PSX Closing Bell: Winter Retreat

MG News | January 17, 2022 at 05:41 PM GMT+05:00

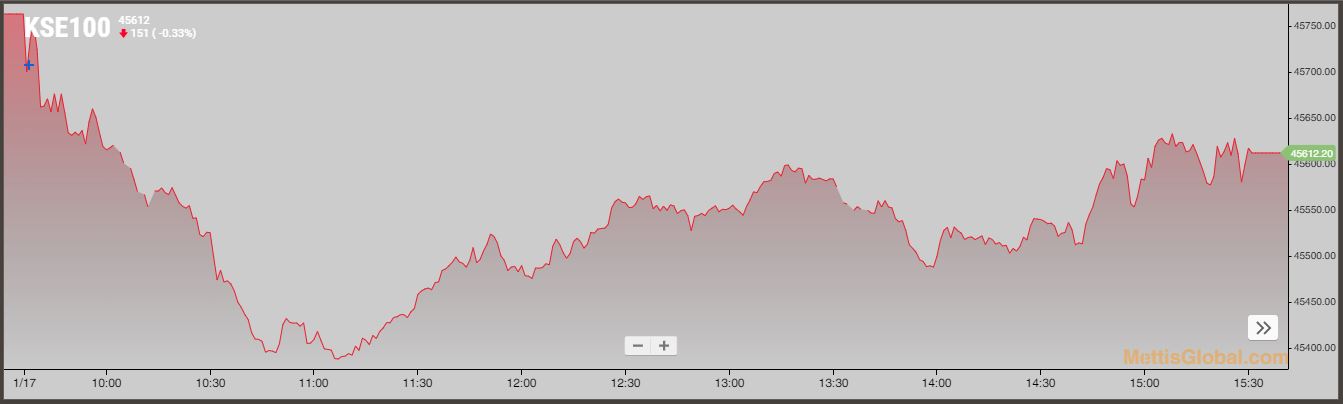

January 17, 2022 (MLN): The capital market remained dull during the first session of the week owing to the lack of fresh triggers. Growing concerns over increasing Covid-19 cases across the country have pushed the trading floor under selling pressure which led the benchmark KSE 100 index to lose 151.25 points as the index settled at 45,612.20.

Investors were also worried over higher international commodities prices which led the market to open sideways, where the market made an intraday low of 377 points.

Initial pressure came from TRG where stock touches its lower limit in the first hour of the session followed suit by other Technology stocks as AVN, OCTOPUS and SYS closed lower, post-market note by Topline Securities stated.

Of the 92 traded companies in the KSE100 Index 34 closed up 56 closed down, while 2 remained unchanged. The total volume traded for the index was 71.63 million shares.

Sector-wise, the index was let down by Technology & Communication with 101 points, Commercial Banks with 28 points, Refinery with 22 points, Textile Composite with 7 points and Insurance with 7 points.

The most points taken off the index was by TRG which stripped the index of 88 points followed by HBL with 17 points, AVN with 11 points, NRL with 8 points and CNERGY with 8 points.

Sectors propping up the index were Cement with 21 points, Power Generation & Distribution with 10 points, Fertilizer with 7 points, Pharmaceuticals with 5 points and Automobile Assembler with 3 points.

The most points added to the index was by LUCK which contributed 21 points followed by HUBC with 16 points, FFC with 7 points, GLAXO with 6 points and POL with 6 points.

All share volume decreased by 66.48 million to 173.50 million shares. Market cap decreased by Rs24.29 billion.

Total companies traded were 336 compared to 350 from the previous session. Of the scrips traded 102 closed up, 218 closed down while 16 remained unchanged.

Total trades decreased by 4,384 to 84,943.

Value Traded increased by 0.01 billion to Rs6.10 billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 25,493,500 |

| TRG Pakistan | 20,075,907 |

| Cnergyico PK | 12,901,420 |

| Alfalah Consumer Index (ETF) | 6,820,500 |

| Telecard | 6,285,500 |

| Hascol Petroleum | 5,403,500 |

| Unity Foods | 5,363,864 |

| Ghani Global Holdings | 5,007,000 |

| Octopus Digital | 3,257,500 |

| Silkbank | 2,777,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 63,404,209 |

| Refinery | 16,545,951 |

| Food & Personal Care Products | 13,051,132 |

| Commercial Banks | 9,417,431 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 7,476,000 |

| Chemical | 7,396,350 |

| Exchange Traded Funds | 7,222,000 |

| Oil & Gas Marketing Companies | 7,002,274 |

| Power Generation & Distribution | 6,177,804 |

| Cement | 5,000,601 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|