PKR slides by 31 paisa per USD

MG News | April 17, 2023 at 03:30 PM GMT+05:00

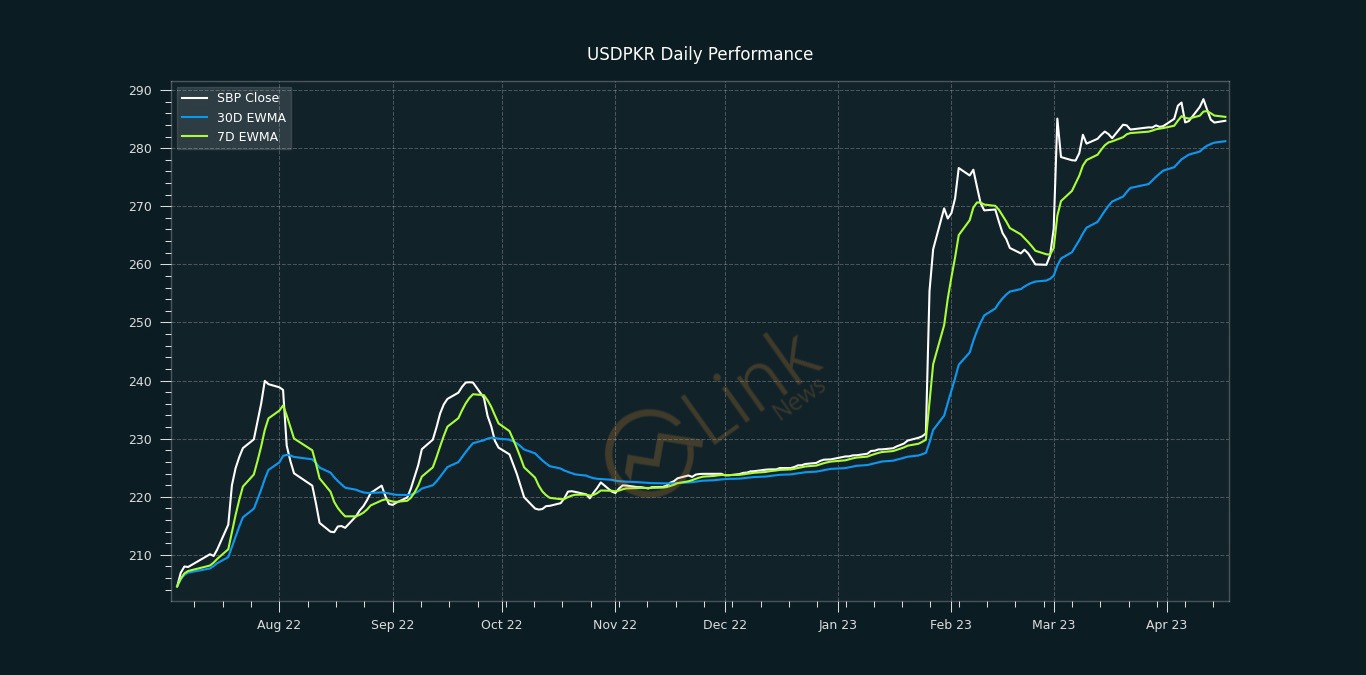

April 17, 2023 (MLN): Snapping its 3-day winning streak, the Pakistani rupee (PKR) has depreciated by 31 paisa against the US dollar in today's interbank session as the currency settled the trade at PKR 284.71 per USD, compared to the previous session's close of PKR 284.4 per USD.

Throughout today’s session, the local unit traded in a band of 1.15 rupees, showing an intraday high bid of 285.40 and low offer of 284.75 while in the open market, PKR was traded at 284/289 per USD.

The sudden drop in market sentiments may be attributed to the latest newsflows wherein the International Monetary Fund (IMF) demands further assurances, despite receiving confirmation from two of the country's key allies, Saudi Arabia and the United Arab Emirates (UAE), that the $6 billion financing condition has been met.

Nathan Porter, the IMF’s Mission Chief to Pakistan, has expressed support for Pakistan's efforts and welcomed financial assistance from its friendly countries.

"We welcome the recent announcement of important financial support to Pakistan from key bilateral partners," he said in a statement.

The IMF is providing support for these efforts and is eager to receive the necessary assurances promptly. This would enable the successful completion of the 9th review of an Extended Fund Facility (EFF) and indicates that Pakistan anticipates receiving additional funding from its allies.

Alternatively, the currency gained 2.8 rupees against the Pound Sterling as the day's closing quote stood at PKR 353.72 per GBP, while the previous session closed at PKR 356.5 per GBP.

Similarly, PKR's value strengthened by 1.7 rupees against EUR which closed at PKR 313.1 at the interbank today.

In FYTD, PKR lost 79.86 rupees or 28.05%, while it plummeted by 58.27 rupees or 20.47% against the USD in CYTD. Within the last seven sessions, the local unit moved up by 0.83%, as per data compiled by Mettis Global.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted a Shariah-compliant Mudarabah Open Market Operation (OMO) today, in which it injected a total of Rs20 billion into the market.

The overnight repo rate towards the close of the session was 20.75%/21%, whereas the 1-week rate was 21.75%/21.85%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,325.00 | 118,355.00 117,905.00 | 705.00 0.60% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.24 | 70.33 70.18 | 0.24 0.34% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|