PSX Closing Bell: Flat Tire

By MG News | September 05, 2024 at 04:21 PM GMT+05:00

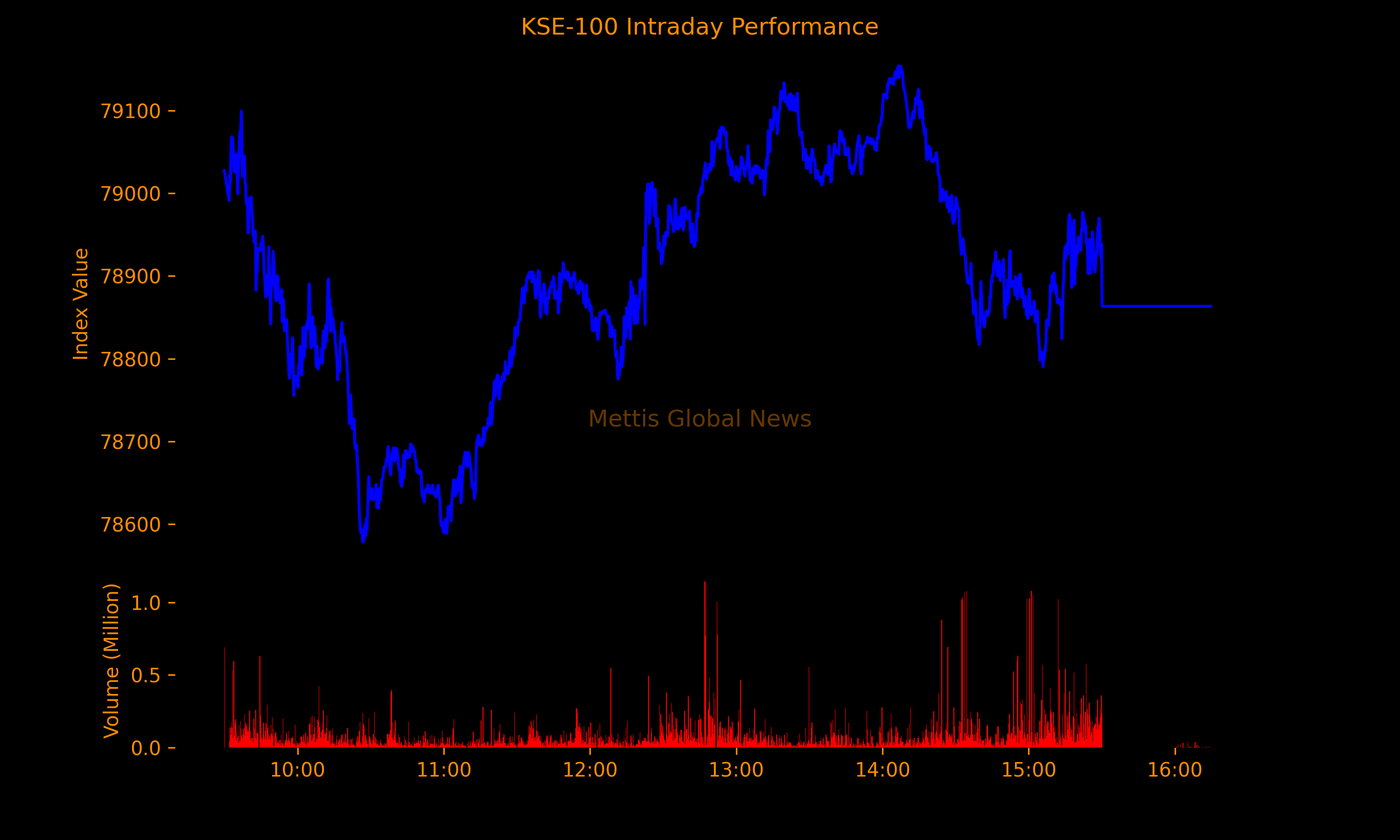

September 05, 2024 (MLN): The benchmark KSE-100 Index concluded Thursday's trading session almost flat at 78,863.34, showing a marginal increase of 15.33 points or 0.02%.

The index traded in a range of 576.28 points showing an intraday high of 79,154.29 (+306.28) and a low of 78,578.01 (-270.00) points.

The total volume of the KSE-100 Index was 132.20 million shares.

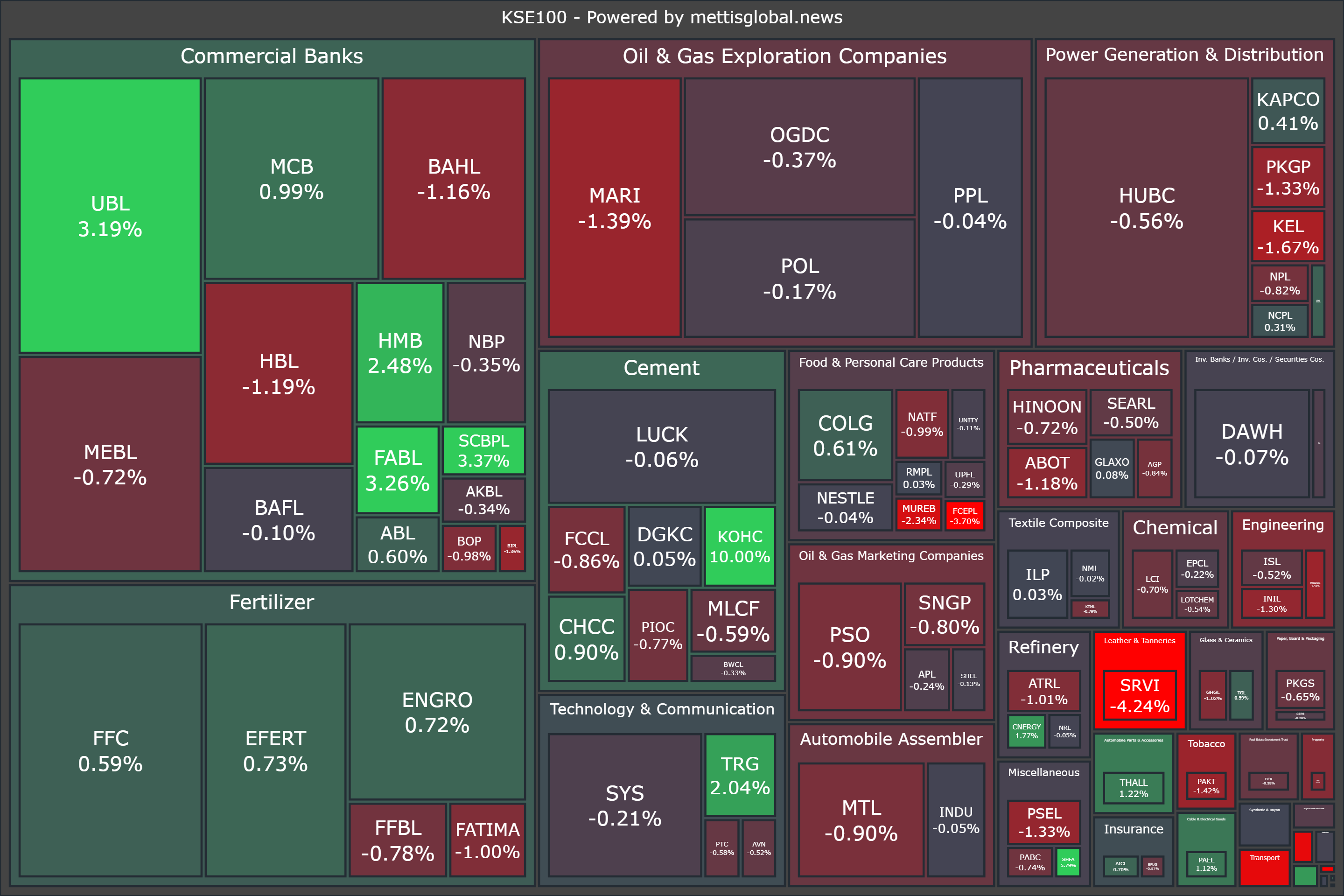

Of the 100 index companies 29 closed up, 69 closed down, 1 was unchanged, while 1 remained untraded.

Top gainers during the day were KOHC (+10.00%), SHFA (+5.79%), SCBPL (+3.37%), FABL (+3.26%), and UBL (+3.19%).

Kohat Cement Limited (KOHC) recorded over a five times increase in its profit during the April-June quarter led by an improvement in gross margins, a surge in its other income, and a significantly lower tax rate.

The board also recommended a buy-back of up to 12 million of its own issued ordinary shares, to be funded from the company’s distributable profits or reserves.

On the other hand, top losers were YOUW (-8.46%), SRVI (-4.24%), FCEPL (-3.70%), HGFA (-2.62%), and PIBTL (-2.61%).

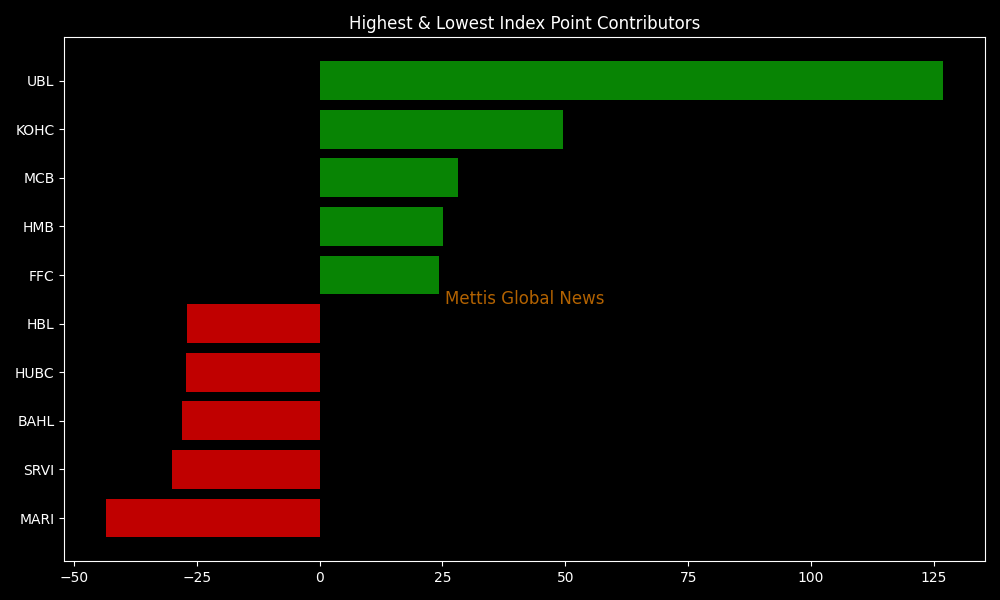

In terms of index-point contributions, companies that propped up the index were UBL (+126.90pts), KOHC (+49.57pts), MCB (+28.24pts), HMB (+25.14pts), and FFC (+24.27pts).

Meanwhile, companies that dragged the index lower were MARI (-43.44pts), SRVI (-30.11pts), BAHL (-27.98pts), HUBC (-27.18pts), and HBL (-26.95pts).

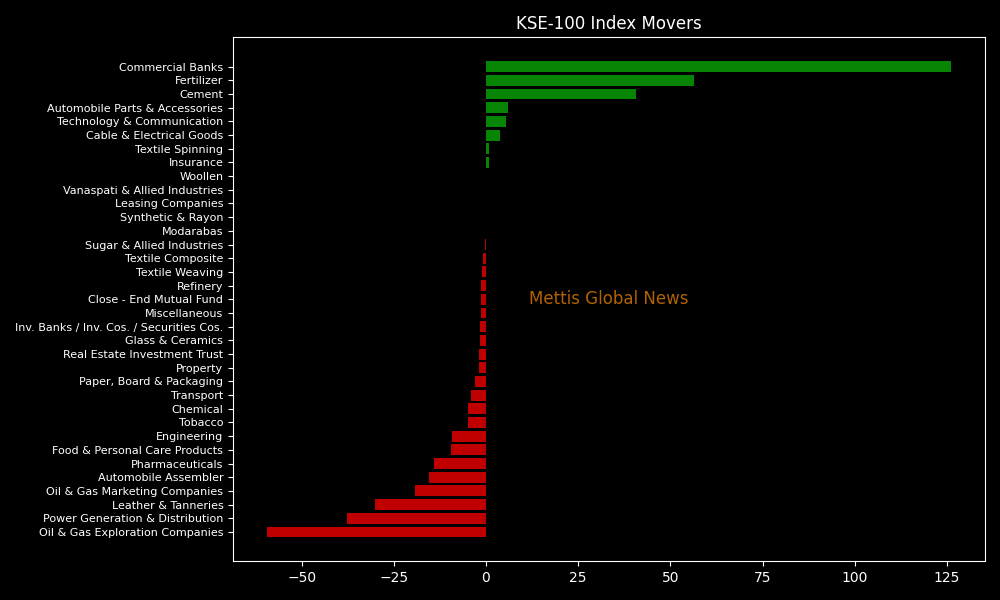

Sector-wise, KSE-100 Index was supported by Commercial Banks (+126.07pts), Fertilizer (+56.48pts), Cement (+40.64pts), Automobile Parts & Accessories (+5.85pts), and Technology & Communication (+5.50pts).

While the index was let down by Oil & Gas Exploration Companies (-59.34pts), Power Generation & Distribution (-37.79pts), Leather & Tanneries (-30.11pts), Oil & Gas Marketing Companies (-19.20pts), and Automobile Assembler (-15.37pts).

In the broader market, the All-Share Index closed at 50,743.00 with a net gain of 36.06 points or 0.07%.

Total market volume was 770.52 million shares compared to 969.77m from the previous session while traded value was recorded at Rs14.29 billion showing a decrease of Rs3.22bn.

There were 256,472 trades reported in 443 companies with 147 closing up, 252 closing down, and 44 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.34 | -2.19% | 87,102,864 |

| PACE | 5.66 | 21.46% | 66,581,544 |

| KOSM | 10.29 | -9.82% | 42,137,767 |

| DCL | 9.49 | 7.60% | 39,823,713 |

| SYM | 10.31 | -6.19% | 37,713,602 |

| MDTL | 2.3 | 5.02% | 25,875,278 |

| AMTEEF | 4.1 | -6.39% | 21,709,832 |

| SLGL | 18.15 | 0.72% | 18,615,883 |

| FNEL | 4.05 | 3.58% | 17,230,583 |

| CNERGY | 4.02 | 1.77% | 15,941,656 |

To note, the KSE-100 has gained 418 points or 0.53% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 16,412 points, equivalent to 26.28%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,170.00 | 106,200.00 105,440.00 |

420.00 0.40% |

| BRENT CRUDE | 67.18 | 67.29 67.05 |

0.07 0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.50 | 65.65 65.34 |

0.05 0.08% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI