PSX Closing Bell: Pyromania

By MG News | October 11, 2021 at 05:29 PM GMT+05:00

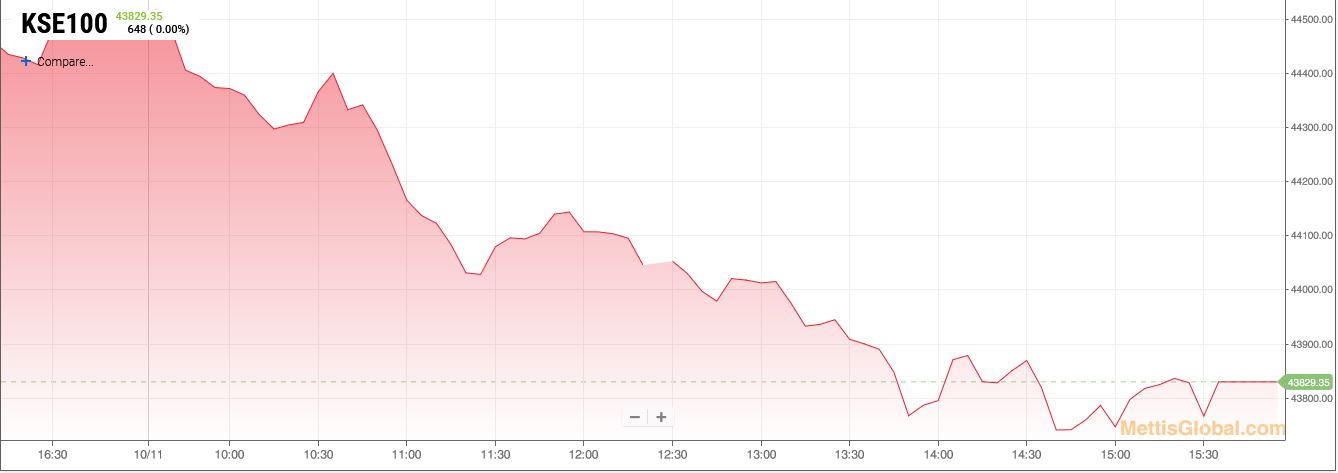

October 11, 2021 (MLN): Bears continued to dominate the domestic capital market on Monday as the benchmark KSE-100 index plunged by 647.89 points or a 1.46 percent decline to close at 43,829.35 level.

The pessimism prevailed across the board due to concerns around upward risk in inflation amid rising energy and commodity prices.

Furthermore, proposals over the implementation of a minimum global tax on technology companies on international forum weighed down on local tech sector, a market closing note by Aba Ali Habib Securities highlighted.

Cement sector continued to put downward pressure on index as coal prices resume an upward rally.

Of the 94 traded companies in the KSE100 Index 17 closed up 74 closed down, while 3 remained unchanged. Total volume traded for the index was 88.78 million shares.

Sector wise, the index was let down by Technology & Communication with 202 points, Cement with 121 points, Commercial Banks with 56 points, Engineering with 49 points and Food & Personal Care Products with 44 points.

The most points taken off the index was by TRG which stripped the index of 119 points followed by SYS with 68 points, LUCK with 26 points, FFC with 25 points and UNITY with 25 points.

Sectors propping up the index were Oil & Gas Exploration Companies with 15 points and Chemical with 8 points.

The most points added to the index was by PPL which contributed 21 points followed by COLG with 9 points, HUBC with 8 points, ABL with 7 points and FML with 7 points.

All Share Volume increased by 50.51 Million to 226.58 Million Shares. Market Cap decreased by Rs.108.16 Billion.

Total companies traded were 548 compared to 550 from the previous session. Of the scrips traded 61 closed up, 470 closed down while 17 remained unchanged.

Total trades increased by 19,512 to 94,242.

Value Traded increased by 1.43 Billion to Rs.8.27 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 41,362,500 |

| Telecard | 13,891,000 |

| Treet Corporation | 9,376,500 |

| Hum Network | 8,366,500 |

| TRG Pakistan | 7,126,974 |

| TPL Corp | 6,207,500 |

| Unity Foods | 5,947,593 |

| Byco Petroleum Pakistan | 5,520,000 |

| Ghani Global Holdings | 5,279,000 |

| Engro Fertilizers | 5,167,631 |

| Sector | Volume |

|---|---|

| Technology & Communication | 82,565,274 |

| Food & Personal Care Products | 19,790,513 |

| Commercial Banks | 15,777,357 |

| Cement | 11,980,947 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 11,153,261 |

| Fertilizer | 10,494,618 |

| Chemical | 8,607,470 |

| Textile Composite | 7,744,000 |

| Oil & Gas Marketing Companies | 7,431,458 |

| Refinery | 7,034,910 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI