PSX Closing Bell: A Storm is Coming

By MG News | July 18, 2022 at 05:17 PM GMT+05:00

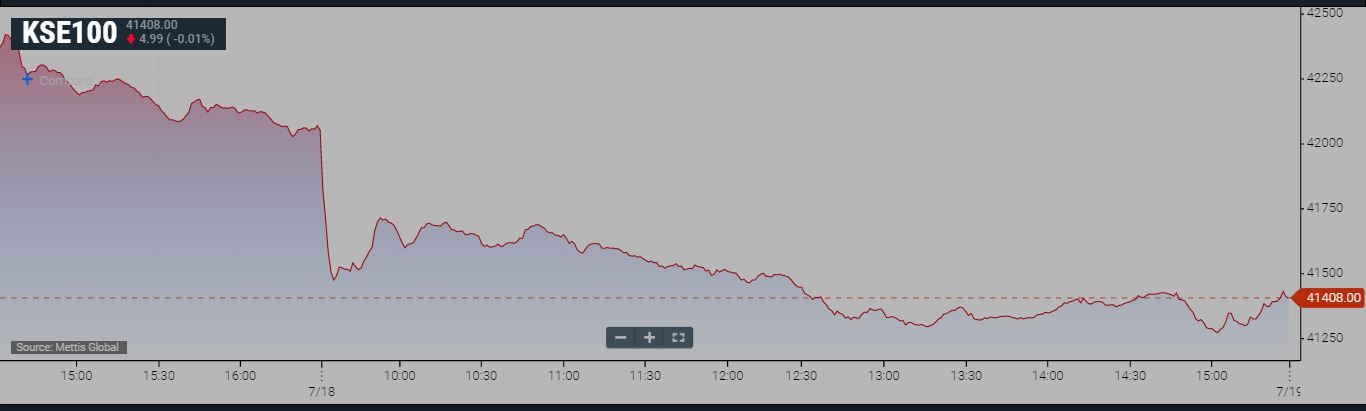

July 18, 2022 (MLN): Amidst surging political heat in the backdrop of bye-elections held yesterday, the capital market witnessed huge selling pressure on Monday as the benchmark KSE-100 index lost 707.80 points or 1.68% DoD to close at 41,367.11, observing an intraday low of 41,274.62.

PTI has secured 15 seats in an unexpected move, which has created significant uncertainty on the economic front and the results of the election would impact the economic decisions of the ruling party.

All eyes will be on the Federal Government on what decisions it takes especially regarding the hike in Electricity/Gas prices as approval of the next IMF tranche would be dependent upon such key measures agreed with IMF, an Analyst at Topline Securities noted on Monday.

Along with political noise, the continuous depreciation of the Pakistani rupee (PKR) has also crushed investors’ confidence.

Of the 93 traded companies in the KSE100 Index 10 closed up 78 closed down, while 5 remained unchanged. The total volume traded for the index was 67.92 million shares.

Sector-wise, the index was let down by Commercial Banks with 128 points, Cement with 107 points, Fertilizer with 106 points, Oil & Gas Exploration Companies with 69 points, and Technology & Communication with 68 points.

The most points taken off the index was by FFC which stripped the index of 45 points followed by LUCK with 43 points, HUBC with 43 points, ENGRO with 38 points, and HBL with 36 points.

Sectors propping up the index were Sugar & Allied Industries with 4 points, Automobile Parts & Accessories with 1 point, Inv. Banks / Inv. Cos. / Securities Cos. with 1 point and Real Estate Investment Trust with 1 point.

The most points added to the index were by ABOT which contributed 6 points followed by SML with 4 points, HINOON with 2 points, THALL with 1 point, and DCR with 1 point.

All Share Volume increased by 11.23 million to 151.35 million Shares. Market Cap decreased by Rs98.58 billion.

Total companies traded were 326 compared to 347 from the previous session. Of the scrips traded 55 closed up, 253 closed down while 18 remained unchanged.

Total trades decreased by 452 to 89,637.

Value Traded decreased by 1.02 billion to Rs4.36 billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 12,730,500 |

| K-Electric | 10,311,000 |

| TPL Properties | 8,299,678 |

| Pakistan Refinery | 8,161,599 |

| Cordoba Logist(R) | 7,873,500 |

| Cnergyico PK | 6,152,362 |

| Unity Foods | 5,946,085 |

| Sui Northern Gas Pipelines | 5,007,715 |

| Pakistan International Bulk Terminal | 4,084,500 |

| Pak Elektron | 3,331,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 26,560,215 |

| Power Generation & Distribution | 17,410,506 |

| Refinery | 16,212,218 |

| Transport | 13,397,600 |

| Food & Personal Care Products | 10,778,425 |

| Chemical | 9,525,067 |

| Oil & Gas Marketing Companies | 8,989,819 |

| Miscellaneous | 8,558,078 |

| Cement | 7,602,495 |

| Commercial Banks | 6,745,831 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI