PKR turns back to fall

MG News | February 09, 2022 at 04:12 PM GMT+05:00

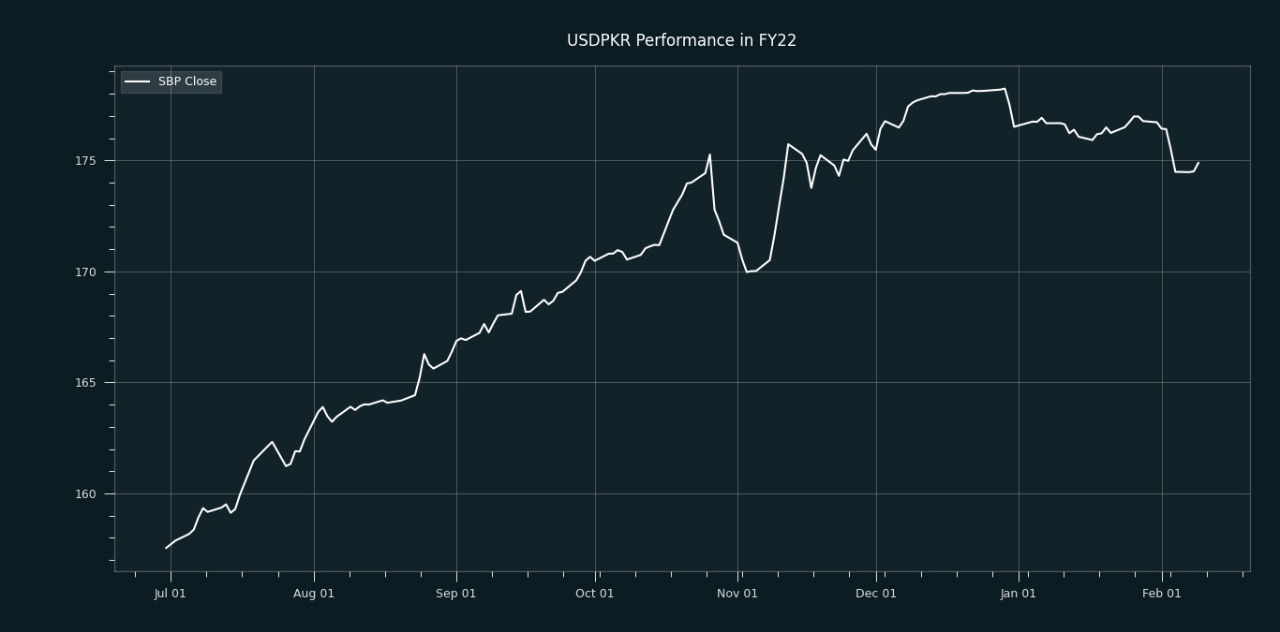

February 09, 2022 (MLN): After finding stable ground in the previous two consecutive sessions, the Pakistani rupee (PKR) joined back its traditional trail of depreciation where it has lost 38 paisa against the US dollar in today's interbank market as the currency settled the trade at PKR 174.89 per USD.

The local unit had closed at PKR 174.5 per USD on Tuesday.

Despite receiving around $1billion each from Sukuk proceeds and IMF loan, the domestic unit could not manage to gain its strength more than 1.89 rupees in the interbank market unlikely to the market expectations wherein the currency experts anticipated a notable appreciation and stability.

PKR traded within a volatile range of 45 paisa per USD showing an intraday high bid of 174.85 and an intraday low offer of 174.50.

The 10-day rupee-dollar parity, after spending a month in a stable zone, again started witnessing volatility in the interbank market.

Meanwhile, the local unit has lost Rs17.34 against the USD from July’21 to date, Whereas, the rupee appreciated by PKR 1.62 in CY22, with the month-to-date (MTD) position showing a gain of 1.05%, as per data compiled by Mettis Global.

However, the performance of PKR remained comparatively better against major currencies during one month to date as the local unit appreciated by 1.45%, 1.25%, 1.02%, 1.02%, 0.97%, 0.82%, 0.80%, and 0.3% against CHF, GBP, USD, AED, SAR, CNY, JPY, and EUR, respectively.

Within the Open Market, PKR was traded at 176/177 per USD.

The currency lost 75 paisa to the Pound Sterling as the day's closing quote stood at PKR 237.16 per GBP, while the previous session closed at PKR 236.4 per GBP.

Similarly, PKR's value weakened by 63 paisa against EUR which closed at PKR 199.6 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 9.75/9.85 percent, whereas the 1-week rate was 9.75/9.85 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,955.00 | 119,275.00 117,905.00 | 1335.00 1.14% |

| BRENT CRUDE | 72.30 | 72.82 72.30 | -0.94 -1.28% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.92 | 70.41 69.92 | -0.08 -0.11% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|