PSX Closing Bell: And Now This...

MG News | December 02, 2021 at 05:32 PM GMT+05:00

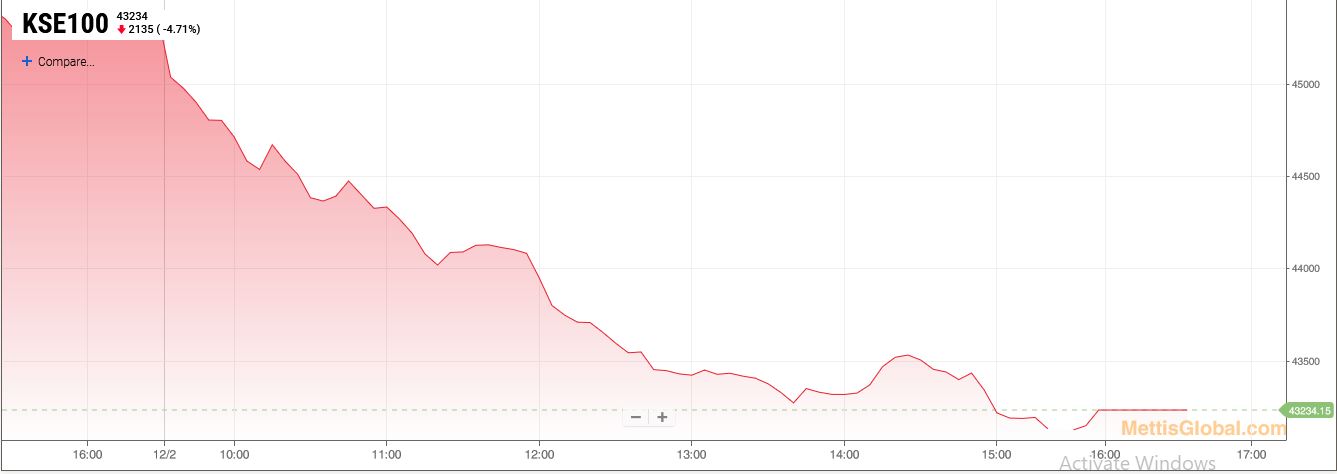

December 02, 2021 (MLN): The local bourse witnessed the record mammoth single-day drop of 2,135 points for the first time in the past 21-months, backed by an increase in yields of T-Bills in yesterday’s auction and all-time high imports of $8.01 billion in November 2021.

"The market is likely incorporating another hike in the upcoming monetary policy announcement on December 14," Saad Hashmi, Executive Director at BMA Capital Management while speaking to Mettis Global.

Ahsan Mehanti, Director Arif Habib group said, “Along with high cut-off yields of T-Bills, the drastic fall can mainly be attributed to widening trade deficit number for November 2021, disclosed yesterday which might put further pressure on the currency.”

Due to this panic selling across the board in the domestic bourse, the benchmark KSE-100 index plummeted by 4.71% to close at 43,234.15 level.

The index remained negative throughout the session touching an intraday low of 43,089.07

Of the 96 traded companies in the KSE100 Index, 1 closed up 93 closed down, while 2 remained unchanged. Total volume traded for the index was 213.44 million shares.

Sector-wise, the index was let down by Commercial Banks with 360 points, Cement with 314 points, Oil & Gas Exploration Companies with 240 points, Technology & Communication with 212 points and Fertilizer with 204 points.

The most points taken off the index was by LUCK which stripped the index of 150 points followed by SYS with 119 points, HUBC with 101 points, HBL with 91 points and PPL with 77 points.

All Share Volume increased by 145.68 Million to 386.75 Million Shares. Market Cap decreased by Rs.332.27 Billion.

Total companies traded were 365 compared to 337 from the previous session. Of the scrips traded 16 closed up, 338 closed down while 11 remained unchanged.

Total trades increased by 36,856 to 131,783.

Value Traded increased by 4.84 Billion to Rs.14.06 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 33,019,000 |

| Dolmen City REIT | 29,583,500 |

| Byco Petroleum Pakistan | 22,828,500 |

| Unity Foods | 17,735,140 |

| G3 Technologies | 17,584,000 |

| Maple Leaf Cement Factory | 16,139,894 |

| Aisha Steel Mills | 13,212,500 |

| TRG Pakistan | 10,985,355 |

| Fauji Foods | 9,809,000 |

| Power Cement | 8,158,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 67,613,838 |

| Cement | 43,607,145 |

| Food & Personal Care Products | 33,051,220 |

| Real Estate Investment Trust | 29,583,500 |

| Refinery | 27,328,328 |

| Commercial Banks | 21,560,278 |

| Engineering | 19,149,876 |

| Textile Weaving | 18,092,500 |

| Power Generation & Distribution | 15,564,948 |

| Miscellaneous | 14,590,200 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,110.00 | 123,615.00 118,675.00 |

1580.00 1.33% |

| BRENT CRUDE | 69.19 | 71.53 69.08 |

-1.17 -1.66% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.94 | 69.65 66.84 |

-1.51 -2.21% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|