PSX Closing Bell: Down to Earth...

MG News | April 18, 2022 at 02:57 PM GMT+05:00

April 18, 2022 (MLN): Domestic equities witnessed profit-taking today in the absence of any positive triggers.

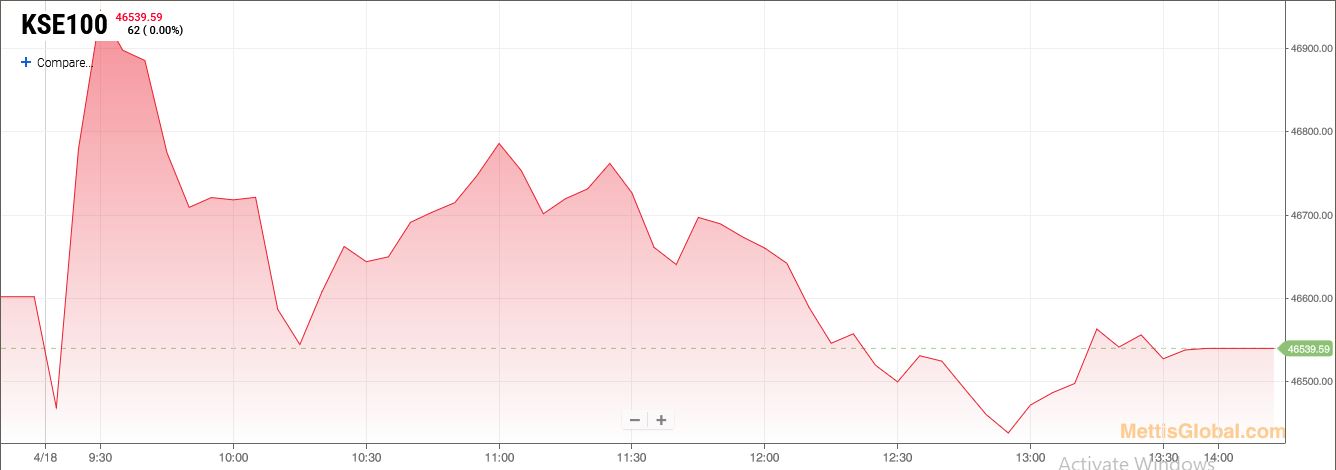

The market opened on a positive note, gaining over 360 points in the early trade to reach a near six-month high at 46,970 level as investors welcomed the news of the Pakistan-IMF formal dialogue on the revival of EFF which is set to begin today.

Moreover, the rally was also led by the Oil and Gas Exploration sector on the backdrop of increase in global oil prices and market chatter of one time heavy dividend in the OGDC and PPL stock, a closing note by Topline Securities said.

However, during the second hour of trading, profit-taking was observed which led the KSE 100 index to close at 46,539 level, down by 62 points or 0.13% DoD.

The Index traded in a range of 540.51 points or 1.16 percent of previous close, showing an intraday high of 46,969.46 and a low of 46,428.95.

Of the 92 traded companies in the KSE100 Index 27 closed up 63 closed down, while 2 remained unchanged. Total volume traded for the index was 118.98 million shares.

Sector wise, the index was let down by Commercial Banks with 122 points, Technology & Communication with 45 points, Cement with 40 points, Inv. Banks / Inv. Cos. / Securities Cos. with 17 points and Textile Composite with 14 points.

The most points taken off the index was by SYS which stripped the index of 29 points followed by EPCL with 29 points, LUCK with 21 points, UBL with 19 points and HMB with 19 points.

Sectors propping up the index were Oil & Gas Exploration Companies with 210 points, Power Generation & Distribution with 21 points, Fertilizer with 13 points, Oil & Gas Marketing Companies with 8 points and Automobile Parts & Accessories with 3 points.

The most points added to the index was by OGDC which contributed 95 points followed by PPL with 91 points, FFC with 37 points, HUBC with 23 points and POL with 15 points.

All Share Volume decreased by 110.18 Million to 255.61 Million Shares. Market Cap increased by Rs.6.99 Billion.

Total companies traded were 336 compared to 335 from the previous session. Of the scrips traded 107 closed up, 199 closed down while 30 remained unchanged.

Total trades decreased by 6,189 to 109,386.

Value Traded increased by 0.51 Billion to Rs.9.64 Billion

| Company | Volume |

|---|---|

| G3 Technologies | 21,233,000 |

| Cnergyico PK | 17,787,449 |

| Worldcall Telecom | 15,457,500 |

| Oil & Gas Development Company | 14,234,819 |

| Ghani Global Holdings | 12,258,500 |

| Pakistan Refinery | 10,306,500 |

| Lotte Chemical Pakistan | 9,666,000 |

| Maple Leaf Cement Factory | 9,149,668 |

| TPL Properties | 8,900,899 |

| Telecard | 7,806,000 |

| Sector | Volume |

|---|---|

| Chemical | 51,769,013 |

| Technology & Communication | 40,328,213 |

| Refinery | 32,081,840 |

| Cement | 20,328,245 |

| Oil & Gas Exploration Companies | 20,032,521 |

| Oil & Gas Marketing Companies | 11,315,516 |

| Miscellaneous | 11,232,299 |

| Food & Personal Care Products | 9,713,404 |

| Power Generation & Distribution | 9,311,670 |

| Commercial Banks | 8,778,872 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,814.12 53.81M | 1.01% 1401.87 |

| ALLSHR | 86,624.22 119.54M | 1.07% 921.26 |

| KSE30 | 42,719.39 31.34M | 1.10% 464.54 |

| KMI30 | 197,034.63 34.58M | 1.51% 2925.04 |

| KMIALLSHR | 57,493.52 58.34M | 1.38% 779.86 |

| BKTi | 38,040.25 3.03M | 0.55% 208.92 |

| OGTi | 28,332.86 14.98M | 3.25% 892.23 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,345.00 | 119,430.00 117,905.00 | 1725.00 1.47% |

| BRENT CRUDE | 72.25 | 72.82 72.19 | -0.99 -1.35% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.86 | 70.41 69.83 | -0.14 -0.20% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|