PSX Closing Bell: The Valley of Fear

By MG News | October 18, 2021 at 05:41 PM GMT+05:00

Ocotober 18, 2021 (MLN): The stock market turned bearish on Monday, as it surrendered to the profit-taking activity owing to hike in petroleum prices by upto Rs10.95/ litre coupled with a delay in IMF negotiations for the resumption of the EFF.

Furthermore, weak macro cues stemming from fresh battering of Rupee against USD also hampered investors’ sentiments as the rupee broke all the record for all-time low, to close the day's trade at PKR 172.78, depreciating by 1.6 rupees against the US dollar in today's interbank session.

However, E&P sector saw renewed investor interest after international oil prices hoit their highest level in years, with Brent trading at $85.97/barrel at the time of writing, a closing note by Topline Securitied cited.

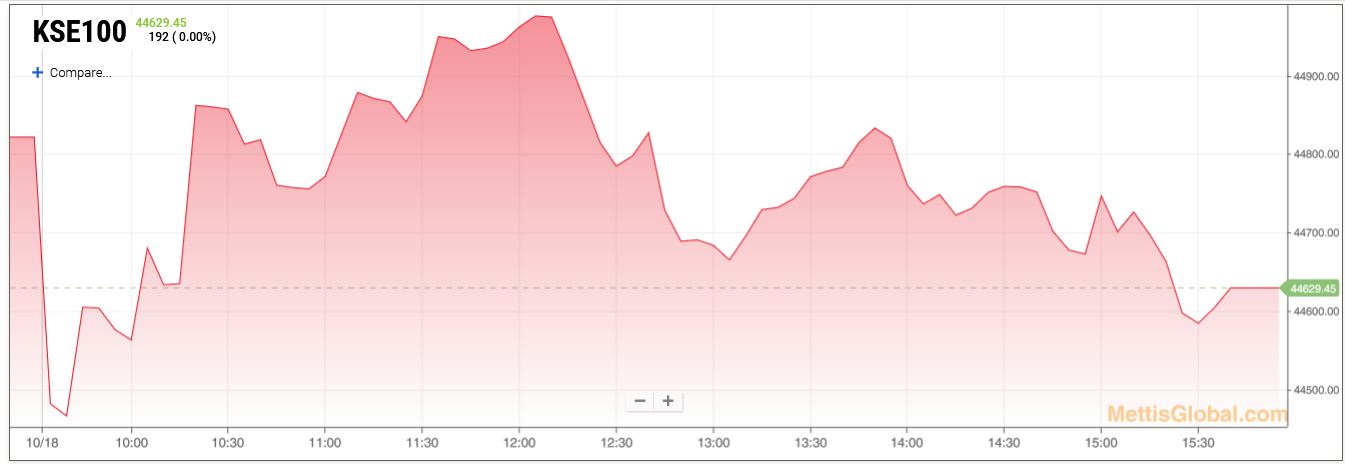

The Index traded in a range of 561.34 points or 1.25 percent of previous close, showing an intraday high of 44,993.66 and a low of 44,432.32.

Of the 95 traded companies in the KSE100 Index 30 closed up 64 closed down, while 1 remained unchanged. Total volume traded for the index was 102.25 million shares.

Sector wise, the index was let down by Technology & Communication with 146 points, Cement with 47 points, Engineering with 27 points, Food & Personal Care Products with 25 points and Textile Composite with 24 points.

The most points taken off the index was by TRG which stripped the index of 88 points followed by SYS with 47 points, BAHL with 42 points, FFC with 22 points and UNITY with 17 points.

Sectors propping up the index were Oil & Gas Exploration Companies with 77 points, Commercial Banks with 42 points, Fertilizer with 19 points, Inv. Banks / Inv. Cos. / Securities Cos. with 8 points and Insurance with 6 points.

The most points added to the index was by HBL which contributed 48 points followed by MCB with 31 points, OGDC with 30 points, PPL with 29 points and ENGRO with 27 points.

All Share Volume decreased by 86.04 Million to 248.29 Million Shares. Market Cap decreased by Rs.29.48 Billion.

Total companies traded were 330 compared to 356 from the previous session. Of the scrips traded 110 closed up, 209 closed down while 11 remained unchanged.

Total trades decreased by 13,087 to 108,216.

Value Traded decreased by 2.97 Billion to Rs.8.82 Billion

| Company | Volume |

|---|---|

| Hum Network | 25,097,500 |

| Worldcall Telecom | 20,839,500 |

| Hascol Petroleum | 13,835,098 |

| Unity Foods | 13,554,483 |

| Dost Steels | 9,910,000 |

| Service Fabrics | 8,828,000 |

| Telecard | 8,608,000 |

| The Bank of Punjab | 8,402,500 |

| Byco Petroleum Pakistan | 7,264,500 |

| TRG Pakistan | 6,620,247 |

| Sector | Volume |

|---|---|

| Technology & Communication | 72,603,047 |

| Food & Personal Care Products | 21,566,983 |

| Commercial Banks | 21,522,938 |

| Oil & Gas Marketing Companies | 20,002,293 |

| Engineering | 15,855,244 |

| Chemical | 11,230,180 |

| Refinery | 9,940,496 |

| Textile Weaving | 9,123,500 |

| Oil & Gas Exploration Companies | 9,014,004 |

| Cement | 8,739,980 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,135.00 | 106,200.00 105,440.00 |

385.00 0.36% |

| BRENT CRUDE | 67.18 | 67.29 67.05 |

0.07 0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.49 | 65.65 65.34 |

0.04 0.06% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI