PSX Closing Bell: Pineapple Express

MG News | October 20, 2021 at 05:34 PM GMT+05:00

October 20, 2021 (MLN): The bulls staged a comeback on Wednesday due to the optimistic sentiments in the market on the back of 24.4% MoM improvement in the current account deficit that clocked in at $1.11billion in the month of September 2021.

With positive outcome expected from the negotiation underway with the IMF, the capital market remained upbeat, as per market closing note by Next capital.

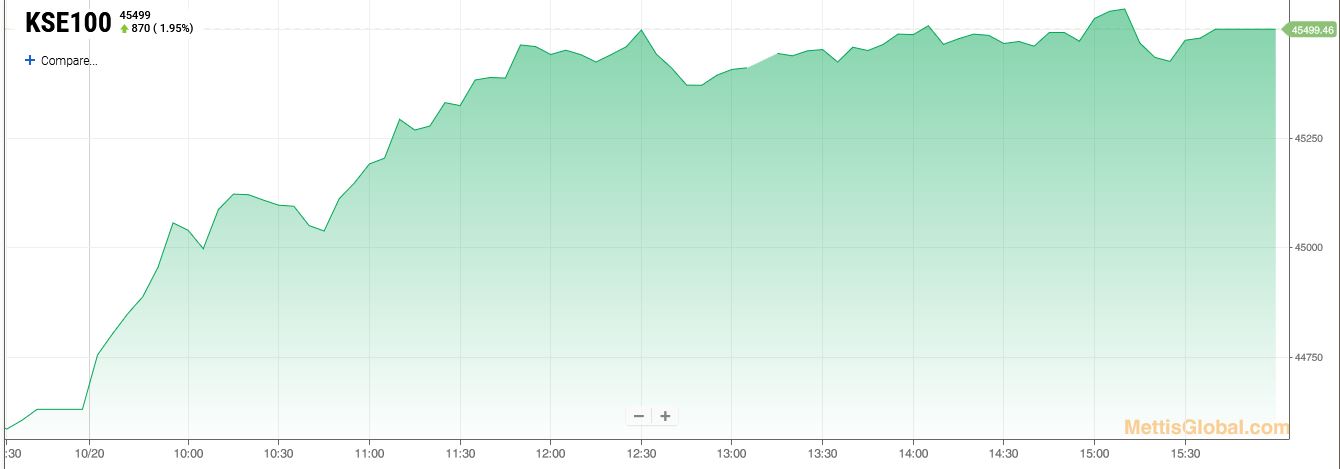

Accordingly, the benchmark KSE-100 index gave a splendid performance in today’s session, as it gained around 870.01 points and settled at 45,499.46-level.

The Index remained positive throughout the session touching an intraday high of 45,564.28

Of the 95 traded companies in the KSE100 Index 82 closed up while 13 closed down. Total volume traded for the index was 132.67 million shares.

Sectors propping up the index were Commercial Banks with 201 points, Cement with 160 points, Technology & Communication with 106 points, Fertilizer with 79 points and Textile Composite with 49 points.

The most points added to the index was by TRG which contributed 65 points followed by LUCK with 58 points, ENGRO with 50 points, HUBC with 49 points and HBL with 44 points.

Sector wise, the index was let down by Close - End Mutual Fund with 6 points, Glass & Ceramics with 5 points and Textile Spinning with 1 points.

The most points taken off the index was by OGDC which stripped the index of 8 points followed by NESTLE with 7 points, HGFA with 6 points, GHGL with 5 points and KAPCO with 3 points.

All Share Volume increased by 59.89 Million to 308.19 Million Shares. Market Cap increased by Rs.92.92 Billion.

Total companies traded were 361 compared to 330 from the previous session. Of the scrips traded 274 closed up, 79 closed down while 8 remained unchanged.

Total trades increased by 9,205 to 117,421.

Value Traded increased by 1.54 Billion to Rs.10.36 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 49,452,000 |

| Hum Network | 24,770,000 |

| Byco Petroleum Pakistan | 15,608,500 |

| Telecard | 15,593,500 |

| Unity Foods | 15,010,722 |

| Service Fabrics | 11,707,000 |

| Azgard Nine | 10,471,000 |

| TRG Pakistan | 7,412,437 |

| Maple Leaf Cement Factory | 6,026,898 |

| Treet Corporation | 5,932,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 110,937,437 |

| Food & Personal Care Products | 25,675,362 |

| Cement | 25,506,914 |

| Commercial Banks | 22,791,972 |

| Refinery | 18,565,983 |

| Textile Composite | 15,548,750 |

| Textile Weaving | 12,272,500 |

| Engineering | 10,464,450 |

| Miscellaneous | 8,356,100 |

| Chemical | 7,600,150 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,155.00 | 123,615.00 118,675.00 |

1625.00 1.37% |

| BRENT CRUDE | 69.14 | 71.53 69.08 |

-1.22 -1.73% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.90 | 69.65 66.84 |

-1.55 -2.26% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|