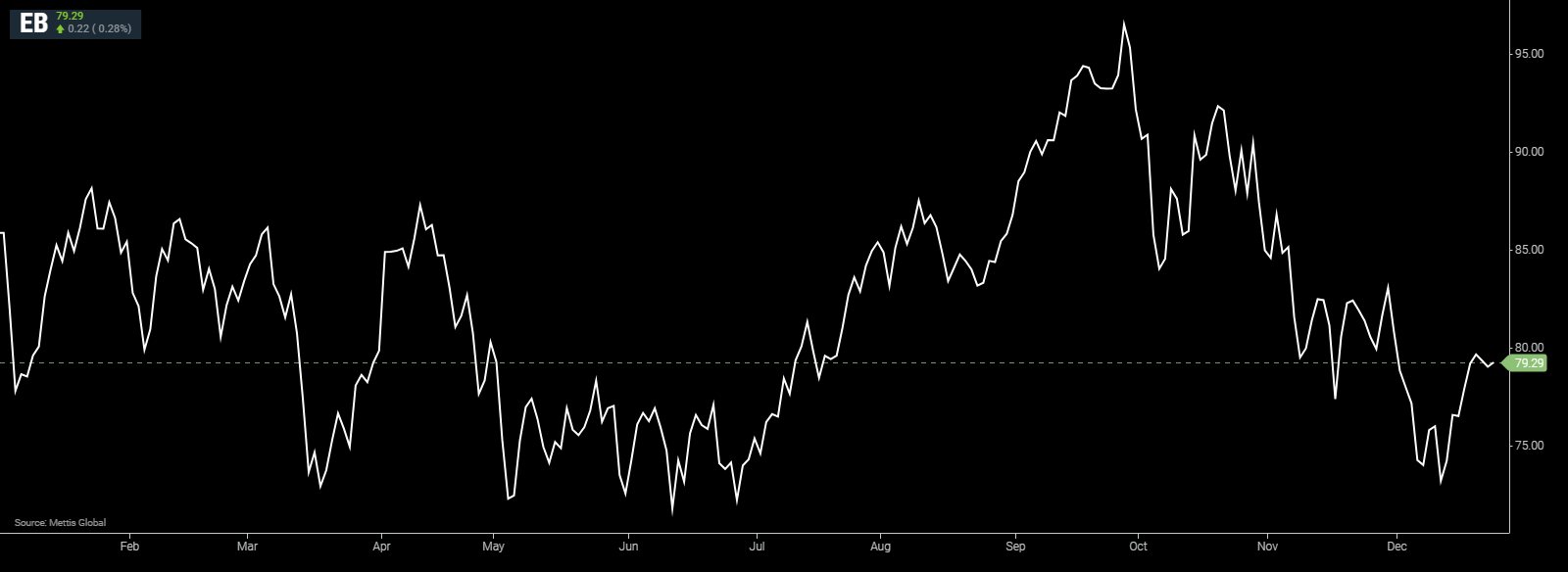

Brent crude is currently trading at $79.29 per barrel, up by 0.28% on the day, while recording more than 3% gain last week.

While West Texas Intermediate crude (WTI) is trading at $73.81 per barrel, up by 0.34% on the day.

Ships have been forced to reroute following the strikes, prompting the formation of a multinational maritime task force to help protect commercial vessels, as Bloomberg reported.

Container giant A.P. Moller-Maersk A/S now says it’s preparing to resume using the route, which links to the Suez Canal.

Crude’s recent gains helped to pare a quarterly decline, as oil remains on course for a loss of about 8% this year.

Traders are concerned that despite pledges of further output cuts from the Organization of Petroleum Exporting Countries and its allies, global crude supply may run ahead of demand next year.

Angola quit the producer group on Friday amid disagreements over quotas, but remaining members were quick to reaffirm the cartel’s unity.

Timespreads have strengthened over recent sessions.

Among them, Brent’s prompt spread, the difference between its two nearest contracts, has swung to 18 cents a barrel in backwardation, a bullish near-term pricing pattern, versus 16 cents a barrel in the opposite contango structure a week ago.

Russia’s oil processing last week, meanwhile, remained close to the highest daily level in more than eight months amid decreased seaborne exports.

The US last week announced fresh enforcement measures for its price cap, including sanctioning the shadowy trader of Russian oil, Bellatrix Energy Ltd., to pressure Moscow over its ongoing war in Ukraine.

The week between the Christmas and New Year holidays is likely to see lackluster liquidity, with combined aggregate open interest across the main oil contracts tracking lower since about the middle of this month.

Oil’s implied volatility has also declined over recent weeks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.14 378.01M | 0.00% 0.00 |

| ALLSHR | 88,401.14 611.71M | 0.00% 0.00 |

| KSE30 | 44,996.50 162.61M | 0.00% 0.00 |

| KMI30 | 210,039.41 136.40M | 0.00% 0.00 |

| KMIALLSHR | 57,315.72 366.68M | 0.00% 0.00 |

| BKTi | 42,364.50 67.24M | 0.00% 0.00 |

| OGTi | 31,480.48 21.12M | 0.00% 0.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,735.00 | 70,765.00 68,485.00 | 530.00 0.77% |

| BRENT CRUDE | 94.62 | 95.04 88.05 | -4.34 -4.39% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -13.60 -12.04% |

| ROTTERDAM COAL MONTHLY | 132.00 | 134.20 132.00 | 5.05 3.98% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 91.00 | 91.48 84.43 | -3.77 -3.98% |

| SUGAR #11 WORLD | 14.62 | 14.64 14.25 | 0.52 3.69% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Business Confidence Survey

Business Confidence Survey