PSX Closing Bell: A Pillow of Winds

By MG News | October 21, 2021 at 05:46 PM GMT+05:00

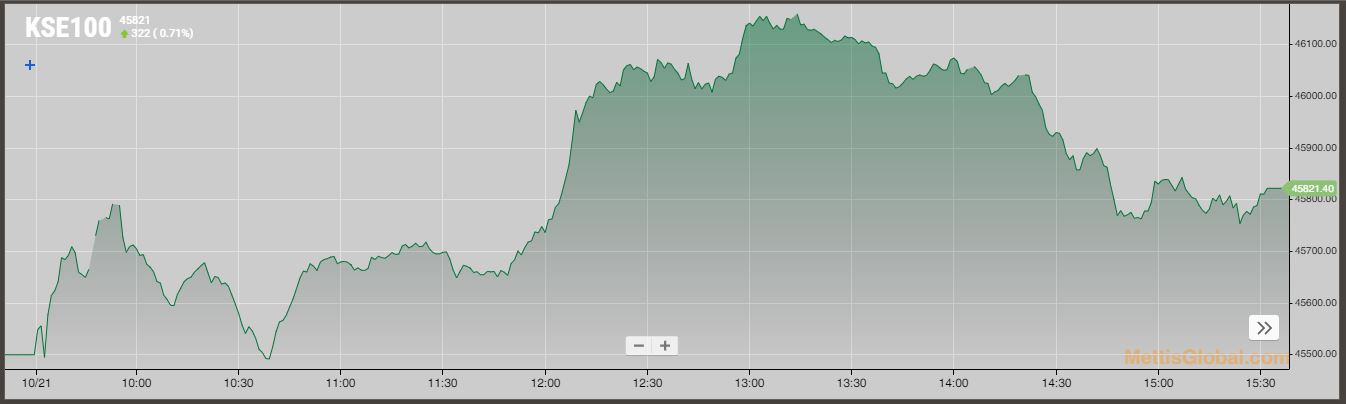

October 21, 2021 (MLN): The local bourse continued to make gains in the second consecutive session as the 100-index printed an intra-day high of 46,162.78 points, traded in a range of 700 points.

The investors’ sentiments remained elevated since they expect a positive outcome from the IMF talks and FATF decision where the governor SBP stated that the country has fulfilled all the major FATF requirements, as per market closing note by Pearl Securities.

Accordingly, the Benchmark KSE-100 index settled the trading session at 45,821.40 points with a gain of 321.94 points.

Of the 97 traded companies in the KSE100 Index 49 closed up 46 closed down, while 2 remained unchanged. Total volume traded for the index was 181.07 million shares.

Sectors propping up the index were Commercial Banks with 220 points, Oil & Gas Exploration Companies with 97 points, Fertilizer with 80 points, Cement with 31 points and Chemical with 29 points.

The most points added to the index was by UBL which contributed 79 points followed by ENGRO with 61 points, HBL with 60 points, BAHL with 33 points and MARI with 30 points.

Sector wise, the index was let down by Technology & Communication with 56 points, Inv. Banks / Inv. Cos. / Securities Cos. with 30 points, Engineering with 20 points, Refinery with 16 points and Power Generation & Distribution with 7 points.

The most points taken off the index was by TRG which stripped the index of 51 points followed by PSX with 17 points, KAPCO with 12 points, AVN with 12 points and INIL with 11 points.

All Share Volume increased by 30.13 Million to 338.32 Million Shares. Market Cap increased by Rs.39.26 Billion.

Total companies traded were 359 compared to 361 from the previous session. Of the scrips traded 158 closed up, 185 closed down while 16 remained unchanged.

Total trades increased by 5,217 to 122,638.

Value Traded increased by 3.00 Billion to Rs.13.36 Billion

| Company | Volume |

|---|---|

| The Bank of Punjab | 25,569,000 |

| Telecard | 24,332,000 |

| Hum Network | 23,889,000 |

| Worldcall Telecom | 21,828,000 |

| Unity Foods | 19,234,071 |

| Engro Polymer & Chemicals | 15,947,000 |

| Service Fabrics | 15,088,500 |

| Maple Leaf Cement Factory | 10,013,521 |

| Silkbank | 7,395,500 |

| Byco Petroleum Pakistan | 6,795,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 90,312,227 |

| Commercial Banks | 70,008,949 |

| Food & Personal Care Products | 29,469,001 |

| Chemical | 23,821,040 |

| Cement | 21,063,315 |

| Textile Weaving | 15,478,500 |

| Fertilizer | 12,889,256 |

| Refinery | 8,795,415 |

| Textile Composite | 8,405,100 |

| Power Generation & Distribution | 8,080,209 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI