PSX Closing Bell: Light Fuse and Get Away

MG News | November 03, 2021 at 05:46 PM GMT+05:00

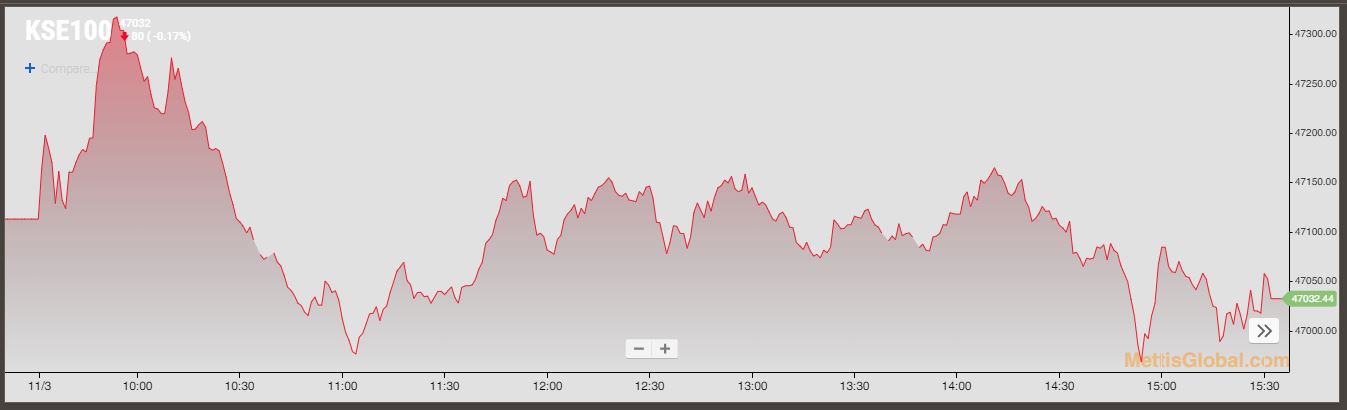

November 3, 2021 (MLN): The domestic equity market remained range-bound throughout the session as it oscillated between red and green zones and concluded the day on a negative note after shedding 80.84 points, down by 0.17% to arrive at the 47,032.44 points mark.

The bearish spell was witnessed due to negative sentiments stemming from resurging international coal prices (7.57% DoD) putting pressure on local cement scrips.

Furthermore, a swell in trade deficit in the month of October by 117.2% YoY basis also dented the investors’ confidence, as per market closing note by Aba Ali Habib Securities.

The Index traded in a range of 351.79 points or 0.75 percent of the previous close, showing an intraday high of 47,320.07 and a low of 46,968.28.

Of the 96 traded companies in the KSE100 Index, 39 closed up 54 closed down, while 3 remained unchanged. The total volume traded for the index was 165.88 million shares.

Sector wise, the index was let down by Commercial Banks with 108 points, Oil & Gas Exploration Companies with 69 points, Cement with 66 points, Engineering with 23 points and Oil & Gas Marketing Companies with 23 points.

The most points taken off the index was by HBL which stripped the index of 48 points followed by UBL with 40 points, PPL with 34 points, LUCK with 30 points and POL with 26 points.

Sectors propping up the index were Technology & Communication with 193 points, Refinery with 22 points, Chemical with 19 points, Leather & Tanneries with 12 points and Insurance with 7 points.

The most points added to the index was by SYS which contributed 96 points followed by TRG with 77 points, COLG with 23 points, FFC with 16 points and PTC with 13 points.

All Share Volume increased by 74.31 Million to 380.56 Million Shares. Market Cap decreased by Rs.22.63 Billion.

Total companies traded were 366 compared to 361 from the previous session. Of the scrips traded 182 closed up, 163 closed down while 21 remained unchanged.

Total trades increased by 5,173 to 139,455.

Value Traded increased by 1.77 Billion to Rs.15.55 Billion

| Company | Volume |

|---|---|

| Pakistan Telecommunication Company Ltd | 22,718,500 |

| Hascol Petroleum | 17,309,578 |

| Worldcall Telecom | 16,290,000 |

| TRG Pakistan | 16,113,966 |

| TPL Properties | 16,093,000 |

| First National Equities | 15,344,500 |

| Ghani Global Holdings | 15,061,500 |

| Byco Petroleum Pakistan | 14,502,000 |

| Azgard Nine | 13,467,500 |

| Treet Corporation | 11,624,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 90,657,778 |

| Food & Personal Care Products | 28,265,104 |

| Miscellaneous | 23,264,000 |

| Engineering | 23,028,205 |

| Commercial Banks | 22,935,979 |

| Refinery | 22,687,709 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 20,803,215 |

| Oil & Gas Marketing Companies | 20,459,830 |

| Chemical | 19,695,310 |

| Cement | 19,566,417 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|