PSX Closing Bell: Magic Carpet Ride

By MG News | October 14, 2021 at 05:33 PM GMT+05:00

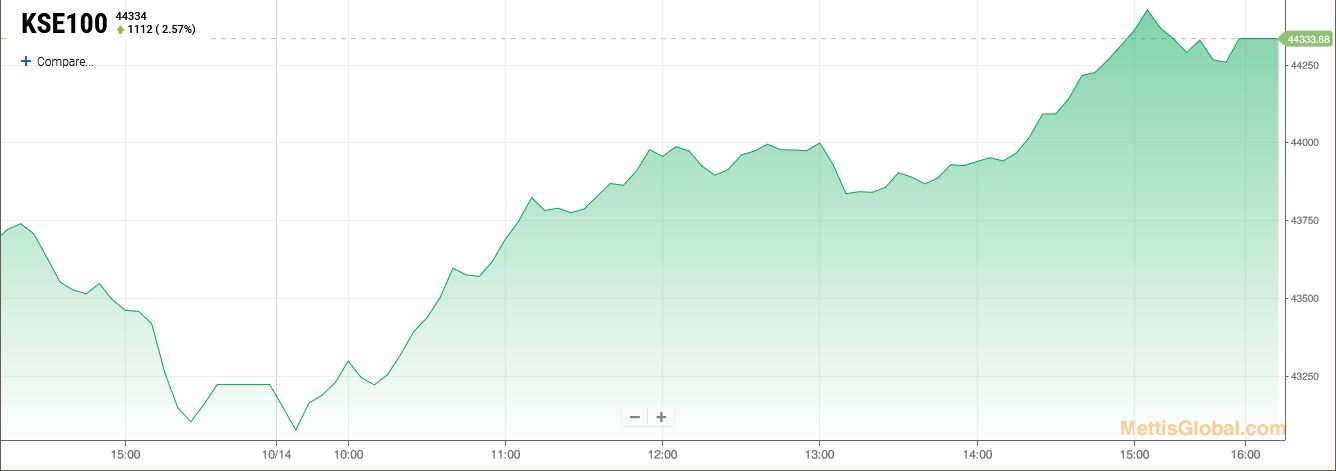

October 14, 2021 (MLN): Contrary to yesterday’s trade, the benchmark KSE-100 Index climbed up by 1111.90 points or an increase of 2.57 percent to close at 44,333.68 on Thursday, in line with global markets amid optimism in recovery outlook.

Investors cherished the clarity over political noise where the Minister of Information said that the process of new DG ISI appointment will be completed soon as the government and military are on the same page, a market closing note by Topline Securities.

The Index traded in a range of 1390.89 points or 3.22 percent of previous close, showing an intraday high of 44,433.33 and a low of 43,042.44.

Of the 97 traded companies in the KSE100 Index 83 closed up 10 closed down, while 4 remained unchanged. Total volume traded for the index was 150.13 million shares.

Sectors propping up the index were Commercial Banks with 233 points, Cement with 209 points, Technology & Communication with 148 points, Fertilizer with 98 points and Oil & Gas Marketing Companies with 48 points.

The most points added to the index was by LUCK which contributed 88 points followed by TRG with 83 points, HBL with 74 points, UBL with 66 points and FFC with 51 points.

Sector wise, the index was let down by Synthetic & Rayon with 2 points, Insurance with 1 points and Real Estate Investment Trust with 1 points.

The most points taken off the index was by HINOON which stripped the index of 7 points followed by ABOT with 2 points, IBFL with 2 points, MEBL with 1 point and MTL with 1 point.

All Share Volume increased by 33.63 Million to 388.60 Million Shares. Market Cap increased by Rs.164.92 Billion.

Total companies traded were 557 compared to 543 from the previous session. Of the scrips traded 464 closed up, 79 closed down while 14 remained unchanged.

Total trades increased by 17,508 to 134,592.

Value Traded increased by 0.79 Billion to Rs.13.09 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 66,164,000 |

| Unity Foods | 25,029,893 |

| Telecard | 18,987,500 |

| Treet Corporation | 16,451,500 |

| Hascol Petroleum | 16,019,621 |

| TRG Pakistan | 13,023,467 |

| Silkbank | 10,045,500 |

| Byco Petroleum Pakistan | 9,738,500 |

| TPL Properties | 9,499,000 |

| TPL Corp | 8,914,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 132,919,867 |

| Food & Personal Care Products | 51,885,683 |

| Commercial Banks | 30,512,389 |

| Cement | 22,133,109 |

| Oil & Gas Marketing Companies | 20,241,316 |

| Chemical | 17,159,350 |

| Miscellaneous | 14,894,100 |

| Refinery | 12,684,488 |

| Engineering | 11,484,481 |

| Power Generation & Distribution | 10,645,556 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI