PKR Review: Only Happy When It Rains

By MG News | May 31, 2022 at 05:26 PM GMT+05:00

May 31, 2022 (MLN): Regaining positive sentiments owing to the government’s key decision to partially uncap the fuel prices as per IMF’s key condition, the interbank market witnessed a third consecutive session wherein the Pakistani rupee (PKR) managed to gain 60 paisa against the greenback to close the month at 198.46 per USD.

During the day, the local unit traded in a range of 95 paisa per USD an intraday high bid of 199.30 and an intraday low offer of 198.50 while in the open market, PKR was traded at 197.50/199.25 per USD.

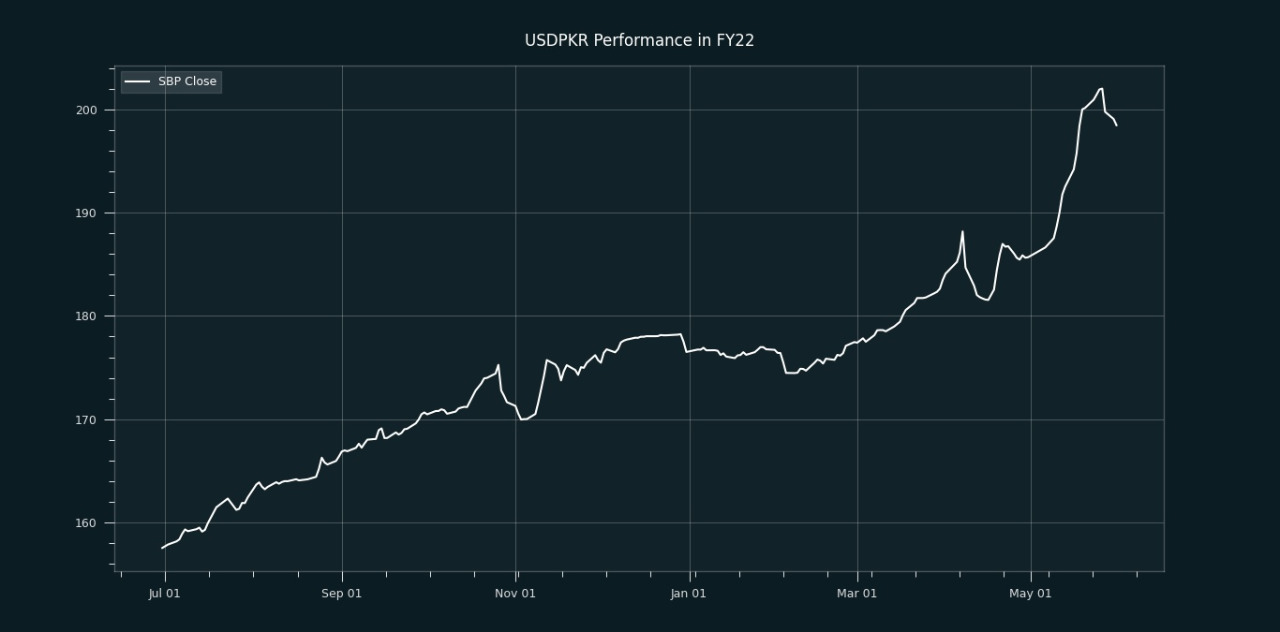

Since most of the sessions went through a rough patch, the domestic unit has lost 12.77 rupees or plunged by 6.44% in May 2022, recording the highest close on May 26, 2022, at PKR202.006 per USD, compared to the depreciation of 0.61% in May 2021.

Commodity headwinds that messed up Pakistan’s current account deficit, a sharp depletion of foreign exchange reserves amid the delay in IMF’s tranche, and the coalition government’s indecisive attitude towards the compliance of the fund’s major conditionalities remained the major factors behind this collapse.

At present, the total liquid foreign exchange reserves held by the country dropped by $11 million or 0.1% WoW to stand at the lowest level of $16.1 billion since Dec 06, 2019, which is barely enough to cover 1.48 months of imports.

To remove the haze of ongoing crises, the State Bank of Pakistan (SBP) increased the interest rate by 150 basis points to 13.75% on May 23, 2022, while emphasizing the need for fiscal consolidation that would help moderate demand to a more sustainable pace while keeping inflation expectations anchored.

While appreciating the recent hike in the policy rate by SBP, the International Monetary Fund (IMF)’s mission on Wednesday also emphasized the need of removing fuel and energy subsidies to avail the next tranche under the Extended Fund Facility (EFF) program.

Despite week-long negotiations, the Pakistan side could not convince the IMF mission to release the tranche as IMF has subjected the $3 billion EFF program with the removal of fuel subsidies.

Meanwhile, Prime Minister has also announced an Rs28 billion package for the poor segment to counter the inflationary pressure. However, the relief package would be released after final approval by the fund.

Minister for Finance and Revenue, Miftah Ismail informed lately that the staff-level agreement with IMF would be signed next month (June).

However, the government’s decision of increasing petroleum prices by Rs30 per litre to avail of IMF’s bailout package has made the Pakistani rupee (PKR) able to break the 15-session long losing streak and recovered by 2.3 rupees against USD on May 27, 2022.

After bearing a storm of panic and uncertainty for a long period, the news become a breath of fresh air as market sentiment has been approved as the local unit recovered by 3.5 rupees in the last three sessions of the month. Economic experts are of the view that this measure would pave the way toward the required IMF tranche along with financial assistance from other friendly countries to improve the foreign exchange reserves of the country.

From July’21 to date, the local unit has lost Rs40.91, plummeting by 20.62% against the USD compared to the appreciation of 6.67% in 11MFY21. Similarly, the rupee fell by Rs21.94 in 5MCY22 or 11.06% compared to the drop of Rs5.4 recorded in 5MCY21, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 22.13% against the greenback, reaching its lowest at 202 on May 26, 2022. While on the other hand, it touched its high of 154.53 on June 1, 2021.

Furthermore, the local unit has weakened by 12.27% since its high on July 02, 2021, against EUR while, it has dropped by 13.17% against GBP since its high on July 02, 2021.

In addition, the performance of PKR remained bleak against major currencies in a calendar year to date as it weakened by 11.14%, 11.06%, 7.09%, 6.67%, 6.23%, 4.78%, and 1.19% against SAR, AED, CNY, CHF, EUR, GBP, and JPY, respectively.

Meanwhile, the currency gained 1.1 rupees against the Pound Sterling as the day's closing quote stood at PKR 250.24 per GBP, while the previous session closed at PKR 251.35 per GBP.

Similarly, PKR's value strengthened by 1.1 rupees against EUR which closed at PKR 212.91 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 13.75/14.00 percent, whereas the 1-week rate was 13.85/13.95 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI