PSX Closing Bell: Loose change

By MG News | November 25, 2021 at 05:38 PM GMT+05:00

November 25, 2021 (MNL): Bears continued to rule the trading floor on the straight fourth session of the week due to the investors’ concerns over continuous foreign selling amid Pakistan’s reclassification from MSCI emerging markets to frontier markets index due next week coupled with the depreciation of the rupee against the greenback.

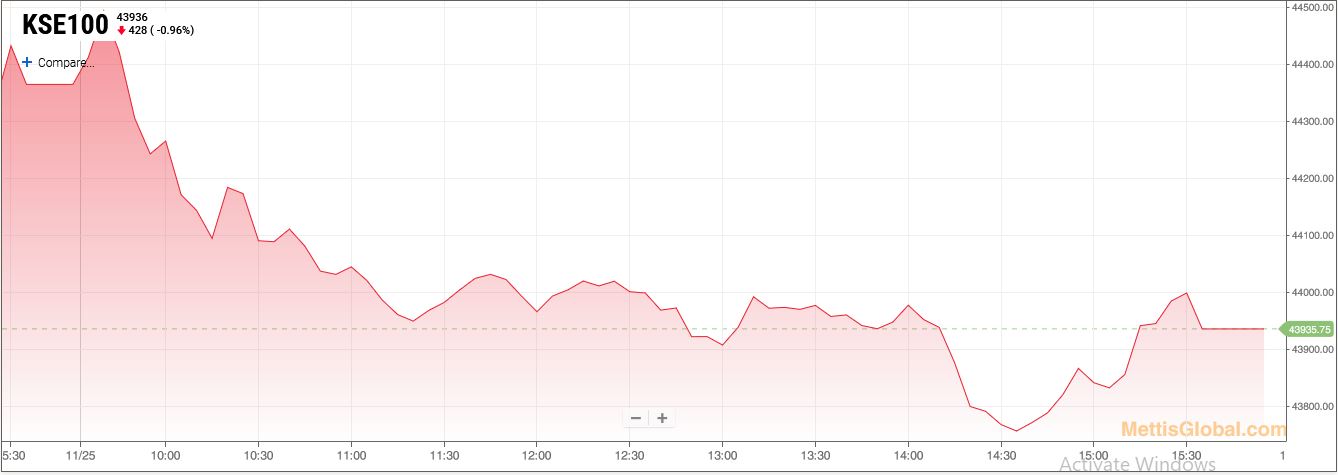

Resultantly, the benchmark KSE-100 index ended the trading session on Thursday with a 427.95 point or 0.96 percent decline to close at 43,935.75.

The Index traded in a range of 779.14 points or 1.76 percent of previous close, showing an intraday high of 44,513.93 and a low of 43,734.79.

Of the 92 traded companies in the KSE100 Index 28 closed up 62 closed down, while 2 remained unchanged. Total volume traded for the index was 97.34 million shares.

Sector wise, the index was let down by Commercial Banks with 139 points, Power Generation & Distribution with 59 points, Fertilizer with 50 points, Cement with 48 points and Pharmaceuticals with 43 points.

The most points taken off the index was by HUBC which stripped the index of 53 points followed by HBL with 46 points, LUCK with 30 points, UBL with 29 points and SEARL with 25 points.

Sectors propping up the index were Refinery with 10 points, Glass & Ceramics with 7 points, Automobile Assembler with 6 points, Food & Personal Care Products with 3 points and Real Estate Investment Trust with 2 points.

The most points added to the index was by GHGL which contributed 7 points followed by SYS with 5 points, NRL with 5 points, BYCO with 5 points and MTL with 4 points.

All Share Volume decreased by 115.21 Million to 195.17 Million Shares. Market Cap decreased by Rs.53.45 Billion.

Total companies traded were 328 compared to 341 from the previous session. Of the scrips traded 121 closed up, 185 closed down while 22 remained unchanged.

Total trades decreased by 134,244 to 0.

Value Traded decreased by 4.55 Billion to Rs.8.39 Billion

| Company | Volume |

|---|---|

| TPL Properties | 16,327,000 |

| Byco Petroleum Pakistan | 12,229,000 |

| The Hub Power Company | 9,501,666 |

| Worldcall Telecom | 8,393,500 |

| TRG Pakistan | 7,946,662 |

| Hascol Petroleum | 7,225,276 |

| First National Equities | 6,616,500 |

| Modaraba Al-Mali(R | 5,296,000 |

| Aisha Steel Mills | 5,135,000 |

| Pakistan Refinery | 5,088,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 27,795,167 |

| Commercial Banks | 19,483,636 |

| Miscellaneous | 18,723,700 |

| Refinery | 18,353,857 |

| Power Generation & Distribution | 14,153,666 |

| Food & Personal Care Products | 13,854,795 |

| Oil & Gas Marketing Companies | 11,106,274 |

| Chemical | 10,293,450 |

| Cement | 9,962,843 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 7,724,743 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI